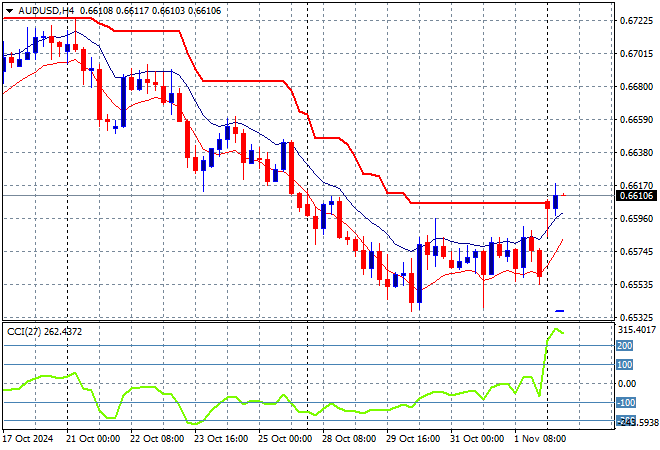

A generally positive day across Asian stock markets to start what could be the most volatile trading week of the year as the US election looms. Friday night saw the release of the latest US non-farm payrolls aka unemployment print that came in quite weak, while the latest Iowa poll is shifting sentiment away from a Trump win with the USD dropping further on the weekend gap as the Australian dollar jumped above the 66 cent level in response.

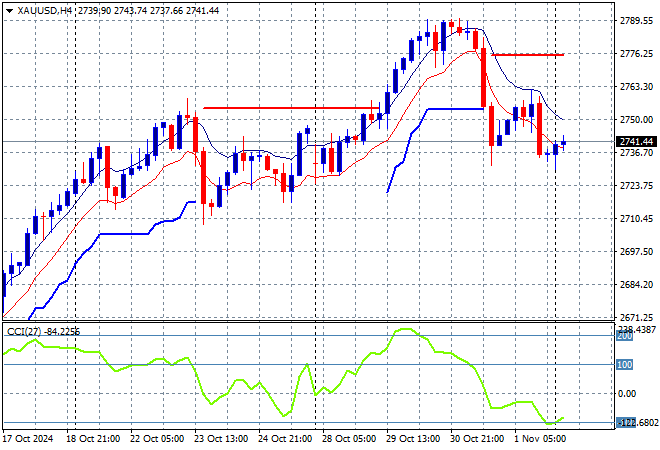

Oil futures are pushing slightly higher on the weaker USD with Brent crude moving above the $74USD per barrel level while gold is trying to recover from its falls last week but is not putting on significant runs with a move back above the $2740USD per ounce level:

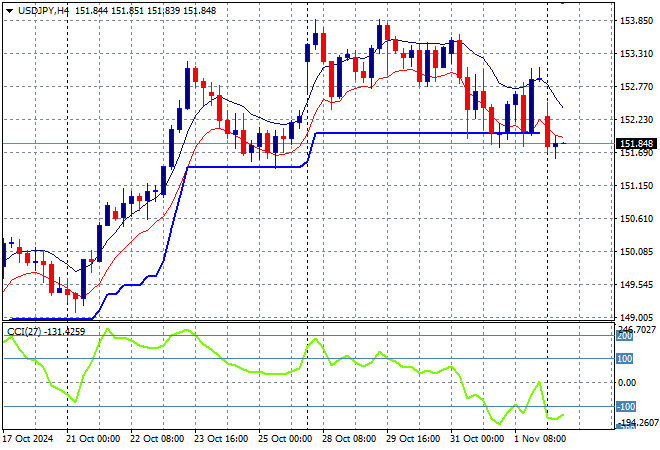

Mainland Chinese share markets are up modestly going into the close with the Shanghai Composite gaining more than 0.6% to be just under the 3300 point level while the Hang Seng Index has kept relatively steady at 20544 points. Japanese stock markets were closed for yet another holiday with trading in the USDPY pair somewhat muted as it retreated below the 152 level:

Australian stocks were the best performers in the region as the ASX200 closed more than 0.6% higher at 8164 points while the Australian dollar has jumped up above the 66 cent level on the US political machinations to get back to its start of week high after a long run down all month:

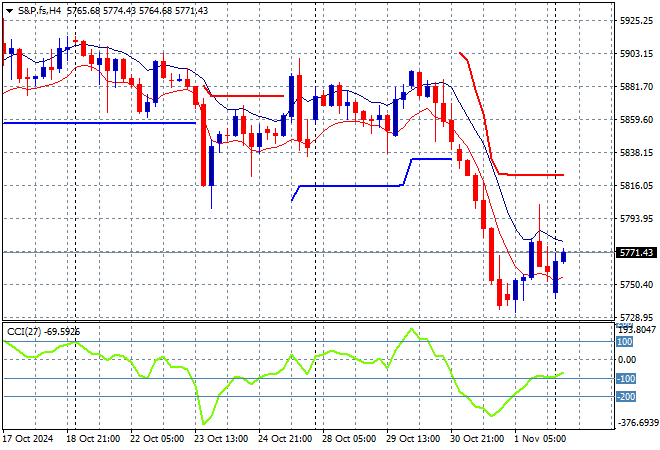

S&P and Eurostoxx futures are up slightly as we head into the London session soon with the S&P500 four hourly chart showing momentum trying to recover from grossly oversold settings as the 5900 point zone becomes a memory:

The economic calendar is very light with a few final manufacturing PMI prints in Europe and not much else.