DXY is a falling meteor.

Australian dollar crash up!

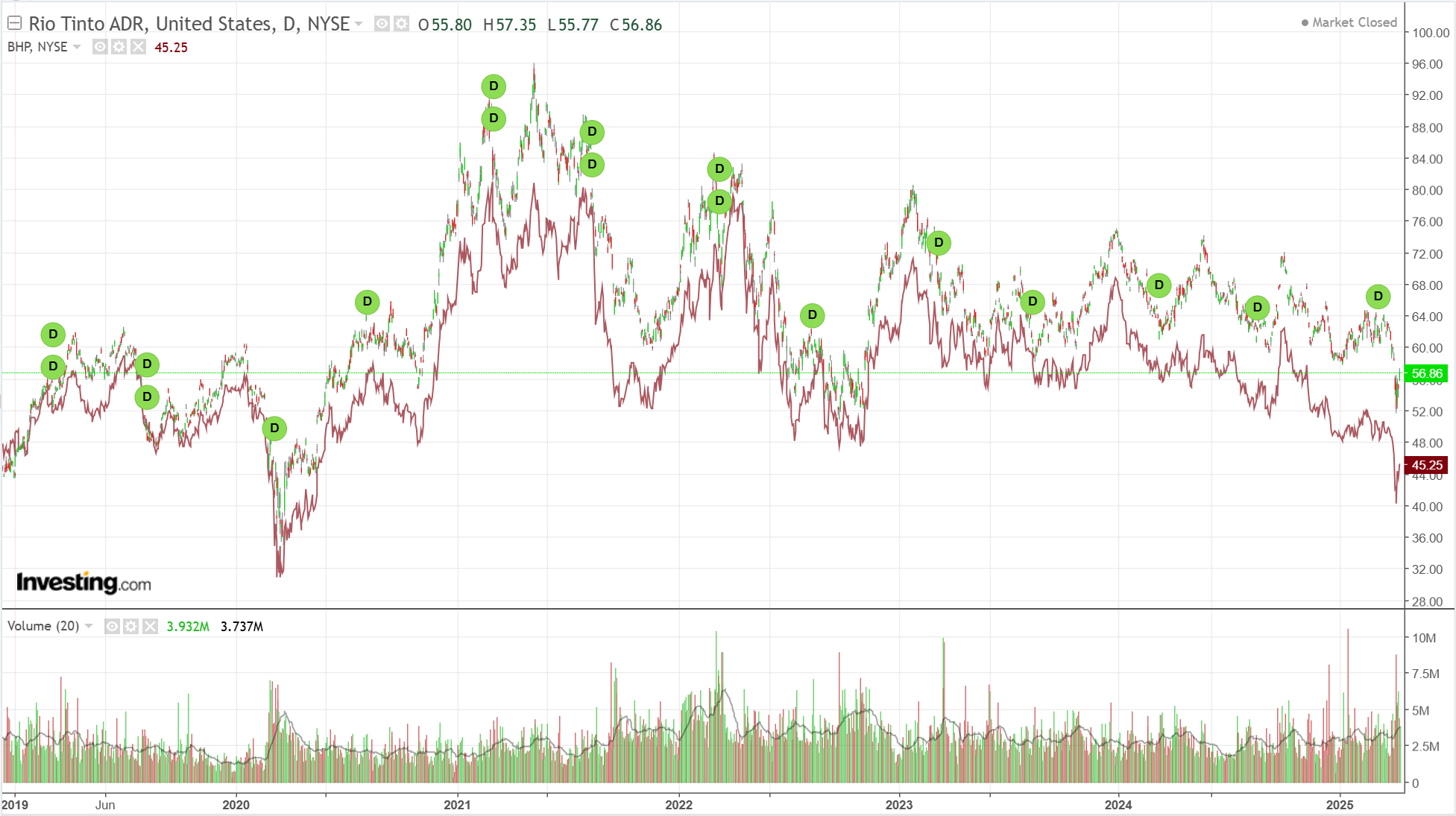

Concrete boots did OK.

Shorts were trimmed last week.

Falling DXY is pushing up commods and gold.

Mining relief.

EM too.

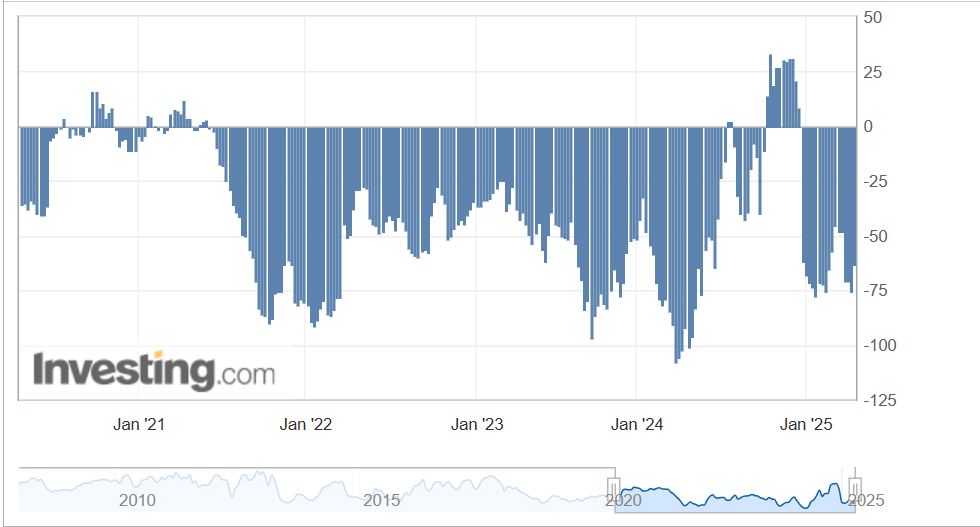

Spreads still stressed.

