With Chinese stocks closed for the week there weren’t many catalysts in the region today with local stocks slumping in the wake of poorer than expected retail sales while risk markets overall reacted to the Israeli invasion of Lebanon. The USD remained somewhat strong from its overnight little surge but the Australian dollar is holding very steady above the 69 cent level.

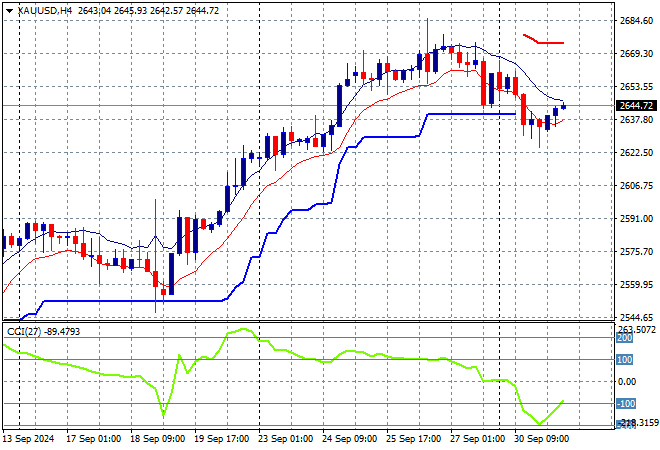

Oil futures are falling back as Brent crude retraces down to the $71USD per barrel level while gold is trying to comeback after its small retracement at the start of the week, now hovering just above the $2640USD per ounce level:

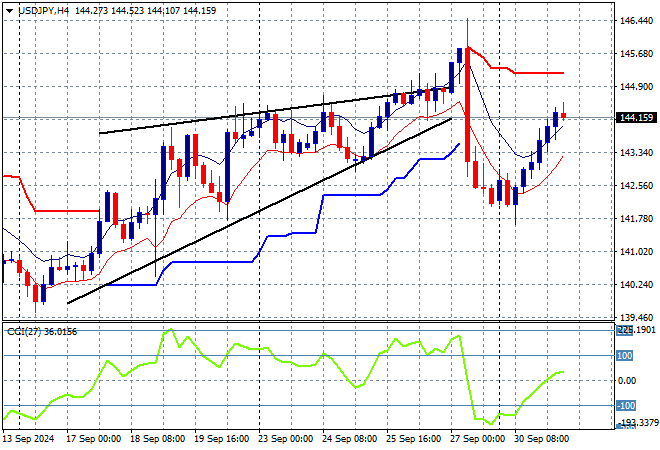

Mainland and offshore Chinese share markets are closed for the week with Japanese stock markets rebounding with the Nikkei 225 closing nearly 2% higher at 38651 points while the USDPY pair continues its rebound to push above the 144 level following the breakdown at the end of last week:

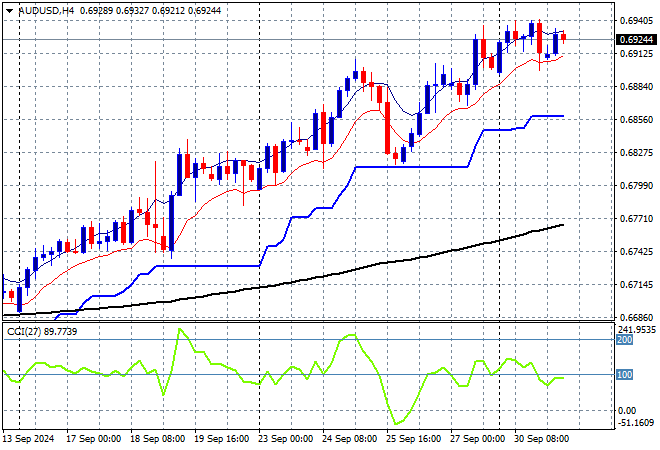

Australian stocks were pushed lower due to the latest retail sales print with the ASX200 losing more than 0.7% to close at 8208 points while the Australian dollar has recovered somewhat to stay above the 69 cent level this afternoon:

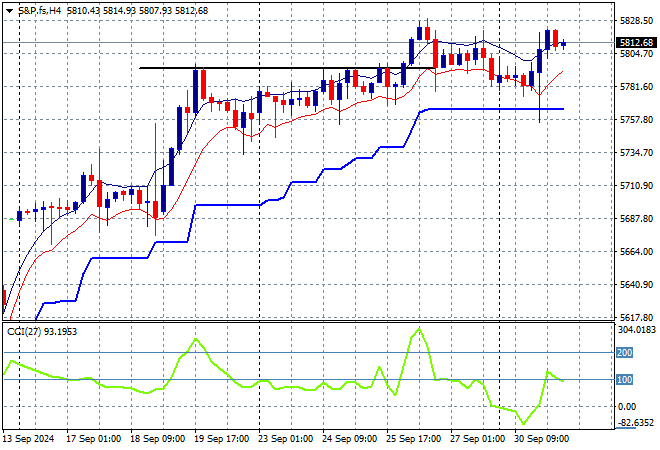

S&P and Eurostoxx futures are up slightly going into the London session with the S&P500 four hourly chart showing momentum still looking good although price action wants to breakout above the recent highs:

The economic calendar continues tonight with some Euro flash inflation prints followed by the latest US ISM manufacturing survey.