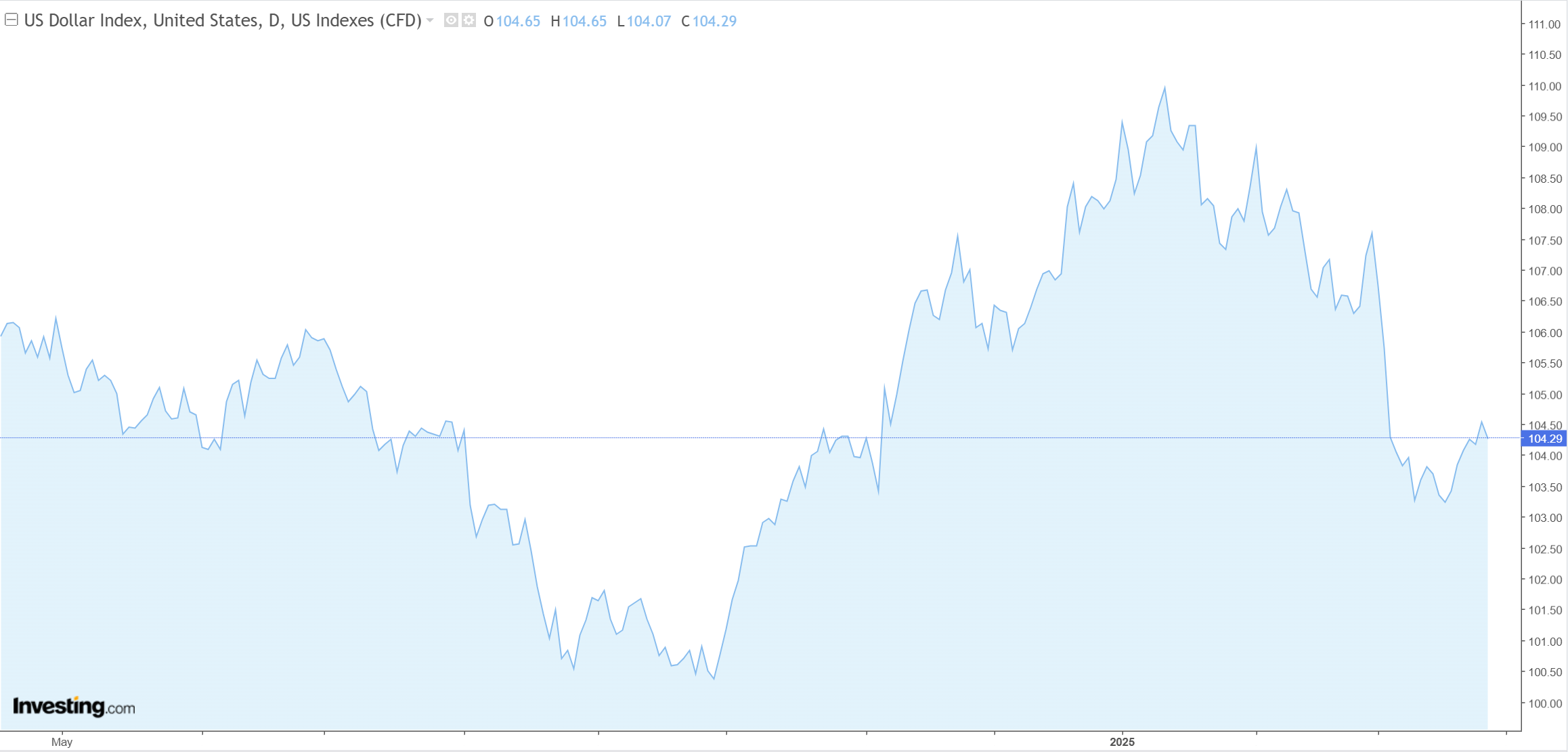

DXY faded.

AUD was stable.

Lead boots are heavy.

Gold is melting up. Oil is a pest.

Advertisement

Alwyas sell copper before Goldman does.

