Corrupt Grattan gas foghorn returns to sink Australia

In 2013, as Origin Energy prepared to export enormous quantities of East Coast gas, mostly to China, the Grattan Institue’s Tony Wood demanded there be no domestic reservation:

“With more than $160 billion forecast to be invested in LNG production, the export industry is good for the economy. Governments should therefore resist self-interested calls from some industries to reserve gas or cap prices for the domestic market”.

“One reason that reserving gas is a bad idea is that there is no shortage of gas. The challenge is to ensure that the gas gets delivered to where it is required, and this means commercial buyers and sellers need to reach commercial terms on new arrangements”.

“Capping prices for the domestic gas market is a very bad idea. It amounts to a tax on producers and a subsidy for domestic gas users. Protectionism of this sort may provide some short-term price relief for targeted industries, but it tends to mean inefficient businesses and less investment”.

“Ultimately it leads to higher prices and damages the economy for us all”.

History proved the opposite, as it was always going to. There is a very good reason that every gas exporter other than Australia’s East Coast has a domestic reservation policy.

Gas exports are capital-intensive and uncompetitive. Left alone, they tend to consolidate reserves in the hands of the few, and domestic prices rise.

This is exactly what happened to Australia’s East Coast as repetitive gas (and therefore electricity) price shocks overtook energy markets after 2013.

A decade on, the consequences are extreme.

Monetary and fiscal policy are at war over inflation and energy rebates. Industrial hollowing out is advanced. The energy transition is an unfolding disaster. Governments regularly rise and fall on failing energy policy.

That is, the lack of domestic reservation for gas on the East Coast is transforming Australia into a Banana Republic at visible speed.

All of this is the direct result of the East Coast gas market failure that Tony Wood at the Grattan Institute recommended while being sponsored by gas export cartelier Origin Energy, where Wood used to work.

Today, Wood returns to discuss his own mess.

…the best solution during the next five to 10 years is a combination of shipping LNG from other parts of Australia into local import terminals, active demand response, and a clear strategy to reduce gas use to the important backup role it will have in a net zero economy.

Of course, this won’t be easy. The LNG terminal component is the most urgent and complex element. Squadron Energy’s terminal at Port Kembla may be able to deliver gas to Victoria by 2026, but customers have been so far unwilling to commit to firm commercial agreements. Other potential terminals in Victoria, including Viva Energy’s proposal at Geelong, are at least a couple of years further off and face considerable local opposition.

The best way to deliver the LNG terminal solution is through some form of commercial agreement between gas retailers, industrial consumers, terminal operators, gas producers, and traders. So far, bringing the parties together has been too hard. Alternatively, governments will have to intervene via some combination of underwriting the costs of the terminals, and market direction through AEMO. The industry would be well-advised to try harder.

A gas-rich, wealthy country unable to supply gas to its major population centres is a massive failure of policy.

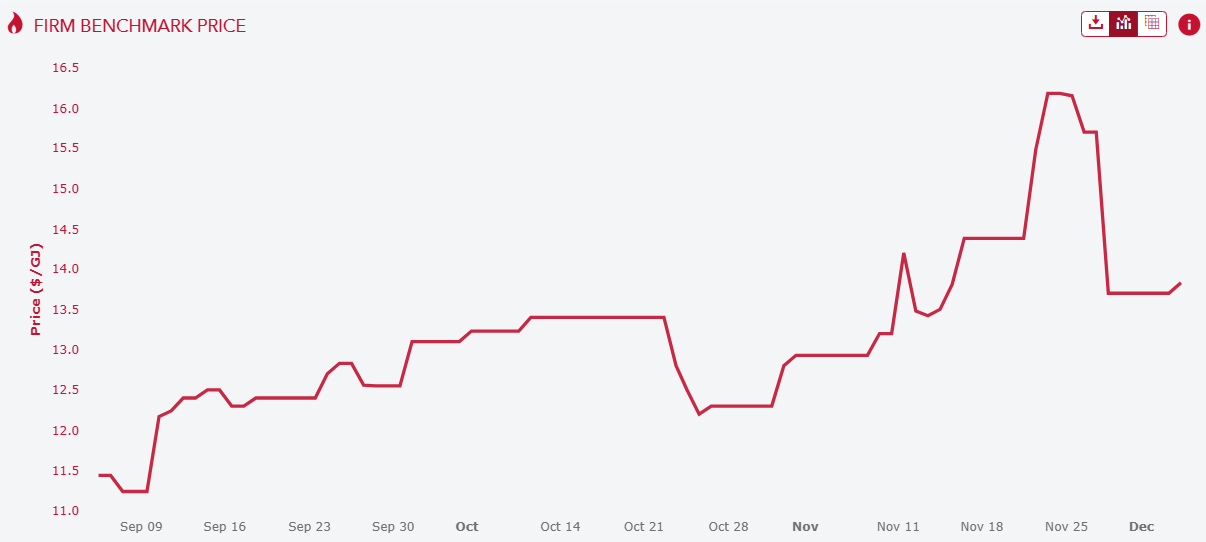

The global outlook suggests falling LNG prices in the next few years. Whether that happens or not, the existing government-gas industry arrangements under the Domestic Gas Security Mechanism and the $12 per gigajoule price cap will need to be revisited.

