DXY is back. EUR splat.

AUD follows EUR.

Lead boots stuck.

Bretton Woods II firming hit gold.

Metals did better.

Big mining=big bear.

EM yawn.

Junk cancels recession.

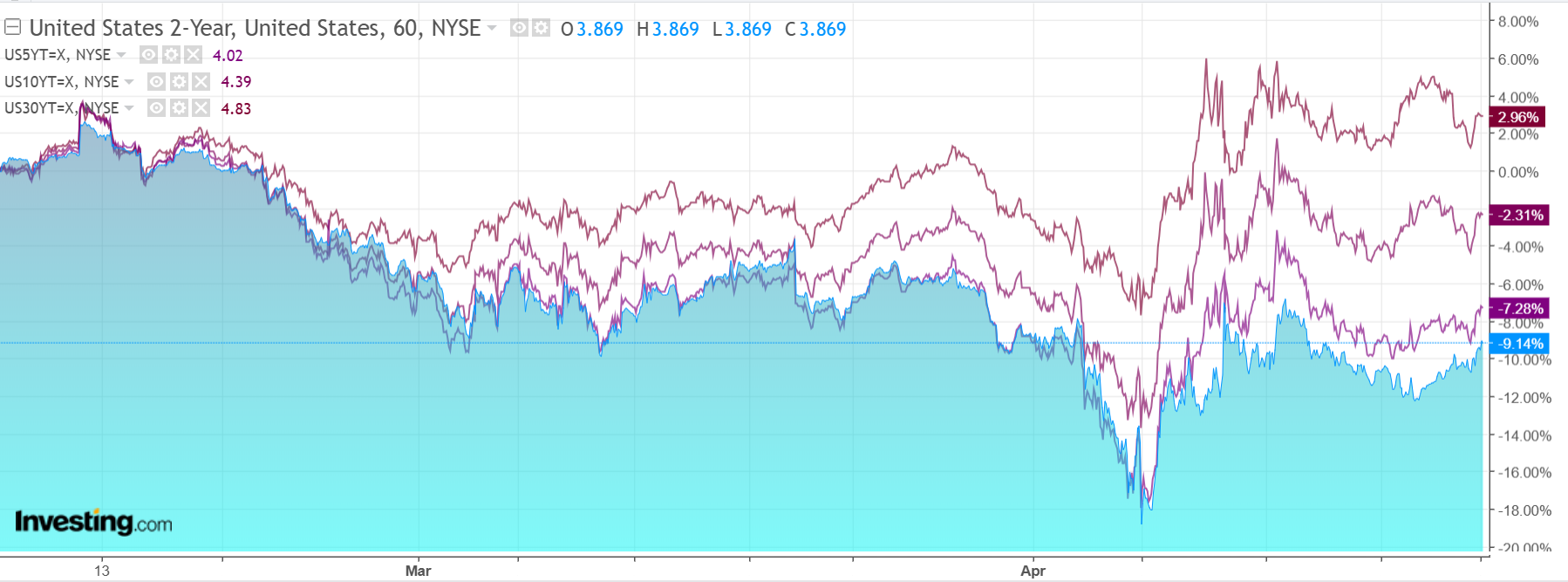

Curve flattened.

Stocks to the moon.

