Asian stock markets are doing slightly better today given the mixed result overnight although S&P futures are looking more robust given more Trump talk about caving in on tariffs, although who knows what will actually happen as another distraction is likely soon given the recent intelligence foul up by half his Cabinet. The USD is also largely unchanged against the major currency pairs as the Australian dollar pushes slightly above the 63 cent level after the most recent monthly CPI print.

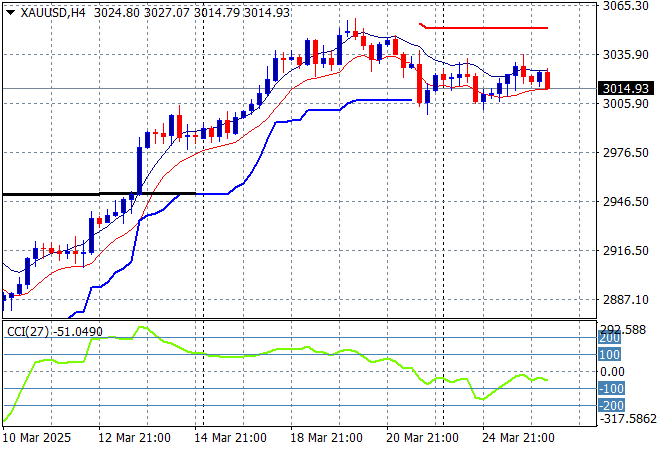

Oil markets are slowly recovering with Brent crude heading slightly above the $72USD per barrel level while gold continues to consolidate just above the $3000USD per ounce level with short term momentum still in a negative funk:

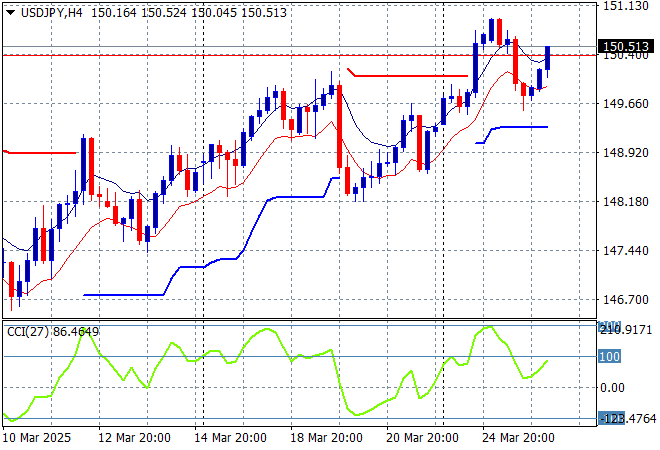

Mainland Chinese share markets are lifting slightly in afternoon trade with the Shanghai Composite up 0.2% while the Hang Seng Index is moving in similar fashion, up 0.2% to 23402 points. Japanese stock markets are continuing to the upside with the Nikkei 225 about to close 0.6% higher at 38031 points while the USDPY pair is trying to hold above last week’s highs at the 150 level:

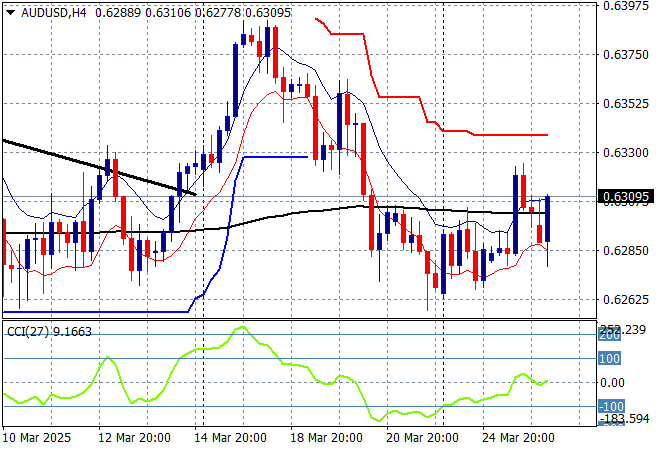

Australian stocks are finally able to make headway with the ASX200 looking to close about 0.7% higher to breach the 8000 point level while the Australian dollar has maintained its position despite a slightly lower monthly CPI print as it hovers around the 63 cent level against the USD:

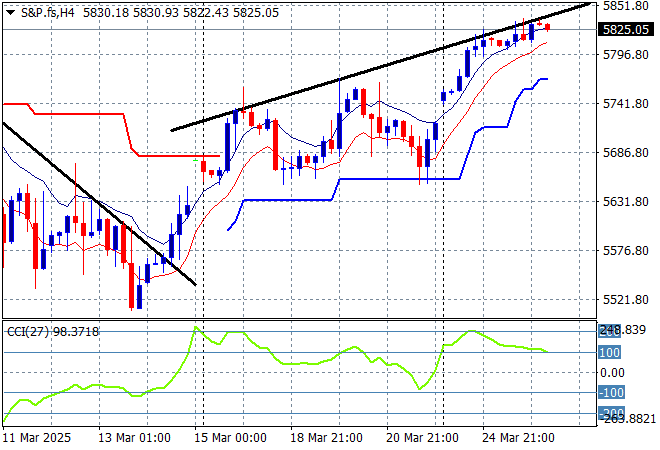

S&P and Eurostoxx futures are moving slightly higher as we head into the London session with the S&P500 four hourly chart showing a proper reversal above the 5750 point level following the post Trump election breakdown:

The economic calendar continues tonight with the latest UK inflation print followed by US durable goods orders for February.