I could not have put it better myself, only adding that it is Wood’s “massive failure of policy”.

Looking forward, the question is, what does Wood mean when he says “the existing government-gas industry arrangements under the Domestic Gas Security Mechanism and the $12 per gigajoule price cap will need to be revisited”.

If he means that we will need a lower price cap and to extend it to the spot market from contracts, then I agree.

This is an effective domestic reservation to fix Wood’s ten-year gas calamity.

But if he means that we need to scrap the price cap and ADGSM so that Australia can bid for its own gas in the Asian market, then Wood is certifiably insane.

Gas prices are already 400% higher than they should be, owing to Wood’s unregulated gas export cartel.

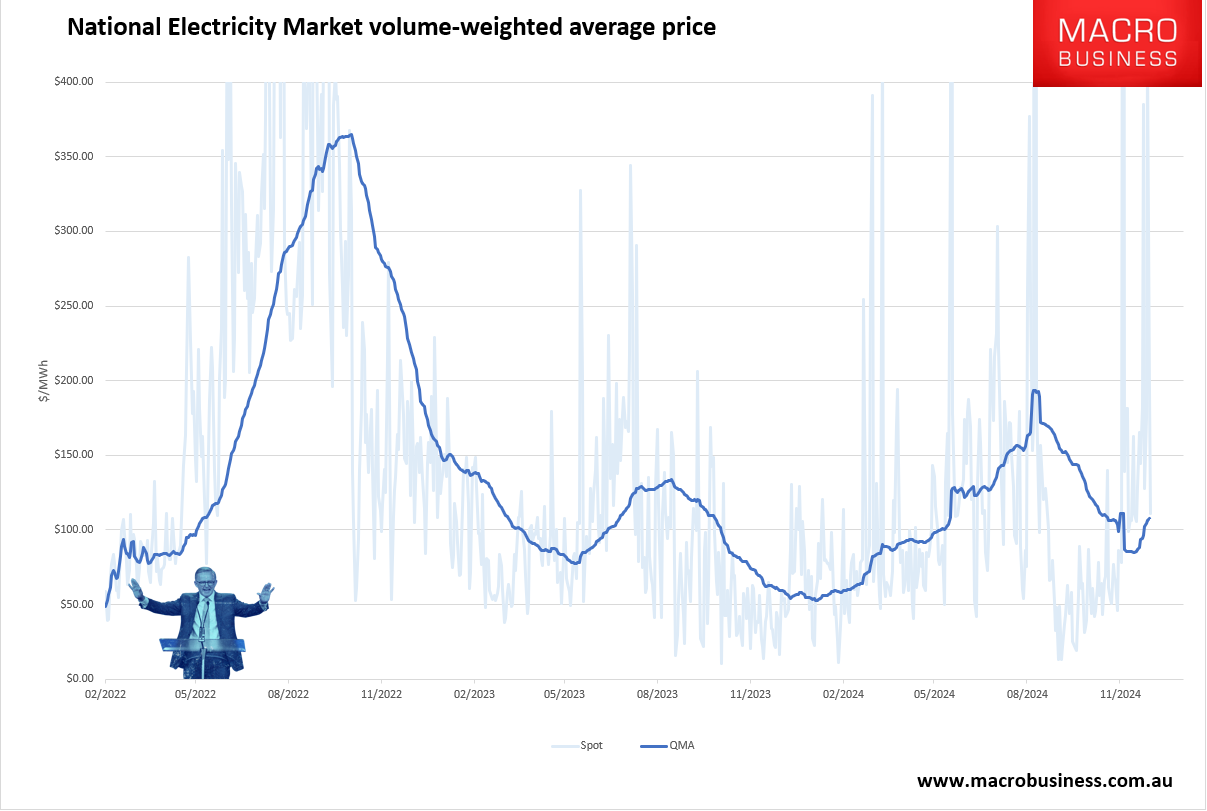

QMA electricity prices are double what they should be as a direct result.

If we scrap regulations to enable Australian import terminals to bid for our own gas via Asia, then we are embedding massive price risk.

First, we would be buying Australian gas but denominated in US dollars using Australian dollars. This means every time AUD falls, LNG prices rise, injecting inflation shocks whenever the economy is weak.

Second, we become exposed to every global energy shock, no matter how distant and irrelevant to Australia.

For instance, Europe is having a cold winter this year, which has driven the Asian LNG price higher.

The landed price for LNG imports in Australia right now would be $25Gj, nearly double what we currently have.

If sustained, this would be equivalent to the Ukraine War price shock, delivering roughly 2% to CPI and forcing the RBA to resume rate hikes unilaterally.

The house price crash that followed would destroy the East Coast economy.

