Behold the DXY express elevator:

And AUD lift to hell:

North Asia is no help:

Gold and DXY do not move like this together. Either the world is about to end or the gold bubble is:

Metals are fighting the king:

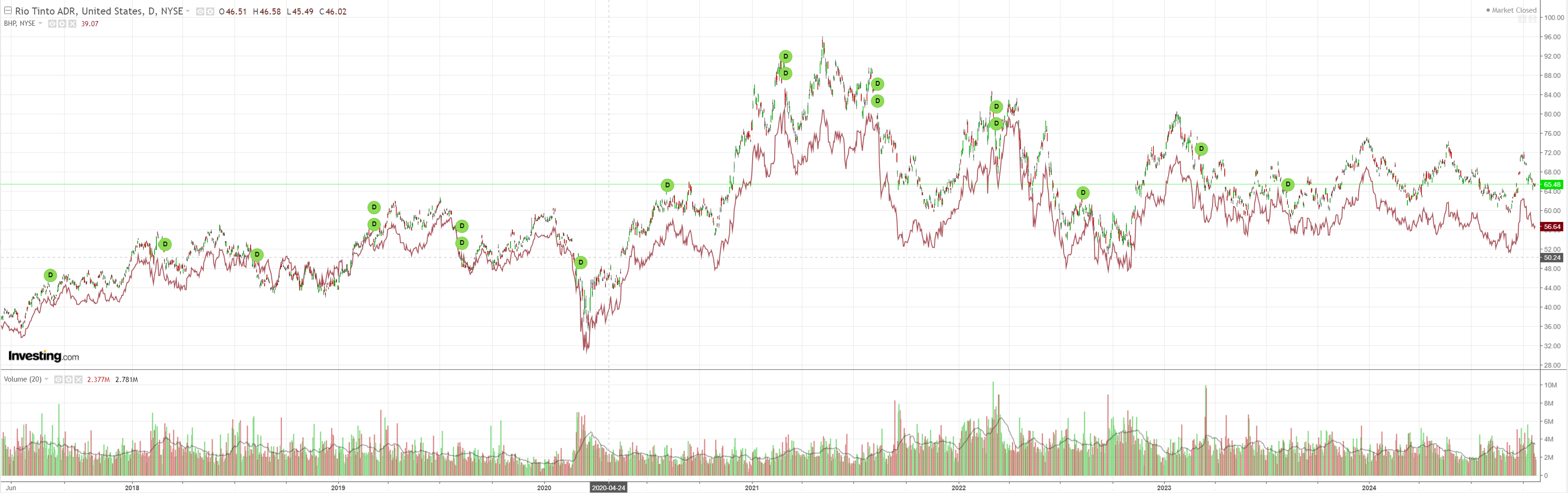

Miners not so much:

Nor EM:

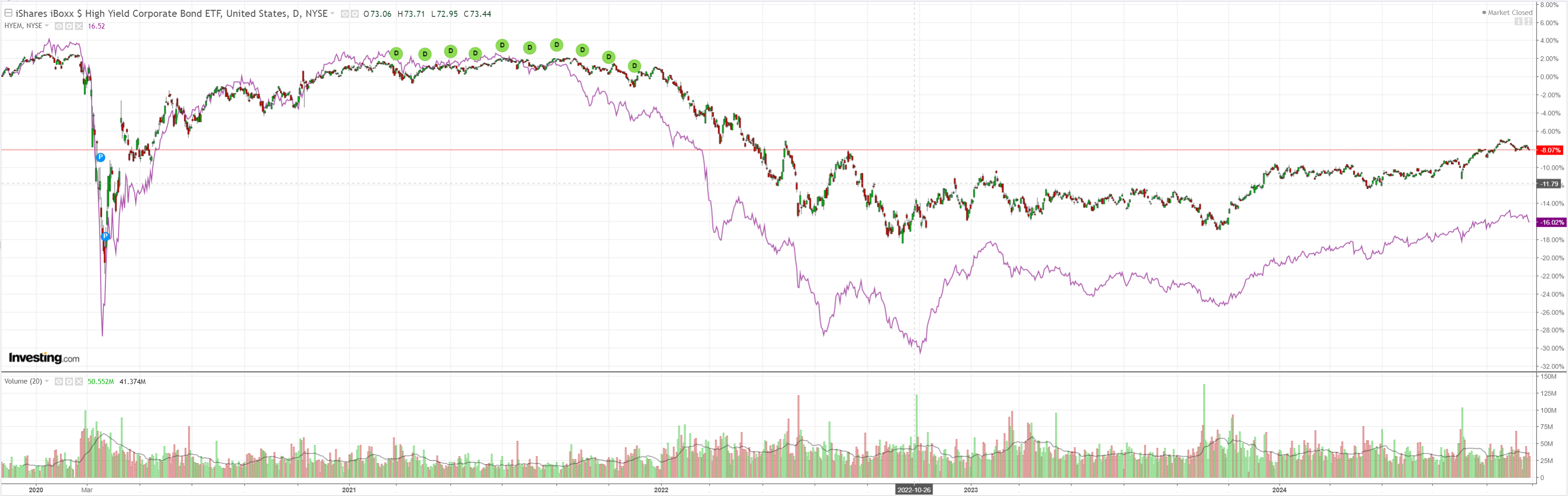

The junk siren just went off for risk:

