What a difference an election makes! DXY is in free fall. EUR surging.

AUD follows EUR and is threatening a 2025 breakout.

Concrete boots are stable.

Gold is in heaven. Nobody needs an oil rally.

Metals ex-copper are signaling much weaker growth.

Big miner’s big bear is intact.

EM meh.

Junk skunk.

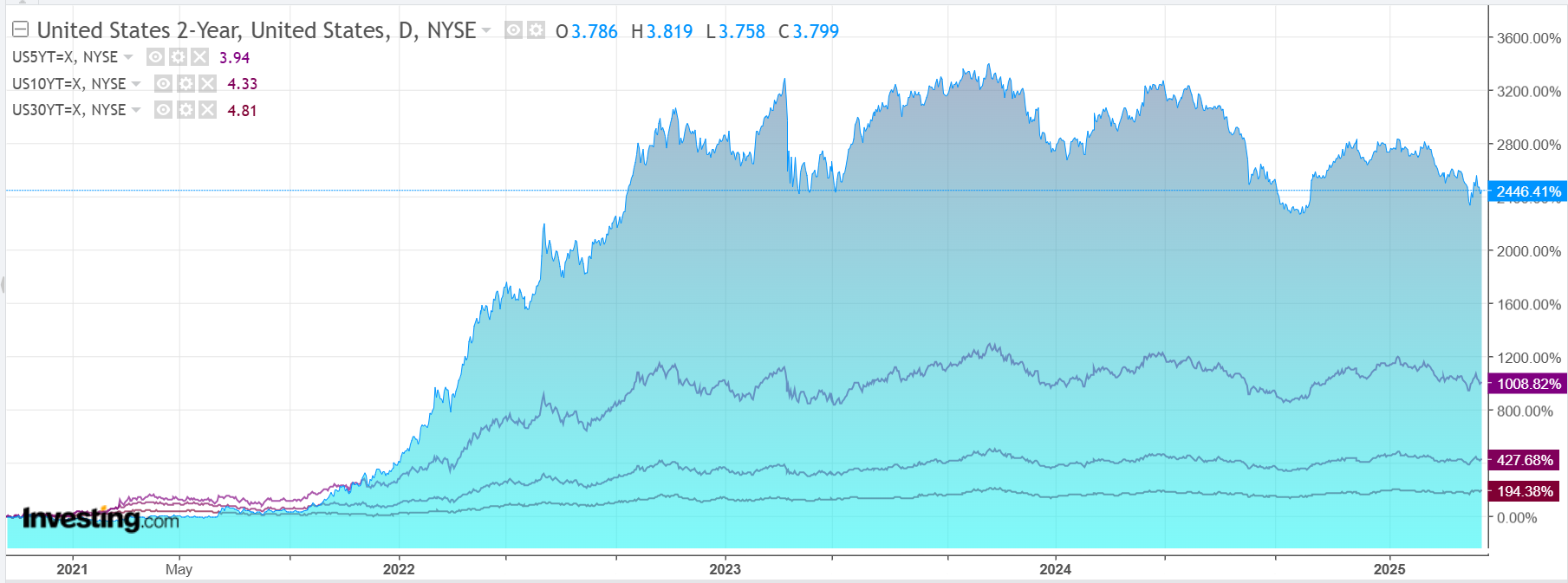

Yields have at least stabilised.

Stocks not so much.

The outflow of capital from US assets has slowed for now, but it’s not stopped. Why would it? The economy is yet to express the hit from tariffs, though there are hints it is underway. Charlie McElligott at Nomura.

The Tariff implications which we’ve been speaking about for Corporates boils down to a “pick your poison”…

Pass through costs to customers to maintain margins, but likely accompanied with lower sales, earnings & profits OR Absorb costs and see margin compression….which eventually becomes lower earnings and profits and likely forces cost cutting, i.e.laying-off Employees.

Philly Fed today showing “signs of damage”: Business outlook Survey Diffusion Index New Orders printing the lowest levels since the COVID crash.

As a tell that businesses are already facing “Margin Compression” and likely needing to eat some of the Tariff-driven cost inflation, we’re seeing a notable diverge btwn “Prices Paid” which continues to trend higher, vs “Prices Received”.

Employment saw a large MoM drop, Shipments dropped negative from MoM.

The survey as a whole points to an ISM Manu print in the low 40s, aka “deep contraction”.

I’m not sure if we’ll see another DXY rally as stocks begin to price this damage. It could go either way.

What I am more certain of is that the damage to US credibility is a regime change and it is probably going to get worse, not better, as the headline hog hogs the headlines. AFR.

Donald Trump is studying whether he’s able to fire Federal Reserve chairman Jerome Powell, his top economist said Friday, a day after the president publicly criticised the head of the central bank for not moving fast enough to slash interest rates.

…Hassett went on to suggest that the Fed under Powell, who was appointed by Trump during his first term, had acted politically to benefit Democrats.

Interference at the Fed, even dovish interference, is likely to accelerate capital outflow and the putative dynamics of an emerging market debt crisis that includes rising yields and falling stocks to boot.

In this scenario, the AUD may march higher not lower, even as local inflation craters.

My long term prediction of a 50 cents AUD was partly based upon persistent US exceptionalism.

In the absence of it, we are much more likely to climb with EUR, though not as fast as CNY falls.