Via Institute for Energy Economics & Financial Analysis.

The worsening supply-demand outlook in Australia’s eastern states has prompted renewed calls for increased gas production. However, such measures have consistently failed to address the longer-term risk of supply gaps, and policy solutions should be further explored instead. Most notably, while LNG producers prioritise exports to take advantage of lucrative international spot markets, diverting those supplies to the domestic market could alleviate current supply concerns.

Released in early January, the Australian Competition and Consumer Commission (ACCC)’s latest gas report forecasts that the perennially tight east coast gas market is likely to have sufficient gas supply to meet anticipated demand in 2025 and 2026. However, the report highlights longer-term concerns around future supply adequacy, with structural supply gaps likely to emerge as early as 2027 in the southern states along the eastern seaboard, and in the broader east coast gas market by 2029.

A range of factors have contributed to the worsening supply-demand outlook, some of which are acknowledged by the ACCC, including:

- Declining gas production in the Gippsland Basin not being offset through additional domestic supply from elsewhere despite east coast gas production increasing over the past decade.

- Continued liquefied natural gas (LNG) exports from Queensland, which have accounted for all of the increase in gas production over the past decade, with LNG exporters now being net withdrawers of gas from the domestic market.

- A lack of investment in new gas supply, which the ACCC suggests reflects regulatory, market and financial barriers, but which may also reflect factors such as increasing gas production costs (as less marginal tenements are developed) and the prospect of further domestic demand destruction.

- The risks of infrastructure asset stranding, which can affect new infrastructure investments (particularly greenfield investments to connect new supply sources).

- Market concentration, which may result in gas “hoarding” by producers, particularly LNG exporters, who control most of the east coast’s proven reserves.

- Assumptions that future gas demand from households, industry and the LNG export sector will remain relatively strong despite demand in non-LNG sectors falling over the past decade due to market conditions. (In IEEFA’s opinion, neither the ACCC nor the Australian Energy Market Operator (AEMO) are giving sufficient consideration to the potential for significant gas demand destruction in industry.)

At its core, the worsening supply-demand outlook reflects two key factors: that gas demand is not falling as quickly as needed, particularly in the southern states; and that the vast majority of gas produced on the east coast is exported as LNG at the expense of domestic gas users.

Developing new gas supply to address projected supply gaps has failed

To address the looming supply gap, and recognising that declining investment is driving declining production, the ACCC’s latest report calls for reduced regulatory barriers and explicit government planning to incentivise market-led gas supply solutions.

The focus on gas supply has been a consistent feature of the ACCC gas inquiry since it began in 2017, with the majority of the ACCC’s 22 gas reports calling for new production to improve the supply-demand outlook. Some of the ACCC’s previous reports have also called for government reform to reduce regulatory barriers to new gas development and production.

Despite these calls, however, the risk of supply gaps remains. This raises questions about the gas industry’s ability to invest in enough new production to offset declining production from legacy gas basins, particularly in the south, and its willingness to supply the domestic market rather than export markets.

It is now clear that increasing gas production will not solve the looming supply gap, and that governments and energy agencies (including the ACCC) should give further consideration to other measures to address potential supply gaps.