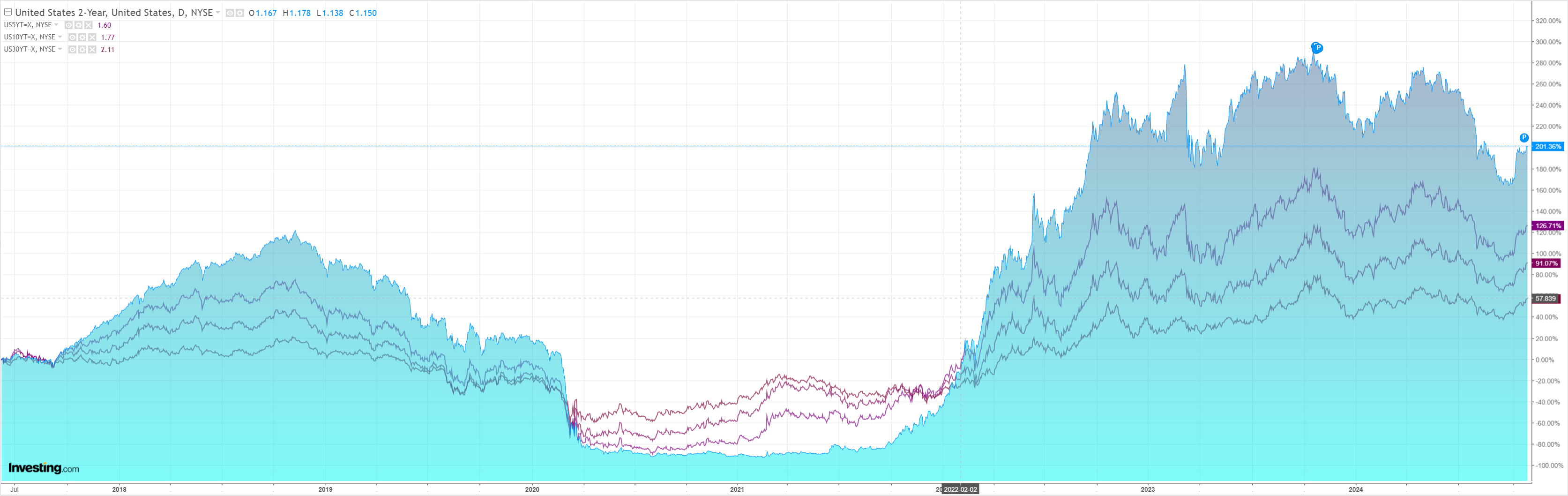

Yields are no friend of gold, either:

Stocks only go up until they don’t:

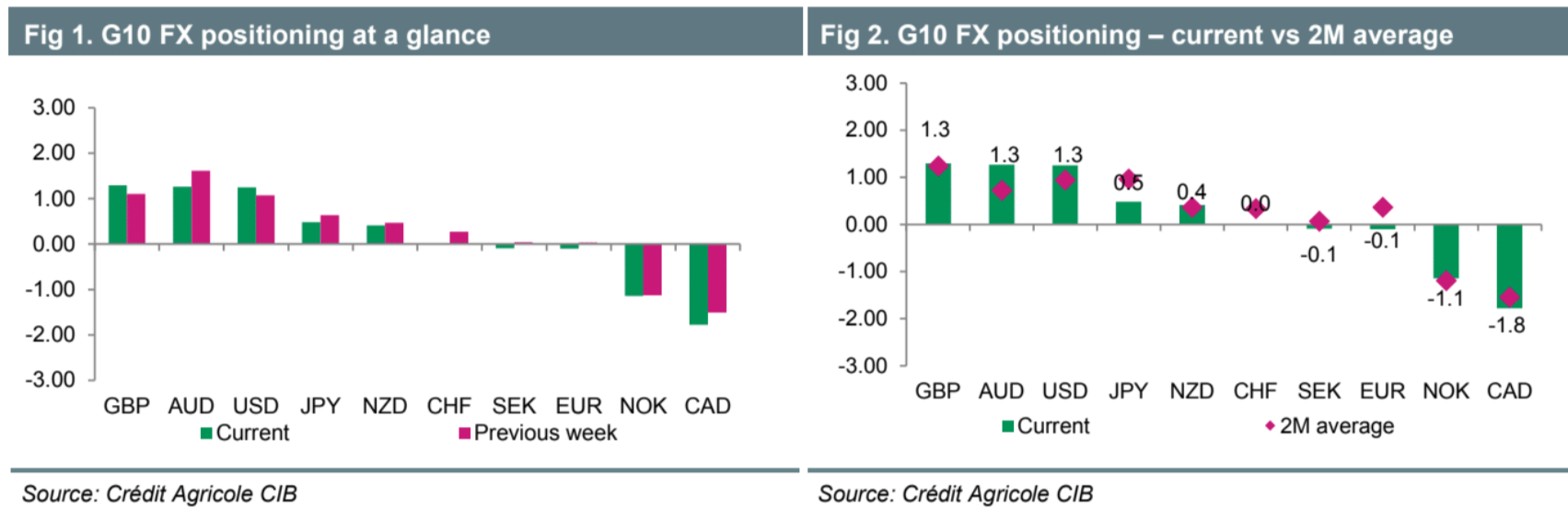

Credit Agricole has the latest positioning data for forex:

At present, the G10 FX PIX 2.0 signals that the GBP has overtaken the AUD as the biggest market long, with the USD a close third, The CAD and NOK remain the biggest shorts.

The USD saw some buying interest last week, predominantly driven by IMM flows. Our FX flow data points at hedge funds inflows, as well as banks,corporates and real money investors outflows.

The AUD faced fresh selling interest last week, predominantly driven by IMM flows. Our FX flow data points at hedge funds inflows, as well as banks, corporates and real money investors outflows.

I can’t remember a time when the market was so hot for AUD but it kept falling anyway.

If we get Donald Trump 2.0, and Chinese stimmies fail again (both base cases), positioning could reverse and the bottom fall out of the AUD in the new year.