In surprise to no one, the Trump regime has wavered first as it signals “very nice” but probably non-existent trade talks with China and nullifies suggestions that Fed Chair Powell’s head is on the chopping block. This has seen extended rallies across stocks while the USD has firmed against most undollars although the Australian dollar is getting back to the 64 cent level this afternoon while Yen is weakening slightly on the trade news.

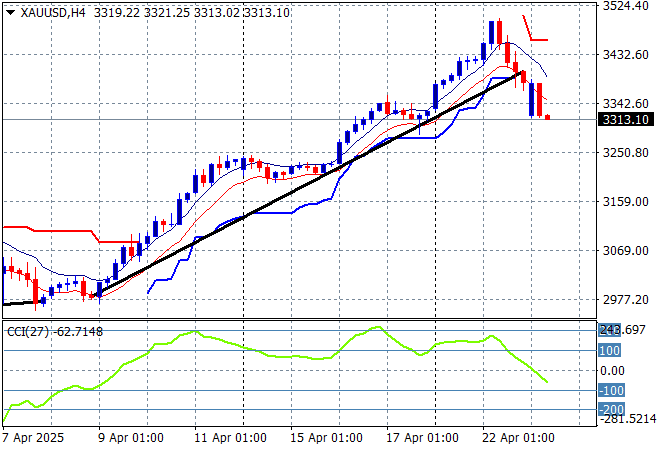

Oil markets are doing well to stabilise with Brent crude now holding above the $66USD per barrel level while gold is having another pullback to threaten the $3300USD per ounce level:

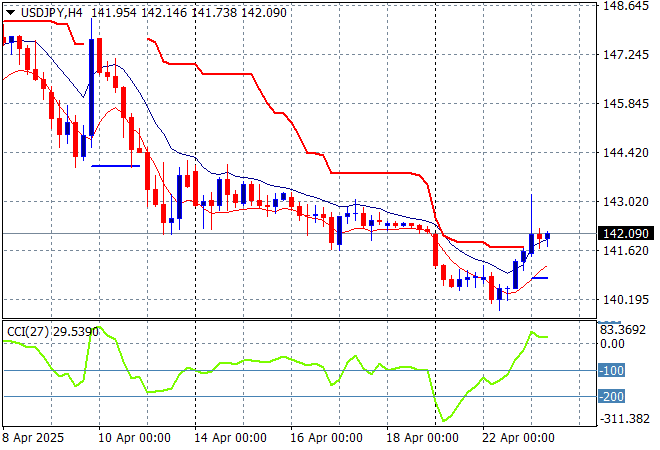

Mainland Chinese share markets are slightly higher going into afternoon trade with the Shanghai Composite just sneaking above the 3300 point level while the Hang Seng Index has surged 2% higher to extend above the 22000 point level. Japanese stock markets are also doing well with the Nikkei 225 up nearly 2% to 34890 points while the USDPY pair is trying to head above the 142 level:

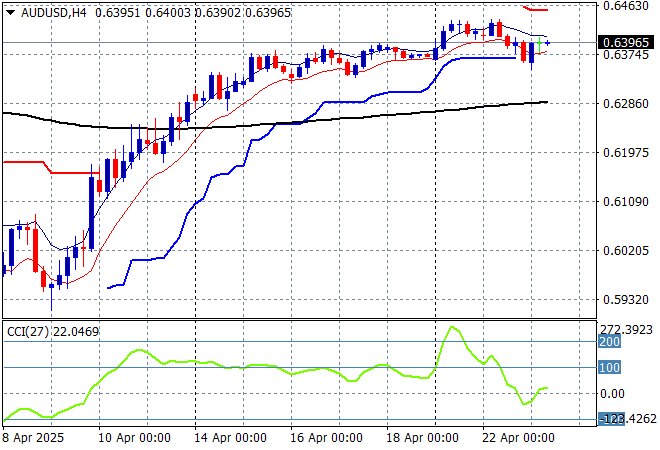

Australian stocks have managed a solid session with the ASX200 up 1.3% to close at 7923 points while the Australian dollar is holding just below the 63 handle as it recovers from a minor pullback last night:

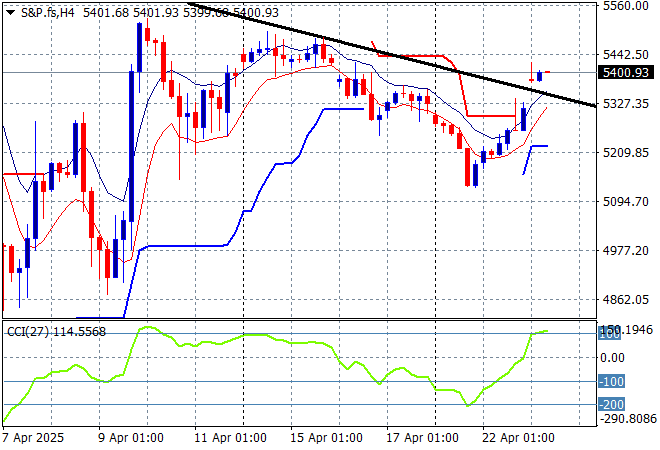

S&P and Eurostoxx futures are fighting back to make good on the Trump backtrack with the S&P500 four hourly chart showing this rollover phase now breaking through support and possibly on its way to the 5500 level:

The economic calendar continues with a slew of Fed speeches plus the latest US new home sales and oil stocks data.