Indeed, it is foreseeable that it would get even worse. As household bad debt cascades into the banks and credit is rationed, the budget will plunge into an enormous deficit.

If this coincides with the iron ore ice age, we are talking about a depth of deficit that will shock markets and the currency will keep falling, forcing gas inflation and the RBA to hike even higher.

These are the outlines of a classic emerging market external debt crisis in which the final transformation into the gas Banana Republic will be the wholesale collapse of governments.

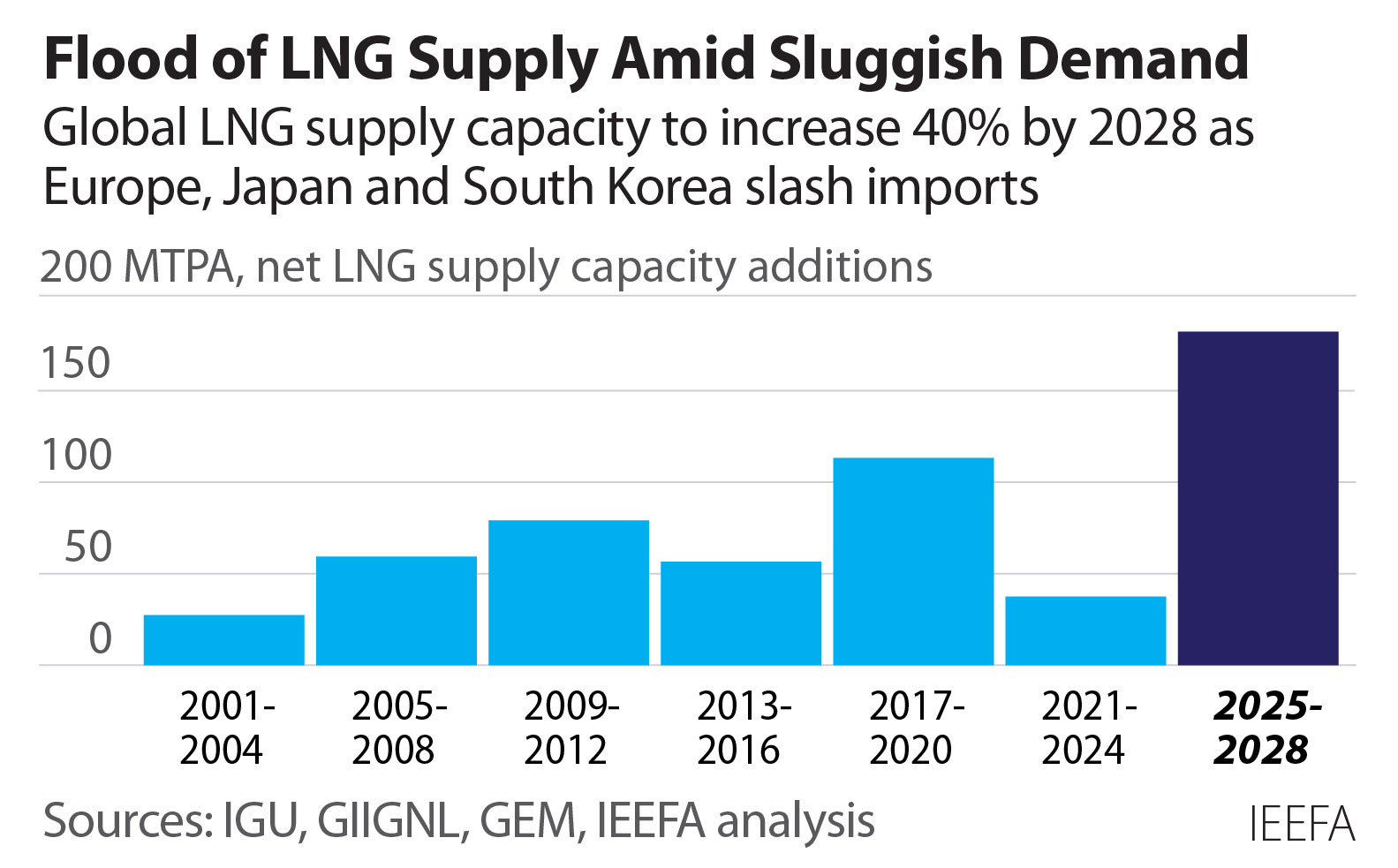

On the other hand, as Wood says, there are also downside price risks to imported LNG, with a flood of shipped gas from Qatar and the US expected by 2028.

But the supply is backended in the period and is being delayed regularly owing to construction impediments.

Moreover, even if this were to halve Asian LNG prices, it would still land in Australia at around today’s $12Gj price cap.

The fact is, versus domestic reservation and/or export levies to regulate Wood’s failed gas market, LNG imports are a potentially fatal risk for the overleveraged East Coast economy.

The Grattan Institute is sponsored by the East Coast gas cartel, which would enjoy boom profits as Australia went historically bust.