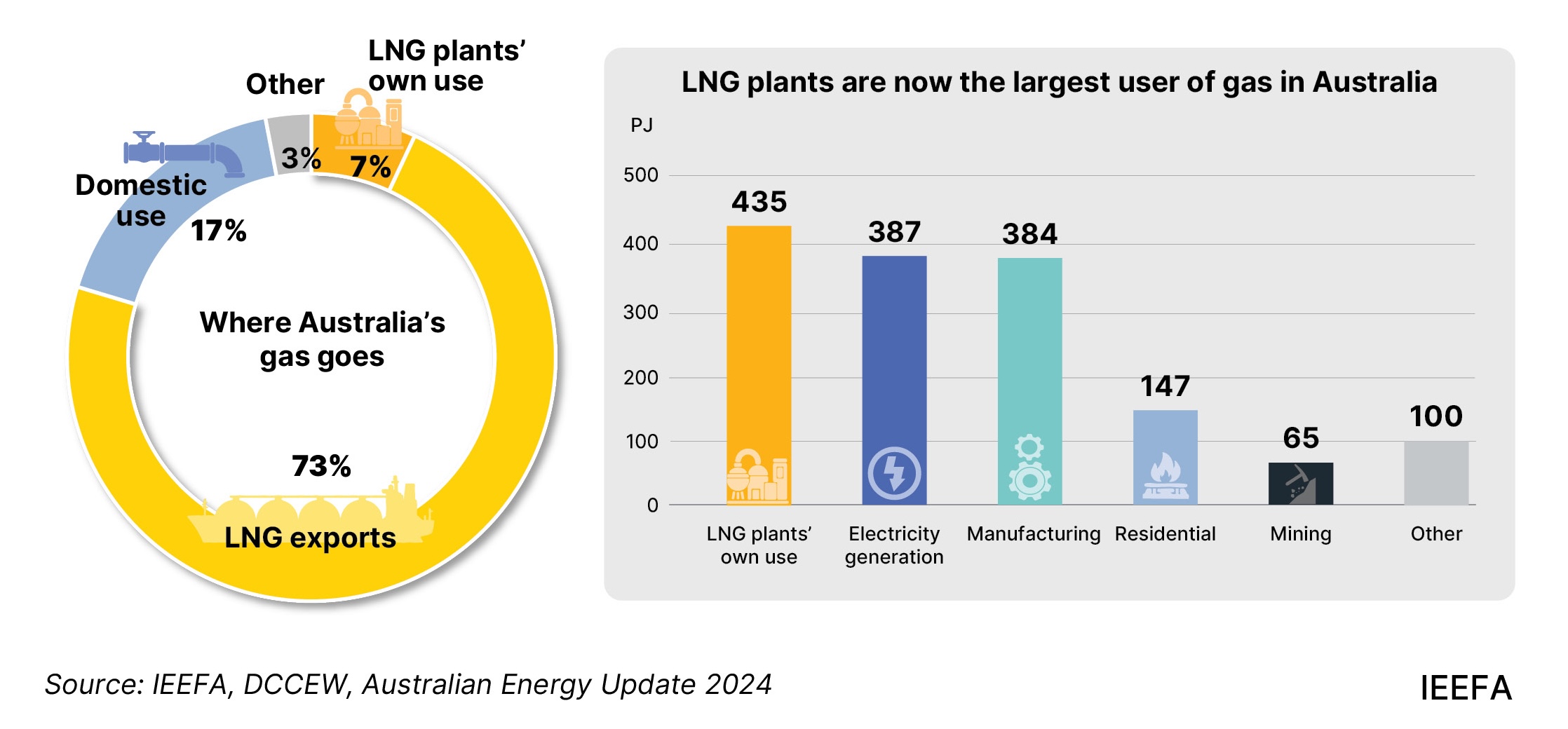

One example would involve diverting some LNG exports into the domestic market. Across Australia, the LNG industry accounts for about 80% of total gas consumption, making it a larger user of gas than all other users combined (Figure 1).

Figure 1: 80% of Australia’s gas production goes to the LNG industry

Sources: IEEFA; Department of Climate Change, Energy, the Environment and Water, Australian Energy Update 2024.

The development of Queensland’s three LNG export projects has coincided with increasing gas prices and tight domestic market conditions on the east coast. These in turn have created challenging market conditions for major industrial gas users and contributed to closures of a number of manufacturing facilities, including those owned by Incitec Pivot and Qenos.

As noted in the ACCC’s report, one industry association stated: “We are seeing the hollowing out of manufacturing capability in Australia … As a result of failures in the east coast gas market and the market power of producers, Qenos were in the position where they had to go into voluntary receivership.”

