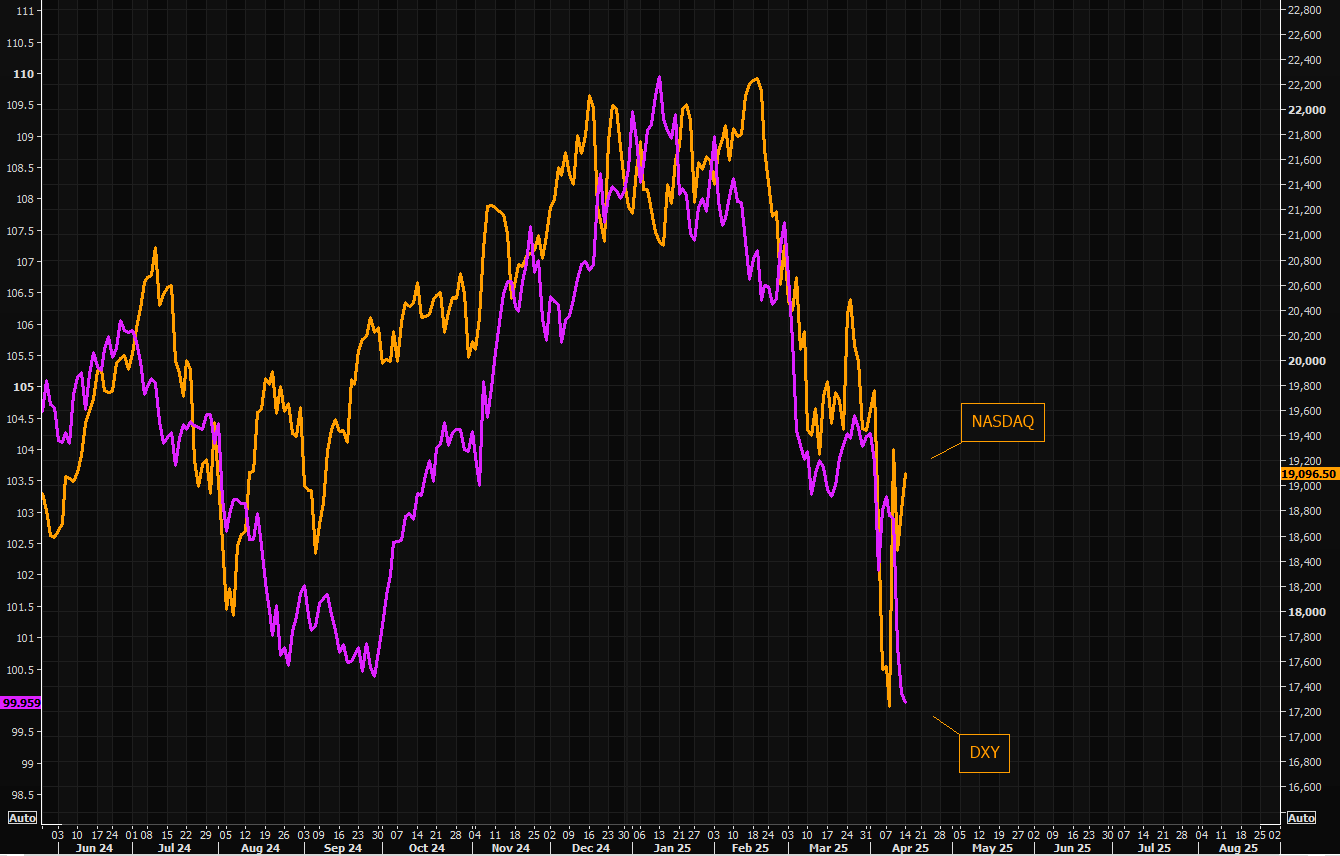

DXY is at critical support.

AUD is a bipolar maniac.

Concrete boots are hanging in.

Gold and oil came off.

The copper market is wrecked.