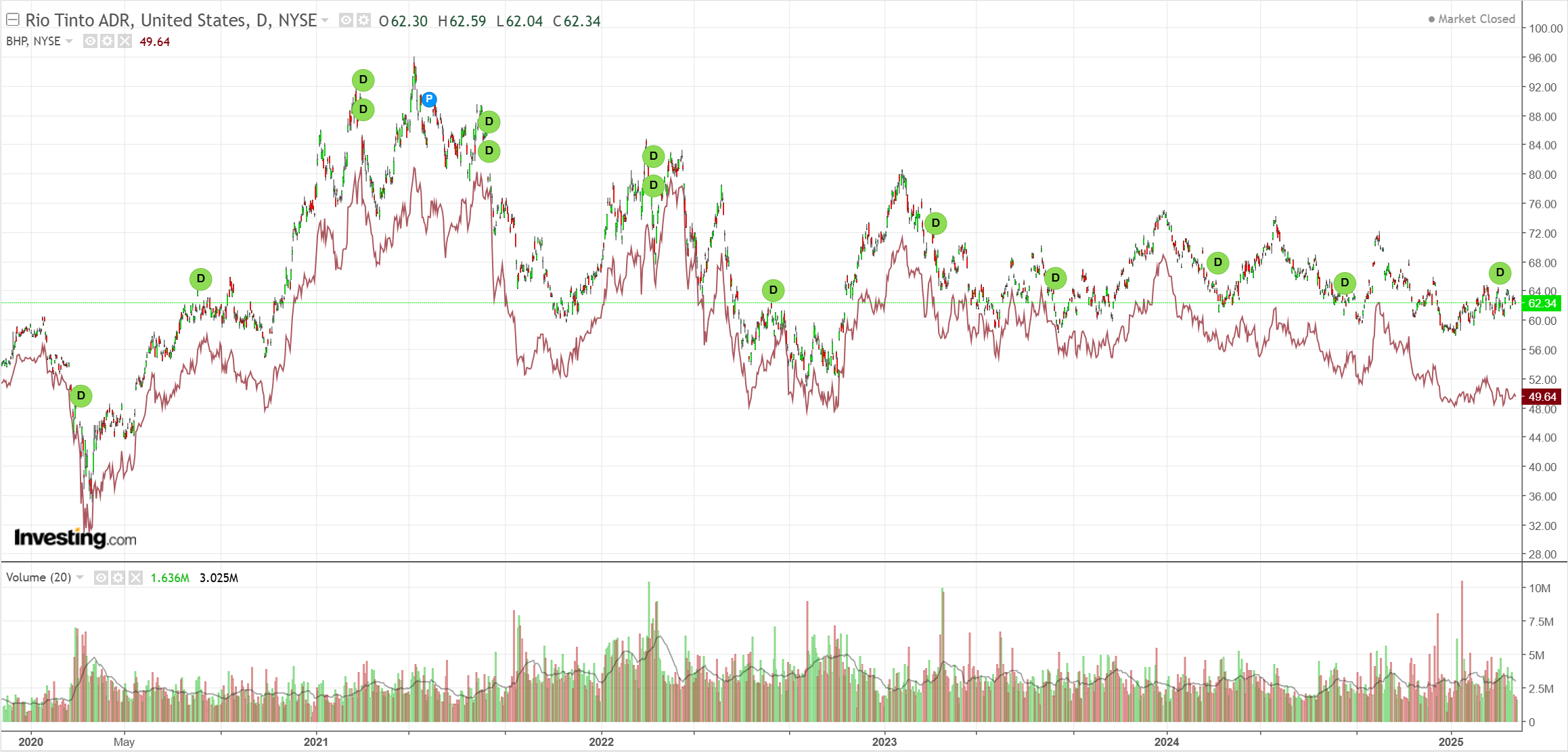

Miners meh.

Em meh.

Advertisement

More junk stress please!

