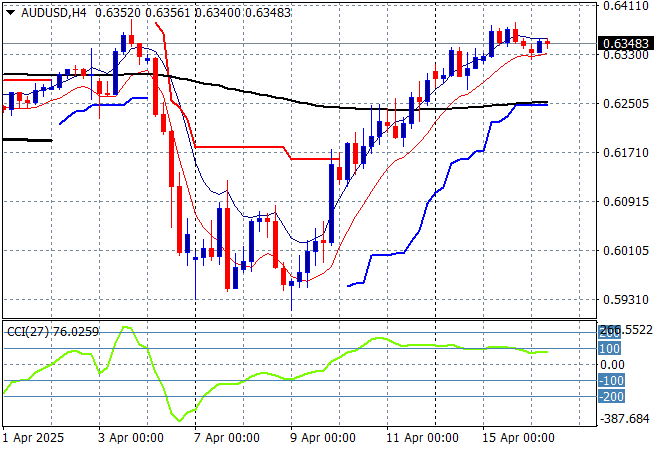

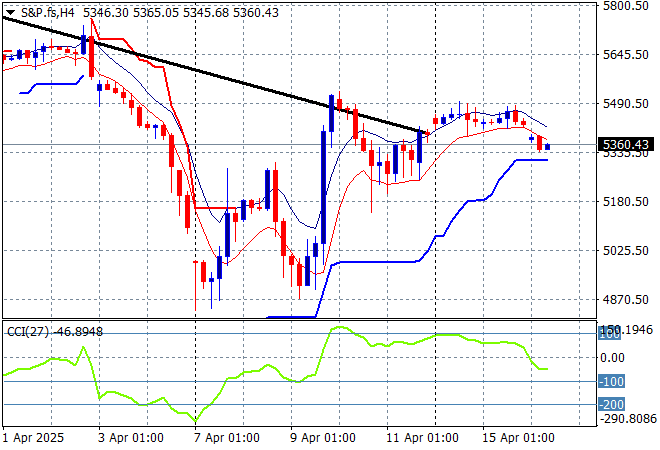

Volatility in equity markets is ramping up after another round of Trump tariff nonsense against China while a miss or two amongst US tech stocks is not helping risk sentiment with S&P and Eurostoxx futures sharply down going into tonight’s session. The latest Chinese GDP figures helped stabilised mainland markets however moves are afoot in currency land as the sentiment against USD grows as the Australian dollar pushed above the mid 63 cent level this afternoon.

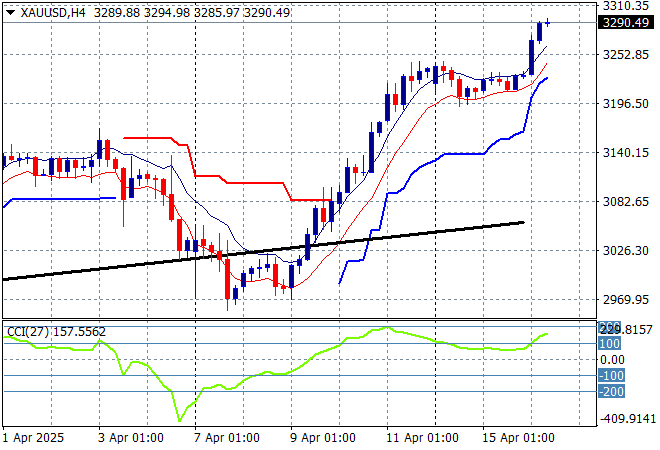

Oil markets are still trying hard to stabilise with Brent crude about to fall to the $64USD per barrel level while gold is zooming higher on the USD run after a short pause from breaking through the $3200USD per ounce level, now threatening a new record high at $3300:

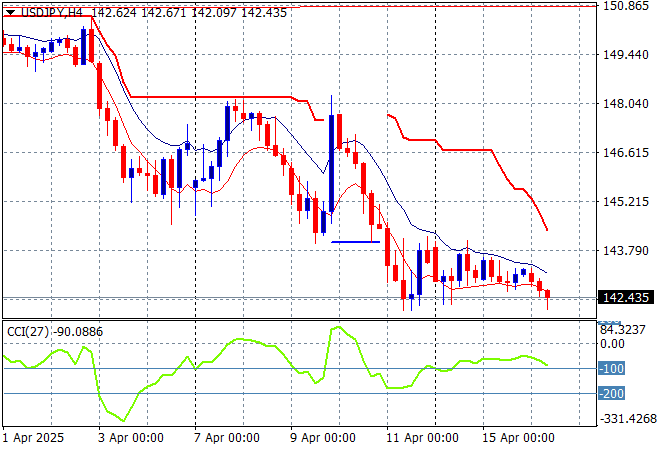

Mainland Chinese share markets were slightly lower going into afternoon trade but have recovered with the Shanghai Composite still above the 3200 point level while the Hang Seng Index has been slammed back some 2% lower to 20954 points. Japanese stock markets are also slipping with the Nikkei 225 down over 1% to 33920 points while the USDPY pair is failing to stabilise as it continues to fall below the 143 level:

Australian stocks have managed another very staid session with the ASX200 barely moving at 7758 points while the Australian dollar is holding above the 63 handle despite the RBA signalling potentially further cuts coming along as the run on USD continues so far:

S&P and Eurostoxx futures are losing ground swiftly as we head into the London session with the S&P500 four hourly chart showing a rollover phase after rejecting the 5500 level:

The economic calendar continues with UK and European inflation figures, then US retail sales and the latest Bank of Canada meeting.