The Market Ear with the setup.

Chop

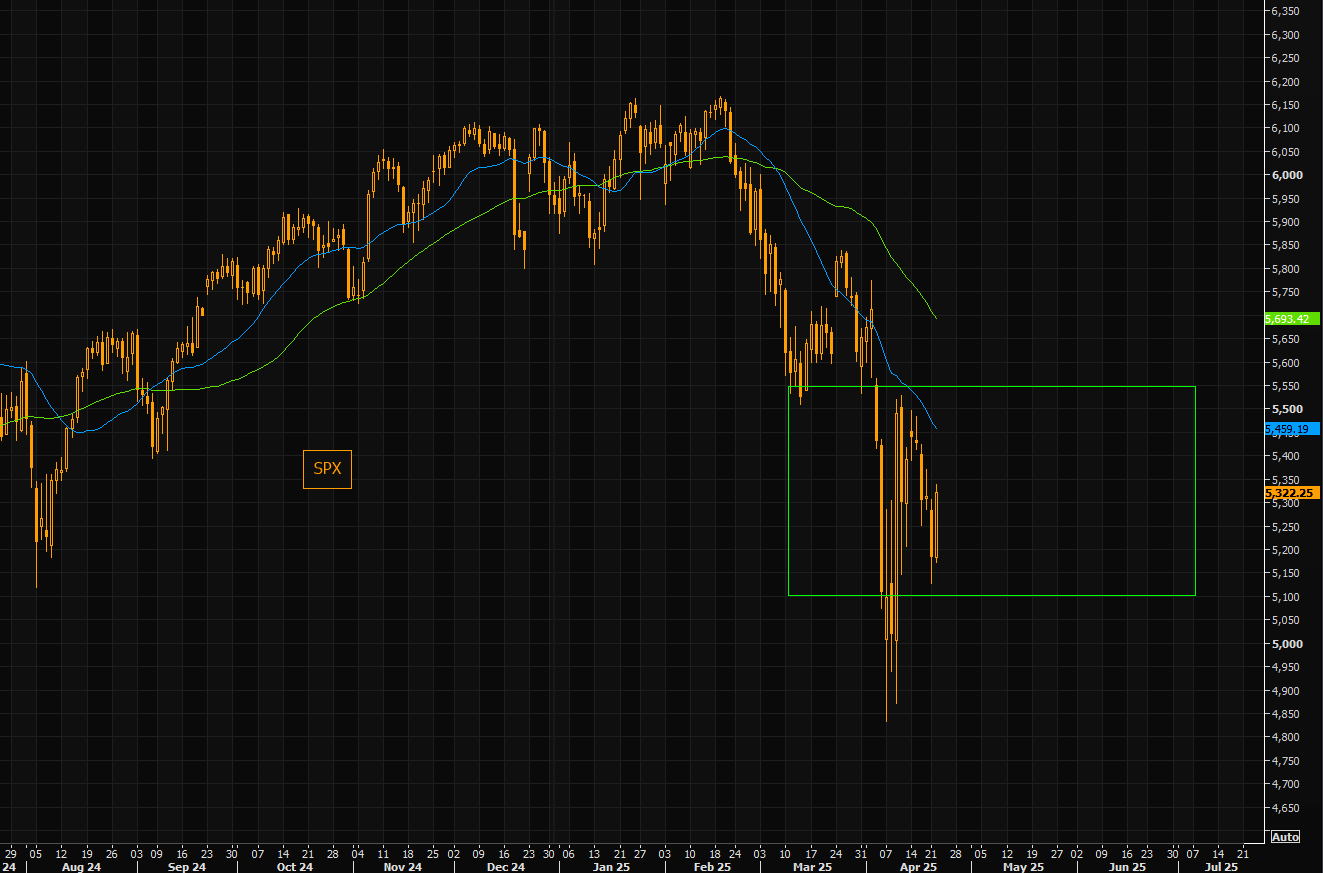

Our base case remains intact: this market needs to heal and it will take time before we get a new direction. Expect more choppiness. Resistance levels: 5450 (21 day), range highs at 5550. Note the 50 day still way higher, currently just below 5700. Support around the 5100 area, and then the recent lows.

Source: Refinitiv

Range mania

Competing factors are at work, keeping the S&P 500 in the middle of our 5000-5500 near-term trading range. The recent reciprocal tariff pause and exemptions show that the administration is willing to show some flexibility on tariff policy—a positive as this was unknown 2 weeks ago. However, on the negative side, earnings revisions remain in a downtrend, the Fed remains on hold, back-end rates remain somewhat sticky and uncertainty around trade policy persists despite recent developments. (MS Wilson)

Source: MS

Green shoots of risk on?

BTC reviving lately. Will this spill over to the broader market?

Source: Refinitiv

2 best “American Exceptionalism” friends

American Exceptionalism has been most apparent in the global outperformance of the Magnificent-7 stocks in recent years. Foreign investors rushed into them and bolstered the Dollar Index. So far this year, the bear market in the Magnificent-7 may be the main reason for the weakness in the dollar.

Source: Refinitiv

Still Magnificent

In aggregate, the “Magnificent 7” companies are expected to report year-over-year earnings growth of 14.8% for the first quarter. Excluding these seven companies, the blended (combines actual and estimated results) earnings growth rate for the remaining 493 companies in the S&P 500 would be 5.1% for Q1 2025.

Source: FactSet

Betting on a break out?

Chasing the euro here is not an early trade. Note that the huge range highs come in around these levels. Sure, some are pointing to the big negative trend and the fact we are above it, but drawing longer term trend lines is not a “hard science”. Our dollar note from earlier today here.

Source: Refinitiv

Dollar shorty

Getting rather huge…especially vs EUR and JPY.

Source: Soc Gen

Watch carefully

Gold putting in a massive shooting star candle. We need confirmation, but as we outlined earlier today (here), gold is extremely overbought and needs a pause.

Source: Refinitiv

Seriously overbought

Gold at the most overbought levels in a long time (daily). Chart 2 shows monthly RSI at the highest levels since 1980. Time to think about better entry levels in gold…

Source: Refinitiv

Source: Refinitiv

Ever time for the digital version?

Gold has left most things behind, BTC included…

Source: Refinitiv

I don’t think it’s time for BTC. Ever. But it may be time for a short-term pain trade upwards in risk.

The human headline is running from himself.

“President Donald Trump said he had no intention of firing Federal Reserve Chair Jerome Powell despite his frustration with the central bank not moving more quickly to slash interest rates.

“Never did,” Trump told reporters on Tuesday. “The press runs away with things. No, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates.”

Bessent is taking control.

“Treasury Secretary Scott Bessent told a closed-door investor summit Tuesday that the tariff standoff with China cannot be sustained by both sides and that the world’s two largest economies will have to find ways to de-escalate.

That de-escalation will come in the very near future, Bessent said during an event hosted by JPMorgan Chase & Co. in Washington, which wasn’t open to the public or media. He characterized the current situation as essentially a trade embargo, according to people who attended the session.”

Finally, there is this.

It’s been unclear how much time Musk has devoted to DOGE, but what has been known is that at some point, he’d reach the 130-day limit for special government employees.

He said he’d continue to keep an eye on DOGE’s efforts to cut waste. He also said he’d give additional time if Trump asks him to.

It sure feels like some kind of ‘Trump put’ is upon us.

Today, anyway.