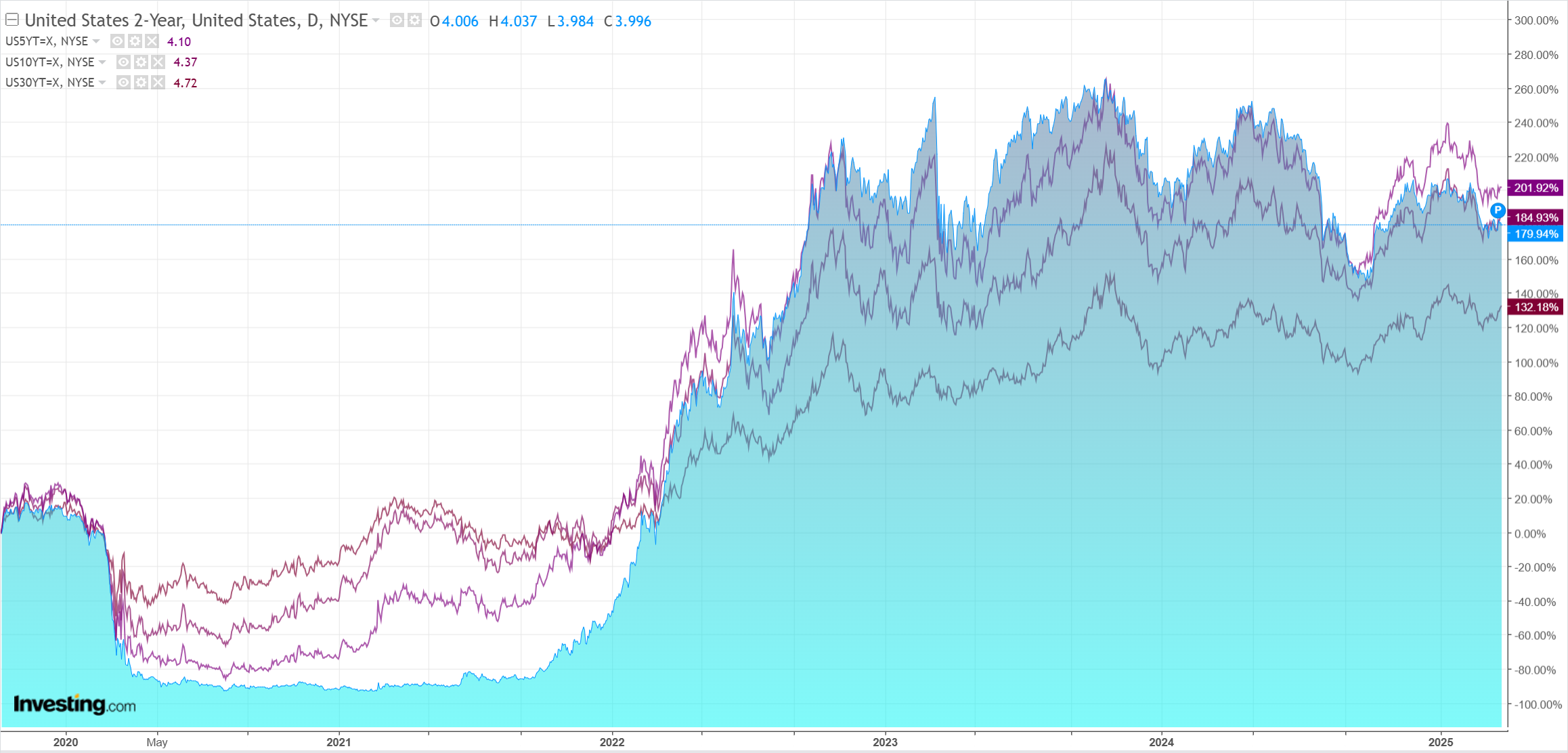

Curve steepened, though.

Stocks fell.

