Asian stock markets are having a poor finish to the trading week with most markets down amid noise around more Trump tariff nonsense, while the latest Japanese inflation figures sent local stocks sharply lower. The USD is lifting slightly against the major currency pairs, particularly Euro while the Australian dollar was pushed back below the 63 cent level as the nation gears up for a new federal election.

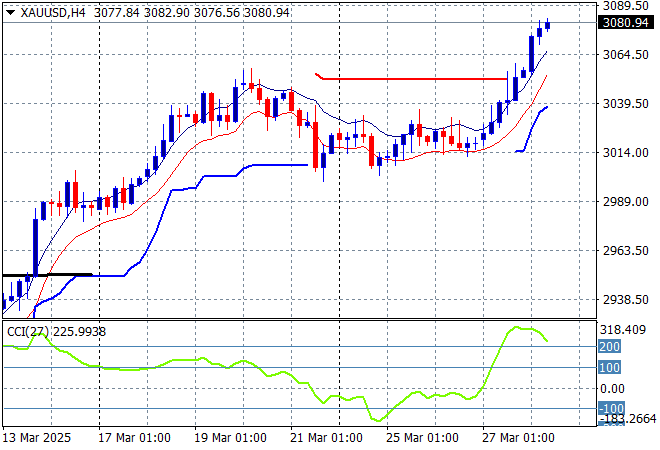

Oil markets are building upside momentum with Brent crude remaining above the $73USD per barrel level while gold continues to push higher, now soaring to the $3080USD per ounce level with short term momentum extremely overbought!

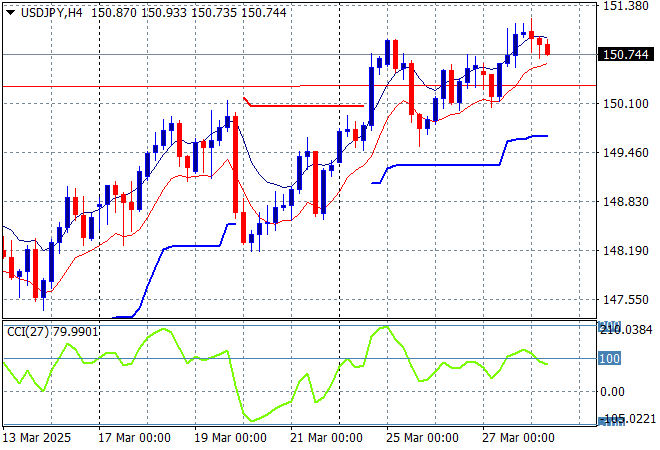

Mainland Chinese share markets are falling in afternoon trade with the Shanghai Composite down 0.4% while the Hang Seng Index is off by nearly 1%, currently at 23353 points. Japanese stock markets continue to reverse their recent gains with the Nikkei 225 slumping more than 2% lower at 37006 points while the USDPY pair is trying to hold above last week’s highs at the 150 level:

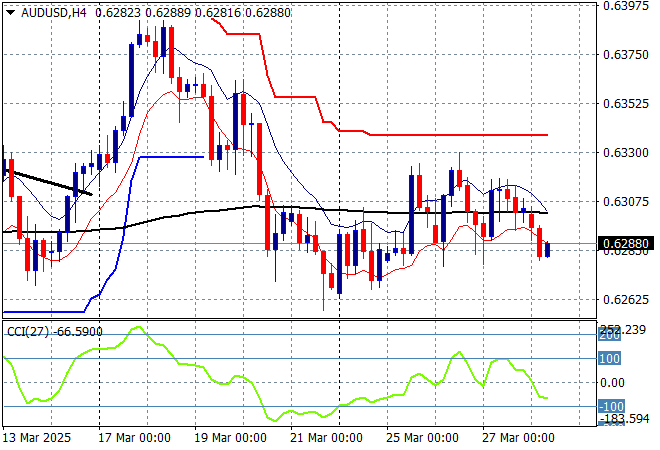

Australian stocks were the only ones to make headway with the ASX200 closing just 0.2% higher but still below the 8000 point level while the Australian dollar has failed to maintain above the 63 cent level against the USD:

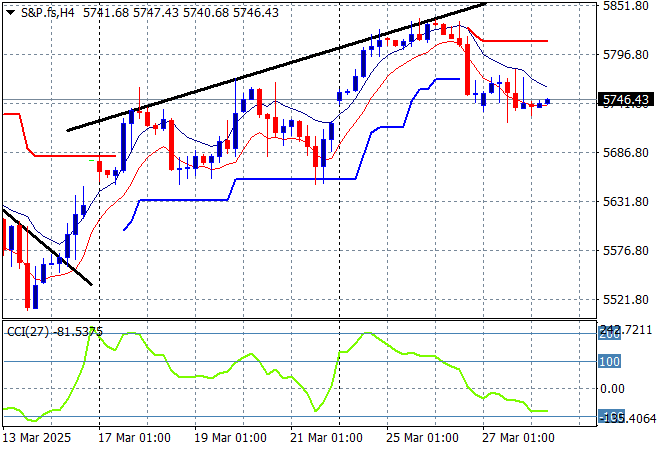

S&P and Eurostoxx futures are moving sideways as we head into the London session trying to recover the overnight losses with the S&P500 four hourly chart showing a return to the 5750 point level following the post Trump election breakdown:

The economic calendar finishes the week with daylight savings changes in Europe while we see the latest German consumer confidence and unemployment prints, plus US PCE figures.