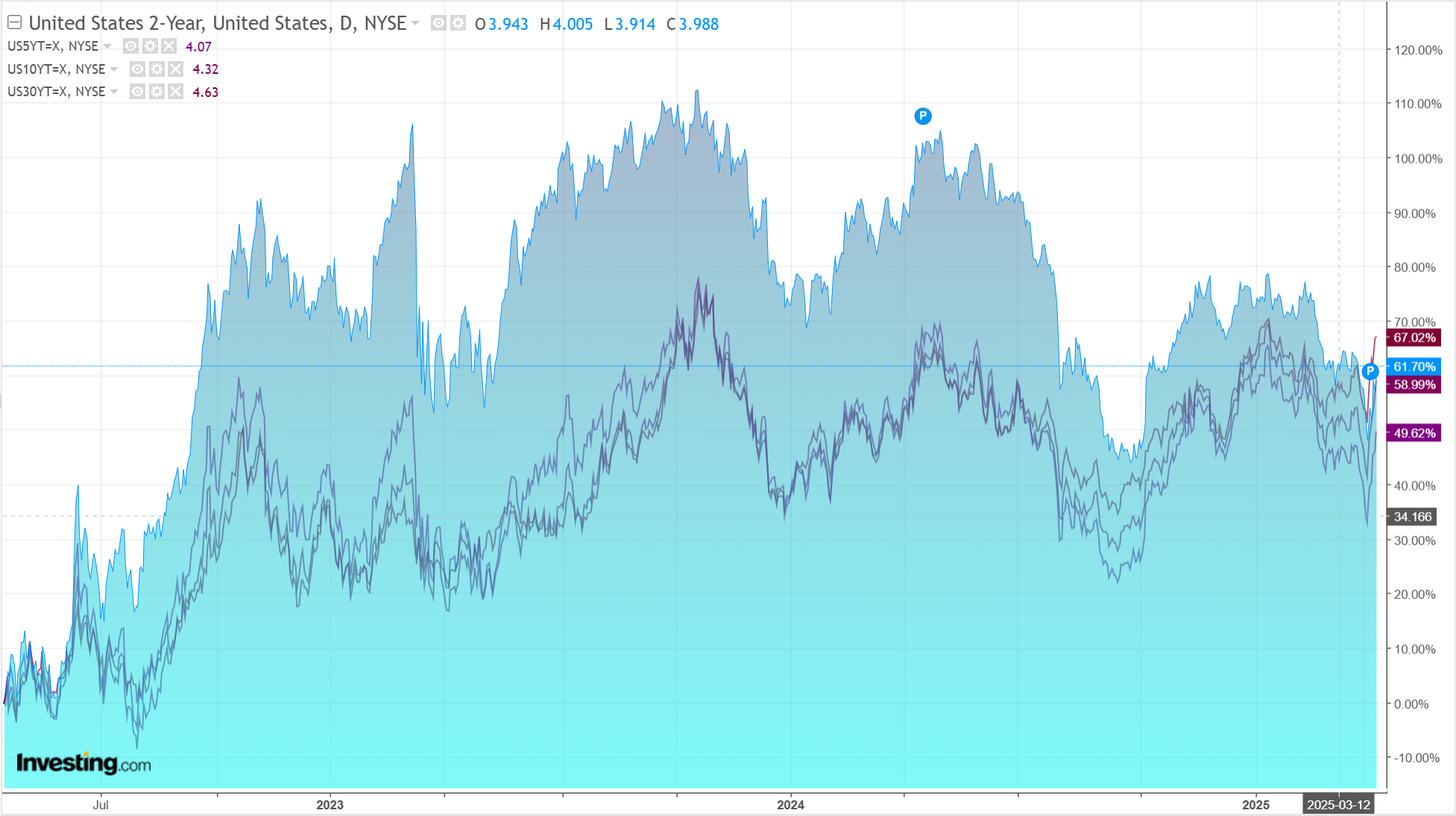

Treasures no bueno.

Stocks are doing a bit better.

I am still watching Treasuries for where markets are going next.

The stress has not diminished much, if at all. While it lasts, DXY is likely to fall, at least until such a time as the Fed piles in with more QE.

Fed speakers indicated their readiness to act on Friday night without seeing the need to.

The trillion-dollar question is what happens to DXY if it does come in?

Would that counterintuitively stabilise DXY? I suspect it might be because bad news will again become good for US assets.

If not, and DXY falls even faster, then Trump has all sorts of problems as he transforms the country into the United States of Turkey.

Anyways, AUD is up for now and down later.