Advertisement

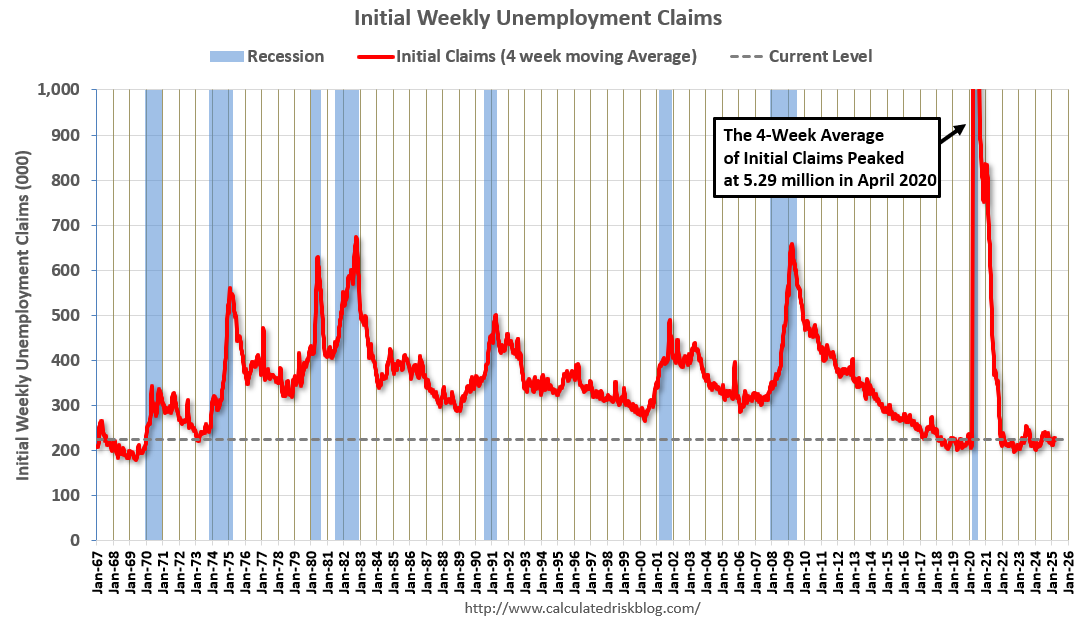

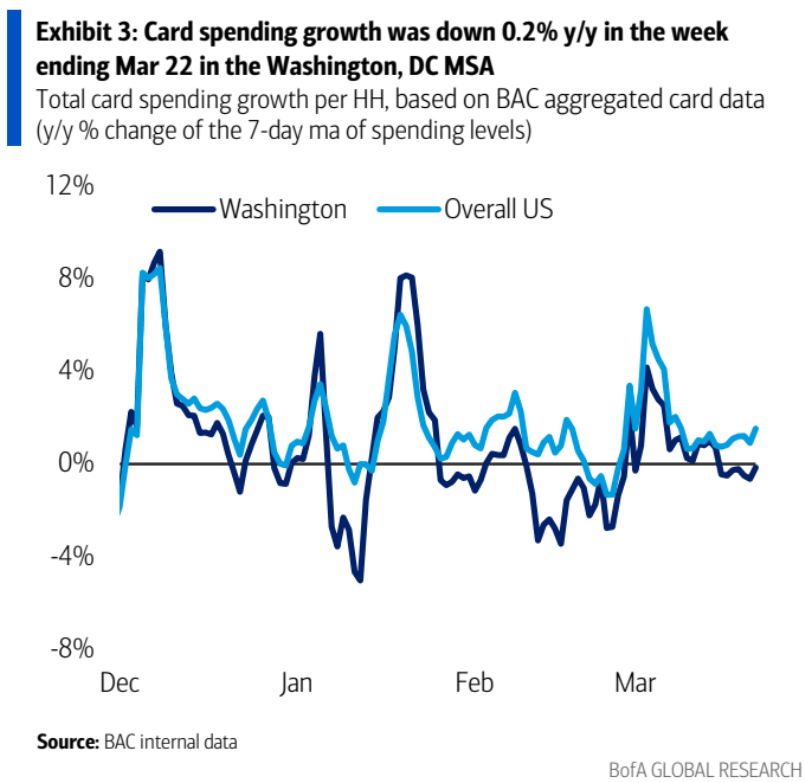

US pending home sales were dreadful again, while initial unemployment claims are showing no sign of DOGE damage outside of Washington.

We are seeing the same in credit card spending.

Advertisement

If we need a recession or something near it to hit Bessent Plan targets for yields, we’ll need a lot more fiscal damage than this.

While the economic data refuses to buckle, DXY won’t either.

With the Fed sidelined by tariffs, stocks remain the primary disinflation mechanism.

Advertisement

AUD will follow with a lag as it is supported by EUR.