Australia is a kind of mind-moulding autocracy in which the words “immigration” and “racist” are interchangeable.

At the zenith of this ersatz society sits a central bank that is paid to do one job and one job only: never mention the word “immigration”.

In an immigration-led labour market expansion economy, it is therefore entirely predictable that the central bank is permanently wrong.

Indeed, this is what it is paid to do. Be wrong. But in doing so, ensure that nobody ever discusses the true nature of the economy.

A living standards wrecker that makes immigration oligopolists rich.

We have reached that point in the cycle once more when the truth can no longer be hidden. From Goldman:

Bottom line: In her post-meeting press conference Governor Bullock noted the decision to cut 25bp was “consensus” across the Board but signaled a 50bp cut was discussed at the meeting.

While not providing explicit forward guidance, Governor Bullock highlighted that inflation was “now back to target” and this “was very good news”, noting the Board was “prepared to take further action” against an uncertain global backdrop.

Governor Bullock also reiterated that the RBA may have underestimated the amount of spare capacity in the labour market.

From our perspective, the press conference marked a significant pivot away from the RBA’s prior hawkish focus on a ‘tight’ labour market and upside risks to inflation—including the pause at April’s meeting ahead of the recent Federal election.

So, not as tight as thought, eh?

Wage growth has been falling for 19 months from a lousy peak of 4.2%, far below any other developed economy.

Why? You tell me.

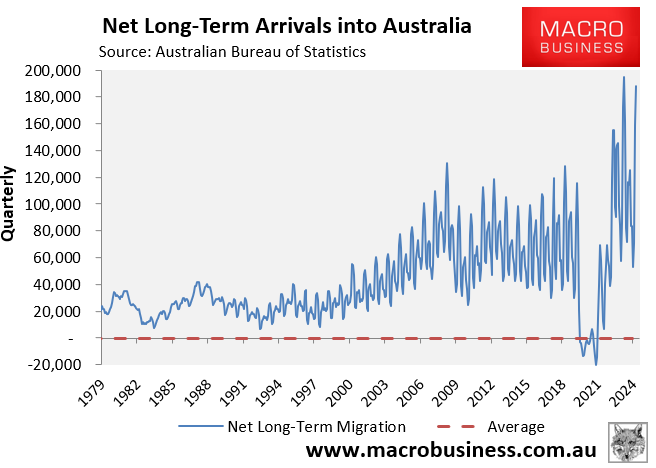

Cheap foreign labour is still pouring in at unprecedented rates. Wage growth would be much weaker already without insane government spending and will be in the near future anyway so long as we run this economic model.

But nobody can be told that, lest they be voted out, so the RBA has literally – not figuratively nor metaphorically – banned the use of the word “immigration”. The only word that matters to its calculus of the cash rate.

This is the equivalent of the Fed banning the use of the word “inflation” or the PBoC banning the word “deflation”.

It is so inane as to be infantile.