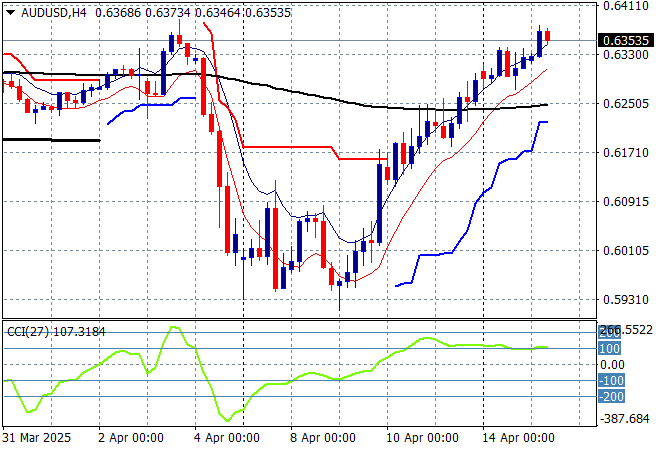

Volatility in equity markets is slowly cooling down and indeed spreading to currency markets with some range trading across the Asian session today although the Kiwi is making big gains against the USD while the Australian dollar remains well above the 63 cent level this afternoon.

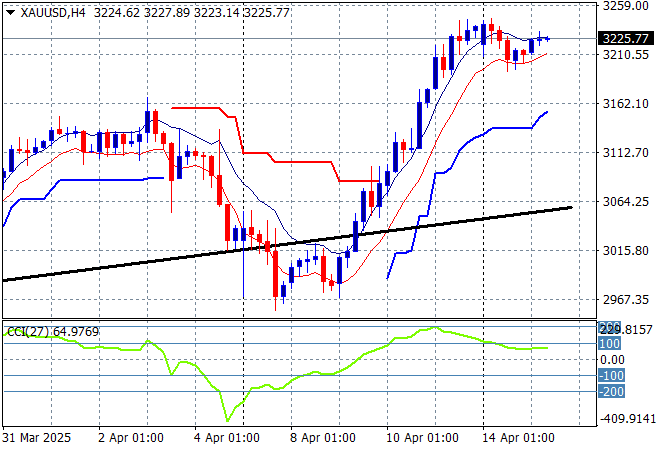

Oil markets are still trying hard to stabilise with Brent crude steadying just below the $65USD per barrel level while gold remains on track after a short pause from breaking through the $3200USD per ounce level:

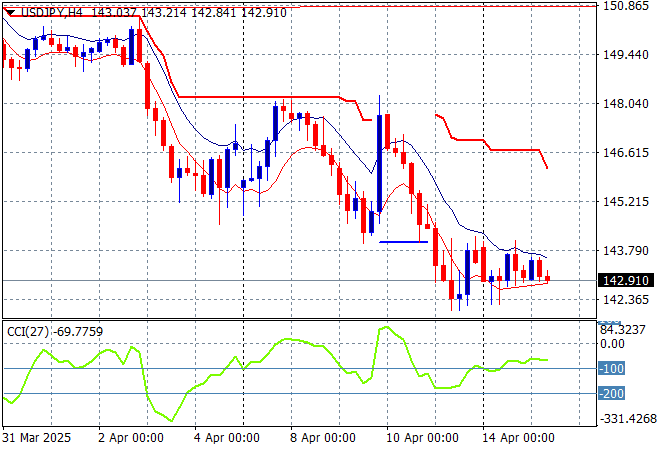

Mainland Chinese share markets are slightly lower this afternoon with the Shanghai Composite off 0.2% to remain above the 3200 point level while the Hang Seng Index has slipped some 0.5% lower to 21304 points. Japanese stock markets are the best performers in the region for a change with the Nikkei 225 up nearly 0.9% to 34279 points while the USDPY pair is trying to stabilise at just below the 143 level but looks weak:

Australian stocks have managed a very staid session with the ASX200 barely moving at 7761 points while the Australian dollar is lifting further above the 63 handle despite the RBA signalling potentially further cuts coming along as the run on USD continues so far:

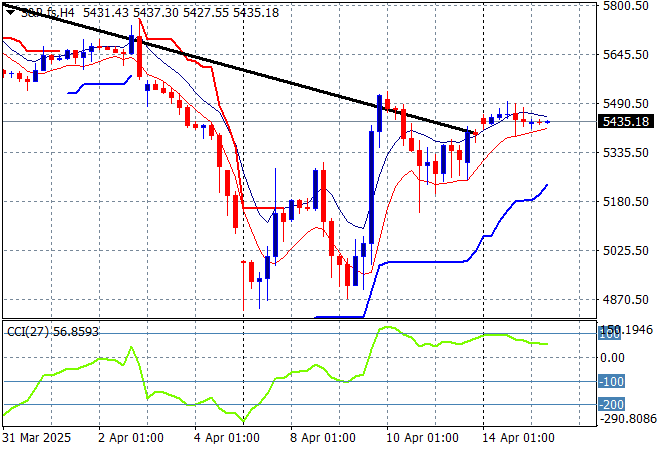

S&P and Eurostoxx futures are losing ground slightly as we head into the London session with the S&P500 four hourly chart showing a pause phase at the 5500 level:

The economic calendar continues with UK unemployment, the closely watched German ZEW survey then a few more important Fed speeches to watch out for.