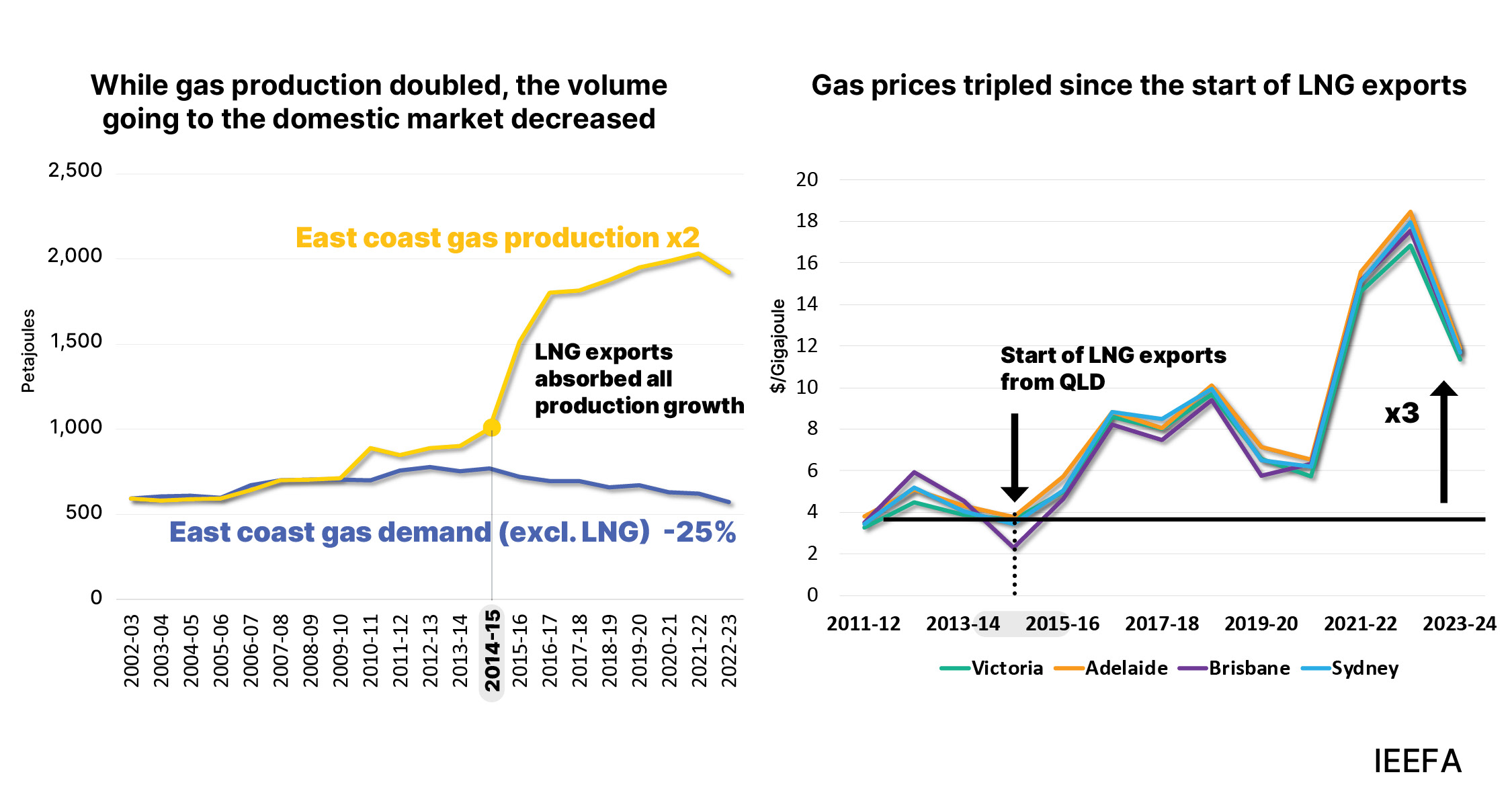

In other words, despite increasing gas production on the east coast, strong demand for LNG exports has resulted in increasingly challenging market conditions, depressing consumption in all non-LNG sectors (Figure 2).

Figure 2: Increasing east coast gas production has not helped the domestic gas market

Sources: Australian government, AER, IEEFA analysis. Note: 2002-03 data is based on Australian Energy Statistics. IEEFA estimated the gas and electricity use associated with LNG production in Queensland based on the increase experienced between 2014 and 2016. Data for FY2023-24 is estimated based on the decline in gas use shown in AER’s daily gas use data from FY2022-23 to FY2023-24.