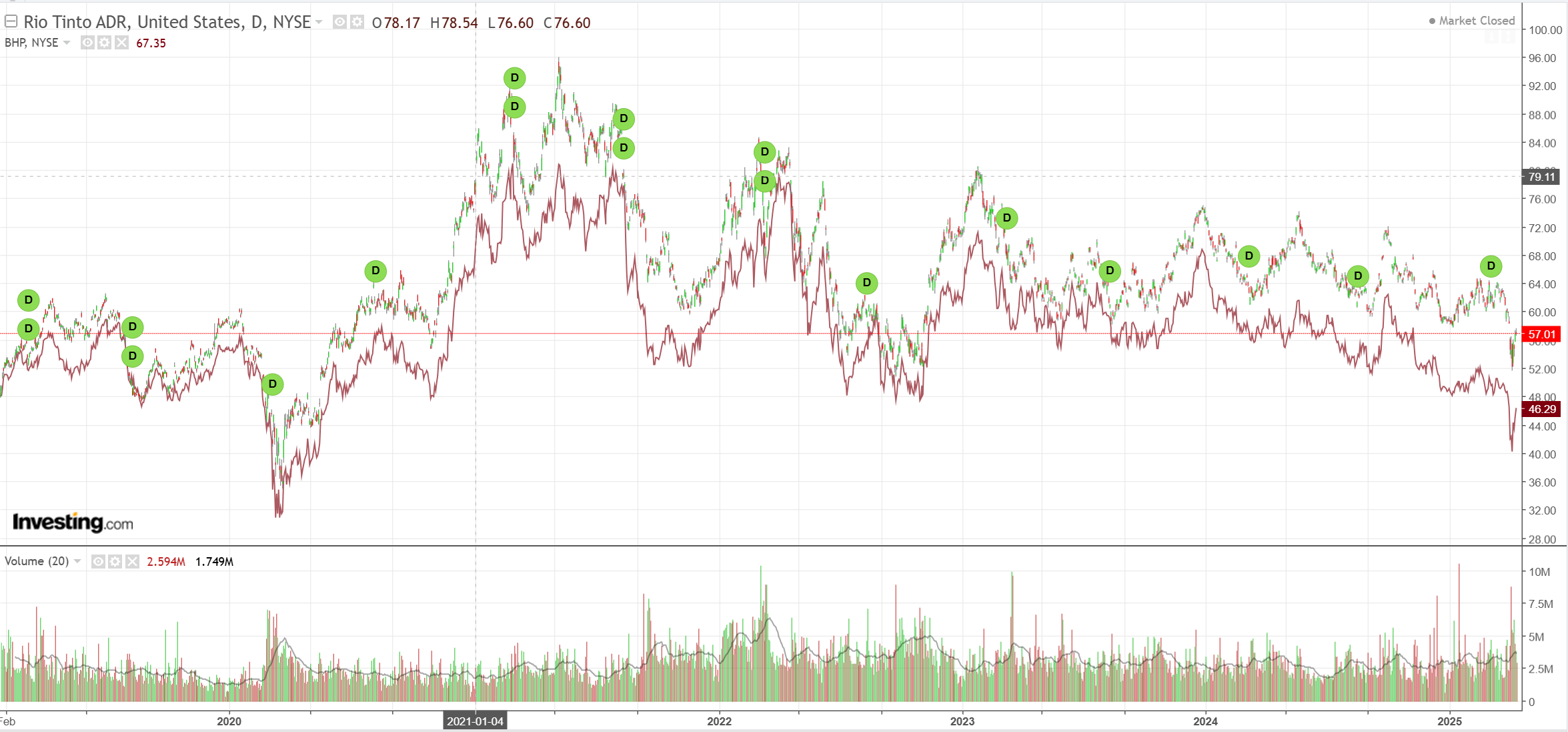

Mining bear market rock solid.

EM bounce.

Junk off the worst.

