DXY is back. EUR is unravelling. Could be tactical.

AUD follows EUR.

Lead boots getting heavier.

Stupid Trump has revived oil with Venezuela and Iran alk.

Copper bubble begins.

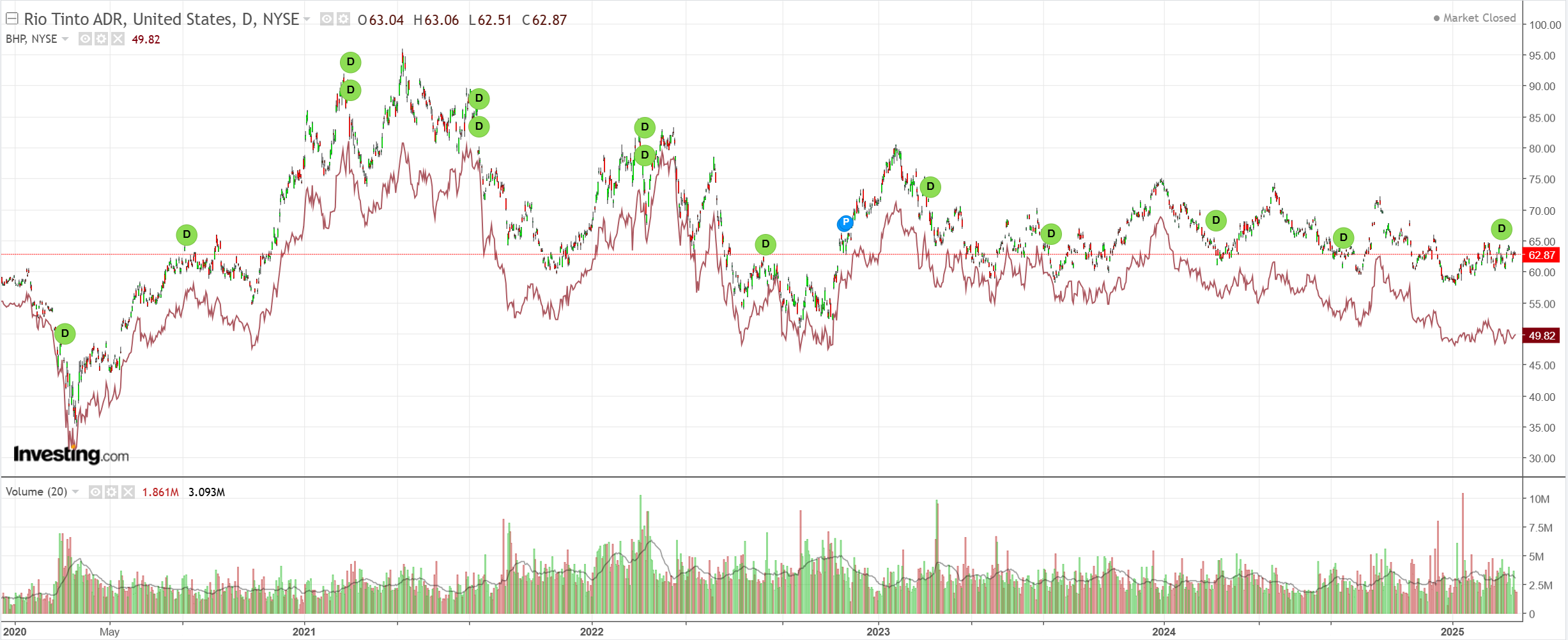

Helping RIO.

EM meh.

Junk stressy.

