Gold is a very useful currency.

It rallies when the reserve currency is being debased owing to low real interest rates and as a safe haven.

However, it is highly volatile and can dramatically overshoot. That is where we are now.

Michael Hartnett leads us off:

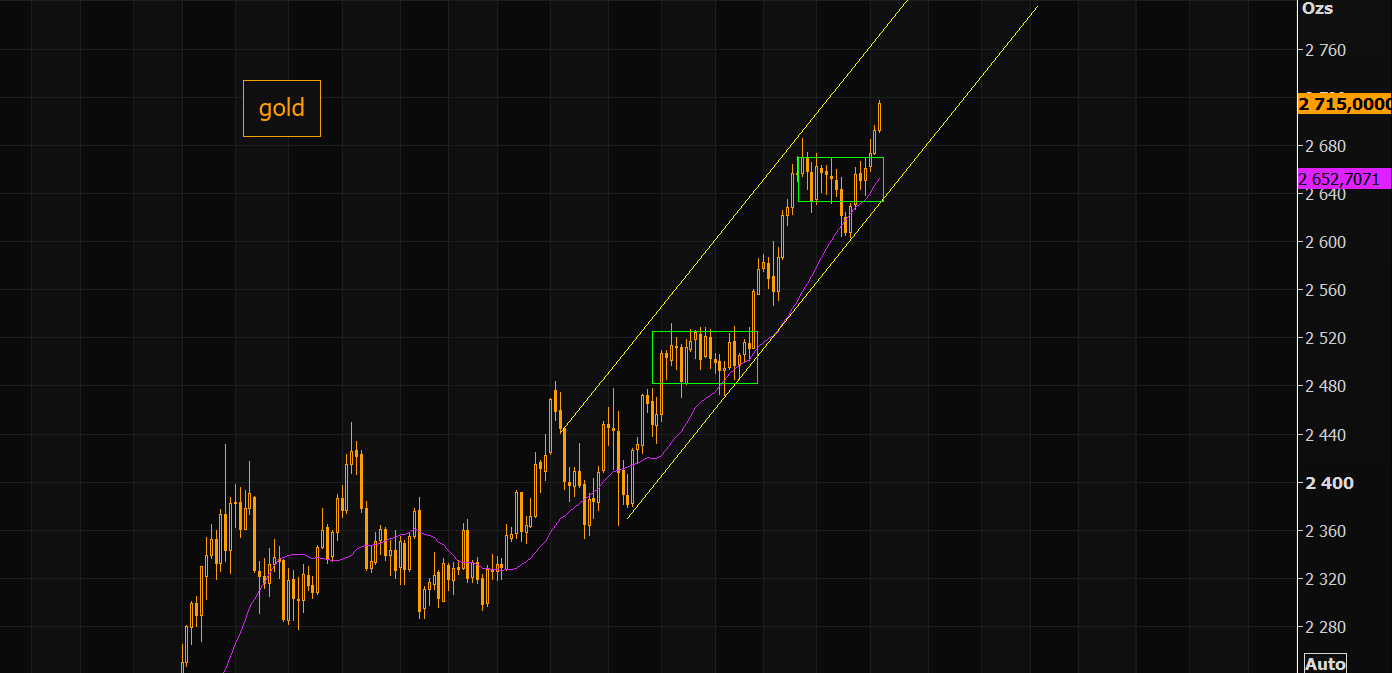

Gold Price: gold at $2695/oz, an all-time high (Chart4), and significantly above prior historic peaks of $2000/oz in 2020, $1900/oz in 2011; gold bull driven by policy & inflation…2020s decade of US & global fiscal excess, 2020s decade of tech & trade tariffs & protectionism, Fed determination to slash real interest rates coming quarters, investors simply need to hedge inflation & threat of US dollar debasement (Bitcoin price all-time high of$75k) would corroborate; gold heading well above$3000/oz.

Gold may well overshoot so high but I disagree with the rationale.

Fiscal excess restricts monetary easing. When it is combined with US tariffs and exceptionalism, DXY gets stronger not weaker.

When that is combined with failing Chinese fiscal stimulus and an inexorable fall in its interest rates and currency, the case for gold is left only with its safe haven status.

This is not fundamentals, it is FOMO:

I have been on board with the gold rally for the past year or so but I’m a seller here.

The fundamentals are gone and will die in the event of Trump 2.0.