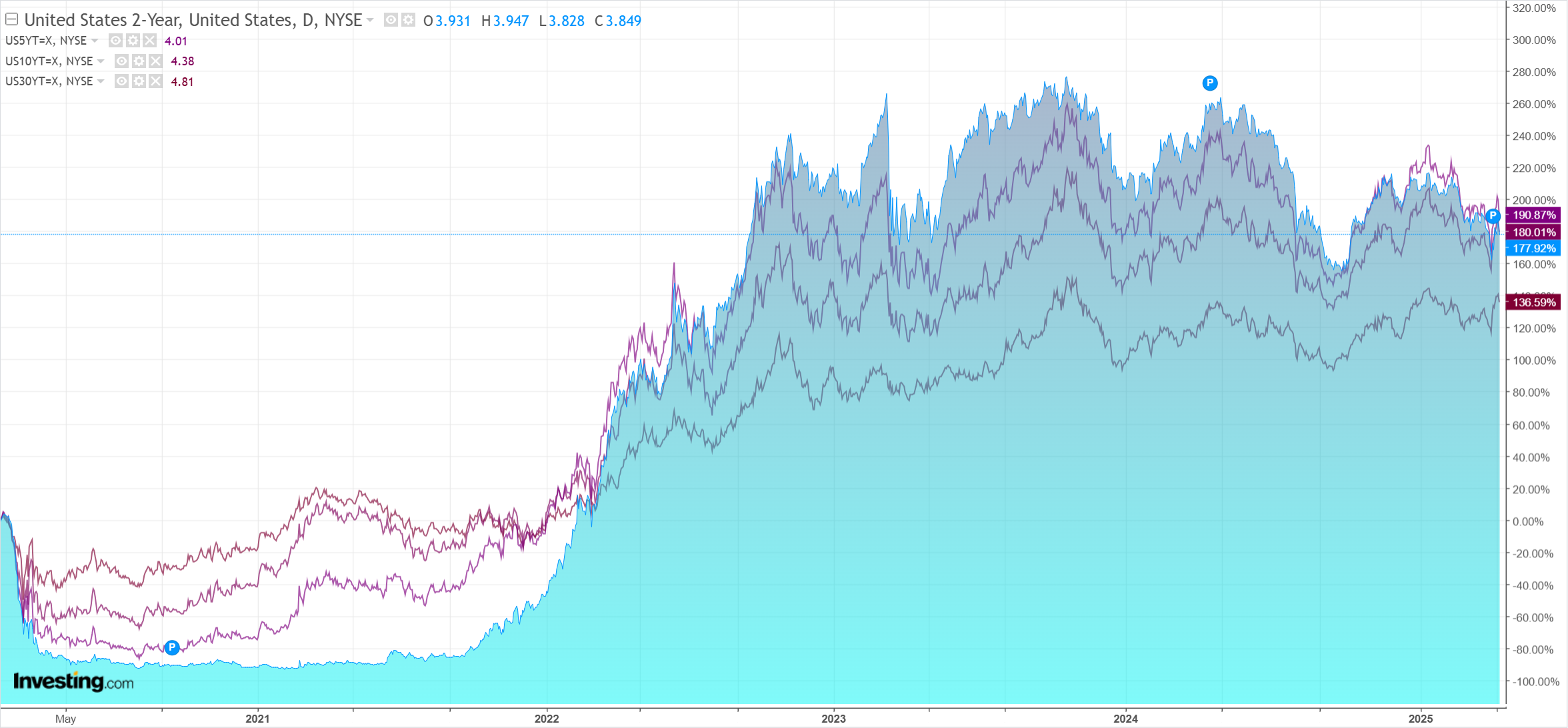

Yields eased, doubtless on the Fed’s calming words Friday.

Stocks firmed.

Now what? DXY is unhinged from Treasuries.

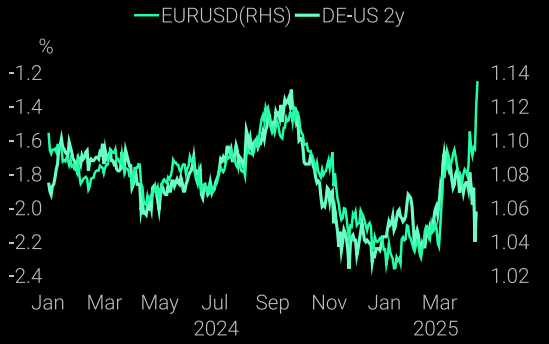

While EUR is unhinged from bunds.

Either the entire Bretton Woods II system is about to collapse into a EUR-led new world order, or these jaws are going to snap shut before long.

The quadrillion-dollar question is, what happens if the Fed comes in? Does it accelerate the disjunction between yields and currency or force them closed?

I suspect the latter. The Bretton Woods II system can’t die overnight, and the chase would be on for US assets again, driving DXY gains.

Question two is, when does the Fed come back in? Or has it already vague comments?

I guess that we will need to see real economic harm yet, so DXY can keep falling for now, and AUD can keep rising until the bad data starts to roll in.