Progress towards peace in Ukraine is slow to the point of being imperceptible.

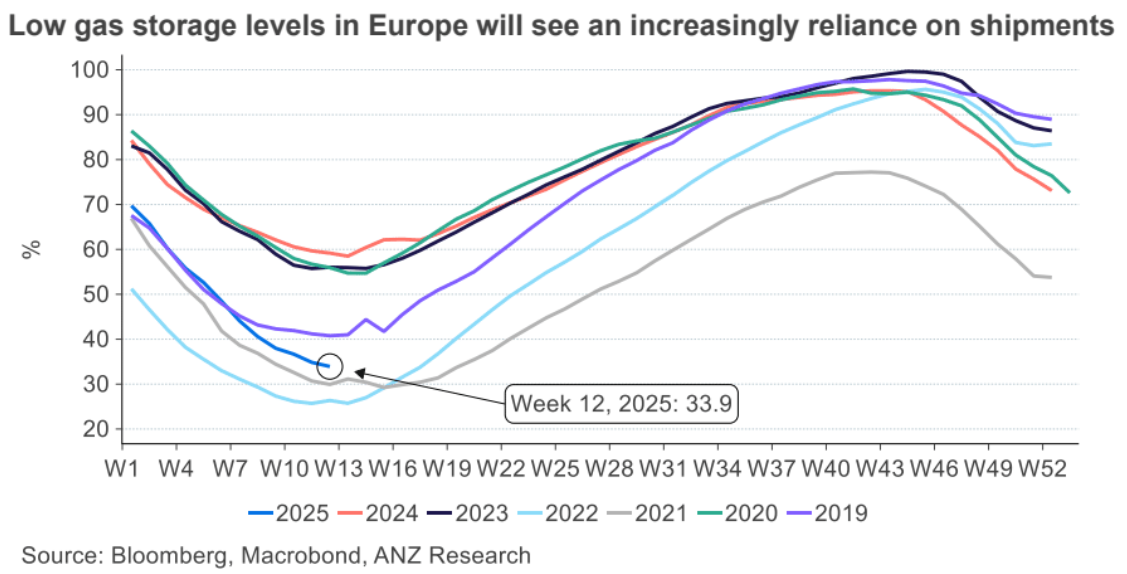

Worse, European gas inventories are sharply depleted after a cold winter. ANZ.

Europe faces challenges restocking its stores of liquid natural gas following sharp drawdowns over winter.

