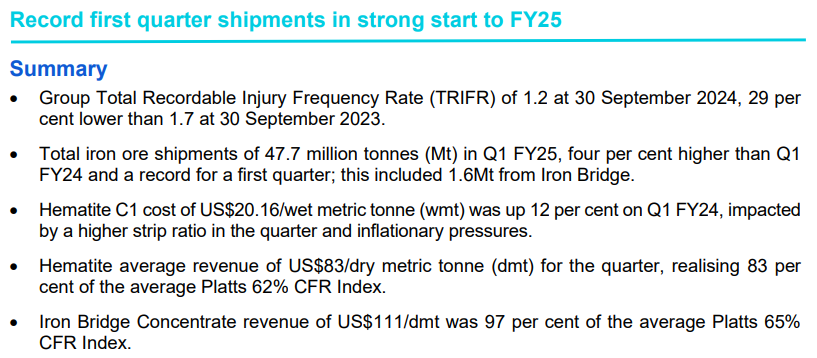

FMG’s Q1 production report is out and appeared decent on the surface regarding volumes but it did not take long to expose the problem:

83% price realisation is up 1% QoQ but is still poor and $83 per tonne is even poorer. The high-quality ore missed as well, slipping from 101% the prior quarter.

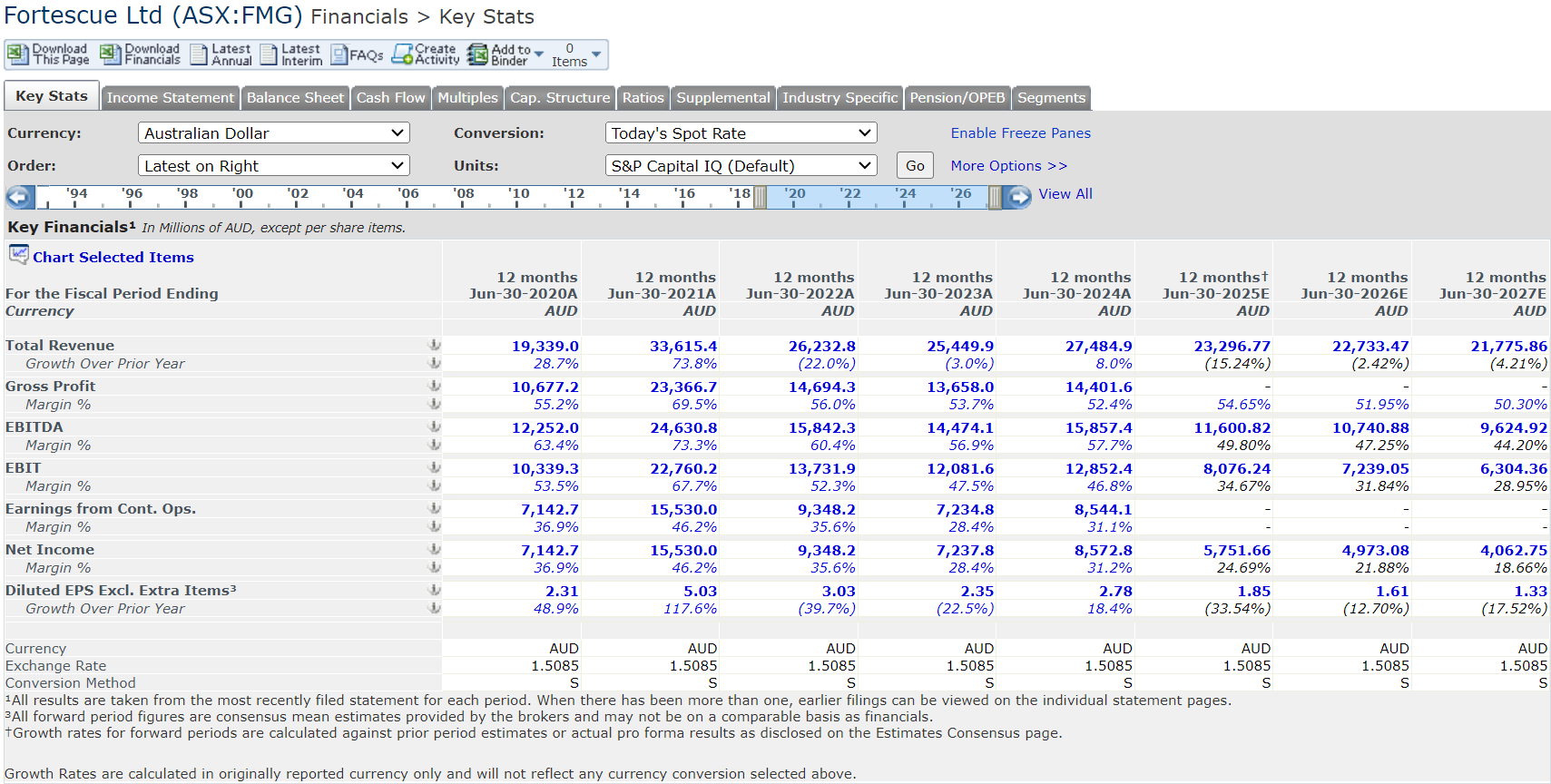

This puts FMG behind consensus revenue and EBITDA outlooks:

Advertisement