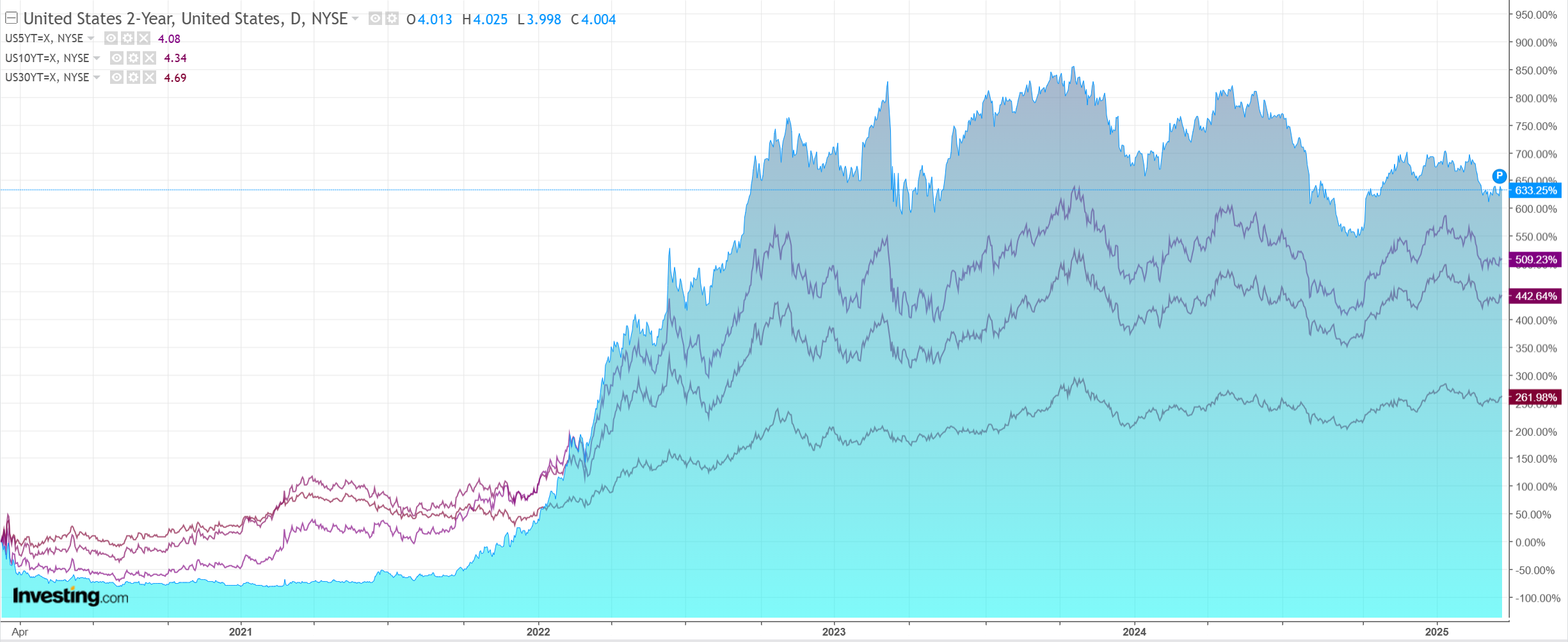

Yields up with oil.

Stocks plunged.

The Australian dollar has once again been tariffed.

President Donald Trump signed a proclamation to implement a 25% tariff on auto imports, expanding a trade war designed to bring more manufacturing jobs to the US and setting the stage for an even broader push on levies next week.

“What we’re going to be doing is a 25% tariff on all cars that are not made in the United States,” Trump said at the White House on Wednesday. “We’re going to charge countries for doing business in our country and taking our jobs, taking our wealth, taking a lot of things that they’ve been taking over the years.”

No problemo for Australia. We threw our car industry into the sea years ago without any help from foreign madmen. Local losers were enough.

In fact, this will mean cheaper cars Donwunder in due course as displaced exports into the US compete for new markets.

Ditto all manner of goods from China.

The last mile of destruction for Australian industry will be a disinflationary boom for Aussie consumers.

Of course, what comes after is a different question if the balkanization of supply chains continues and Cold War 2.0 turns hot.

Then we’ll just be taken over without so much as a shot being fired because we can’t make anything at all with which to defend ourselves.