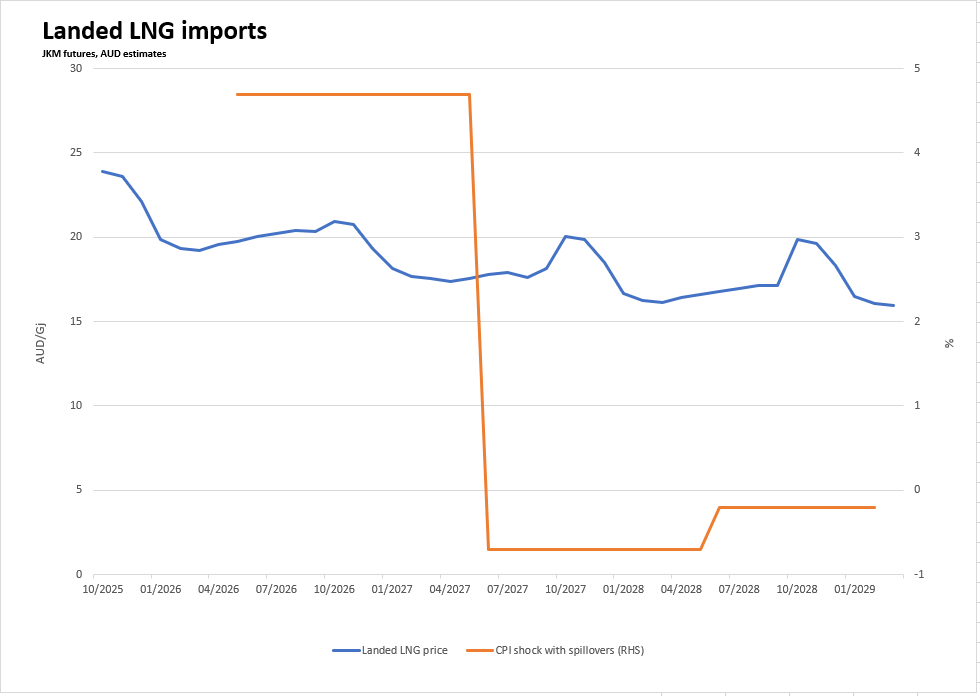

This is likely to increase pressure on the global LNG market.

Increasingly tight supplies resulted in a drop in Europe’s overall gas storage levels.

The expiration of the gas pipeline deal between Russia and Ukraine cut more than 5% of Europe’s gas supply.

This has left Europe in a precarious position. Storage levels are likely to fall below 30% by April, significantly below historical levels.

This makes it almost impossible for Europe to meet its mandated storage target of 90% by 1 November.

With little prospect of a return of Russian pipeline gas, European Union (EU) member states are increasingly reliant on the LNG market.

Restocking will be complicated by challenging geopolitics.

Recent US sanctions on Russian LNG have constrained supply, and US tariffs on Chinese goods risk initiating retaliatory levies or sanctions.

We see upward pressure on North Asian LNG prices.

Supply-demand fundamentals suggest tightness will emerge as European and Asian buyers ompete for limited cargo supply.

With Europe’s gas inventories likely to remain below targets, we expect its LNG demand to remain high through the 2025-26 winter.

Goldman has soured as well.

Of all Russian gas flow scenarios we’ve discussed in recent notes, we’ve thought of the scenario of only a partial return of flows through Ukraine (40-80mcm/d through the Sudzha transit) as the most likely one.

A return to full pre-war Ukraine flows (120 mcm/d, including both the Sudzha and Sokhranivka transit routes) seemed to us harder to negotiate, especially given the force majeure of the Sokhranivka pipeline, ongoing since May 2022, while Germany’s certification of Nord Stream 2 and flows through Poland’s Yamal pipeline seemed politically challenging, in our view.

We now believe that this partial Ukraine flow restart scenario also faces complex challenges. While ceasefire discussions have progressed, we believe that conditions for any incremental Russian gas flow to Europe this year have become less favorable than two weeks ago as a result of recent damage to the Ukraine Sudzha transit infrastructure and questions raised by recent statements from Russian officials.

To be clear, our baseline remains consistent with the status quo. We assume no incremental Russian gas flows to Europe in our forward balances and we maintain our 49 EUR/MWh Balance of 2025 TTF price forecast.

Last week’s damage to a Sudzha metering station was the first reported incident directly impacting Ukraine gas transit infrastructure. In addition to reducing the probability of an imminent return of Russian gas flows to Europe, the incident was followed by statements by Russia’s Deputy Prime Minister Novak this week stressing the Sudzha route is not currently under contract to be used and that its future will depend on the “future interaction on energy with European countries”, which we interpret as a suggestion that Sudzha’s repair might depend on the signing of new long-term gas agreements with European buyers.

While an ask for long-term contracts might make economic sense when there are significant up-front costs to building or repairing infrastructure, we note this argument would be more compelling if applied to the cost to repair the extensive damage caused by explosions to the undersea Nord Stream pipeline in September 2022 than to the arguably much lower costs to repair an overground metering station.

Our interpretation of Novak’s comments would be consistent with what Russian officials had been pushing for before the Ukraine war started. Specifically, after curtailing spot gas sales to Europe from Sep 21, the Kremlin explicitly asked for additional long-term gas contracts with European buyers as well as for Germany’s certification of Nord Stream 2.

Should Sudzha repairs not happen, or be severely delayed, NS2 might once again be presented by Russia as Europe’s best option for incremental gas, effectively removing Ukraine from gas transit negotiations.

Just in time for Australia to start LNG imports and deliver the Gasmgaeddon into your electricity bills.

Vote 1 Peter Dutton’s gas reservation scheme.