Diverting LNG exports could alleviate east coast gas scarcity

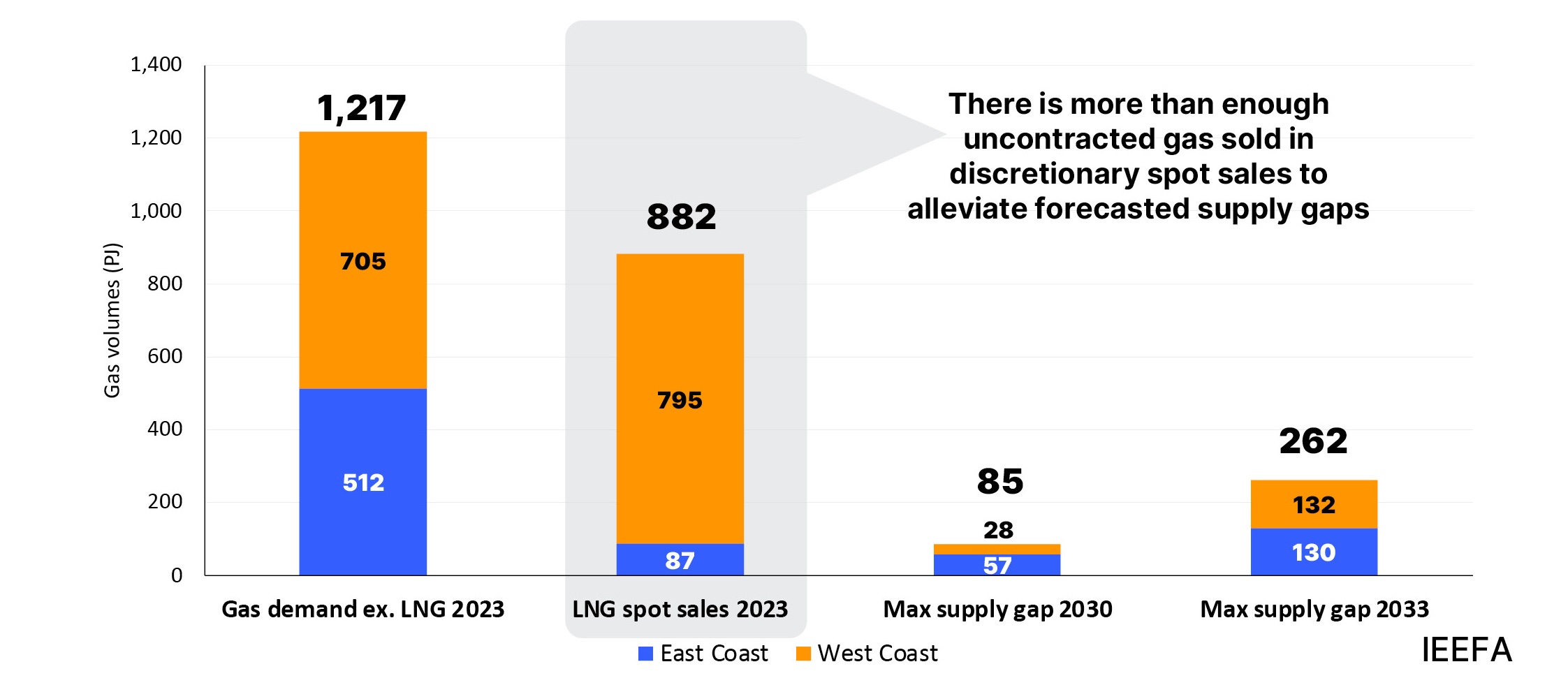

In recent years, Australian LNG exporters have continued to export gas beyond that required to meet their long-term contracts, into LNG spot markets to take advantage of high prices. (Spot markets facilitate quick sales of LNG cargoes, without the need to negotiate long-term contracts, at prevailing spot market prices). These exports, which otherwise could have been supplied to Australian gas users, represent a sizeable portion of Australia’s current domestic gas demand and forecast future supply gaps (Figure 3).

Figure 3: Diversion of LNG spot exports could fully address supply gap risks

Sources: IEEFA estimates; AEMO 2024 Gas Statement of Opportunities; ACCC June 2024 Gas Inquiry Report.

At the same time, Queensland LNG exporters have collectively shifted from being net contributors of gas into the domestic market to net withdrawers, thereby worsening the supply-demand outlook. While their net withdrawal is relatively small – estimated at 6 petajoules (PJ) in 2023 – the ACCC expects this will increase in coming years.

The ACCC acknowledged this impact and highlighted the potential for LNG exporters to supply more gas into the domestic market following the expiry of their foundation LNG contracts in the 2030s. Should these contracts not be renewed, it would result in a material shift in the east coast supply-demand outlook – for example, the Queensland LNG exporters anticipate requiring 1,334PJ of gas to meet their long-term LNG contracts in 2025.

Consideration should be given to the merits of redirecting discretionary LNG spot exports now (such as through an export cap or some other mechanism), whether from Queensland, the Northern Territory or Western Australia, into the east coast gas market to alleviate supply concerns (imports from Western Australia will only be possible if an import terminal commences operations).

Global LNG markets will soon see an unprecedented wave of new low-cost supply that will outstrip demand growth and lead to a global glut. At the same time, LNG buyers in Japan (Australia’s largest export destination) are over-contracted and on-selling record levels of LNG into third countries. By redirecting this gas for domestic use, Australia has an opportunity to resolve the east coast supply issue with minimal impact on LNG exporters, thereby ensuring we retain gas-intensive manufacturing jobs and skills until commercially viable alternatives are available.

No brainer.