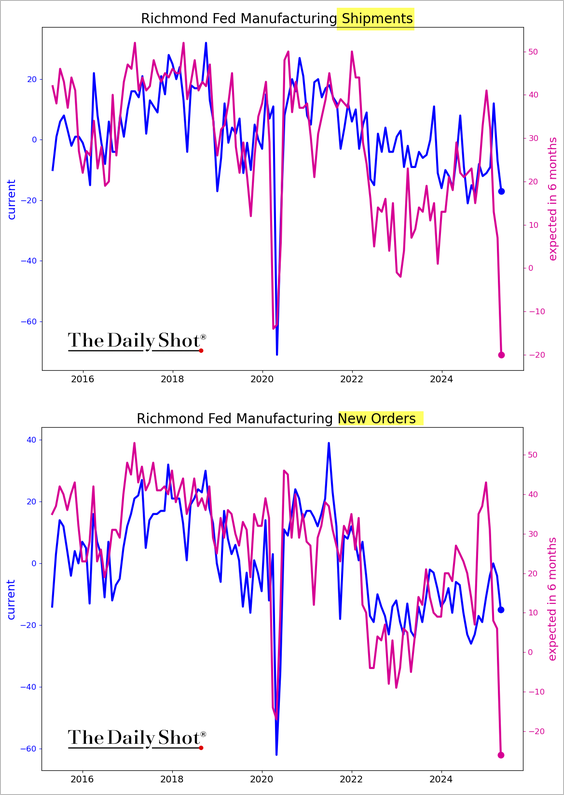

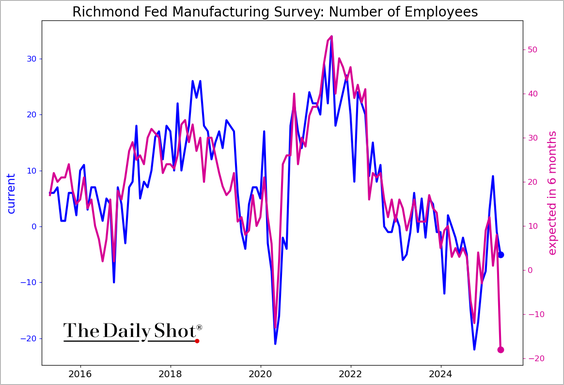

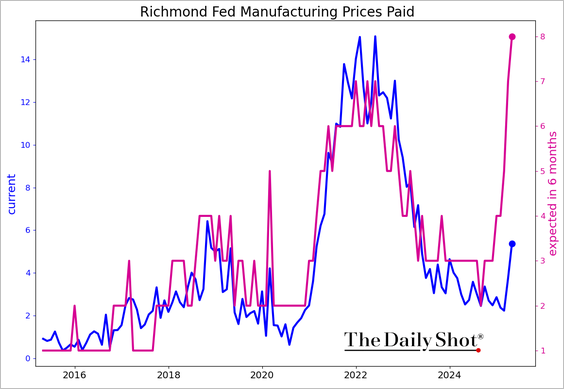

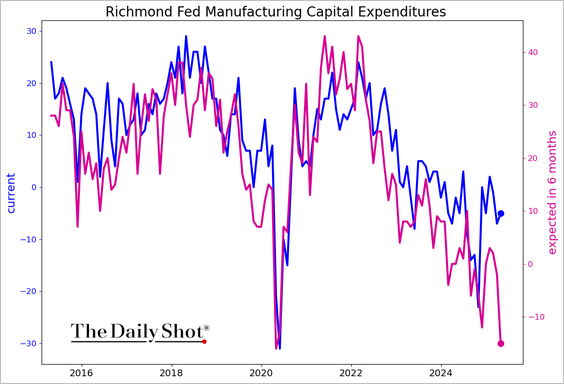

It’s not hard to see why the child president is in a panicked reversal. Check out these internal from the Richmond Fed regional manufacturing survey,

These calamitous stagflationary outcomes will throw the US economy into recessionary shock.

The ISM that follows the regionals has a very good correlation with GDP, stock prices, and capex.

Basically, the child president’s hopeless implementation of tariffs has destroyed his own leverage.

If I were China and others, I would just wait him out now.

The US economy is about to implode.

As for AUD, the dynamics have changed again. As long as Trump continues to hard reverse his tariffs, Bretton Woods II can fight to see another day, and capital outflow from the US will slow.

However, a US-led global growth shock is still underway, so the child president probably can’t reverse it fast enough, so the AUD may fall with growth from here.

Until the child president does something different tomorrow!