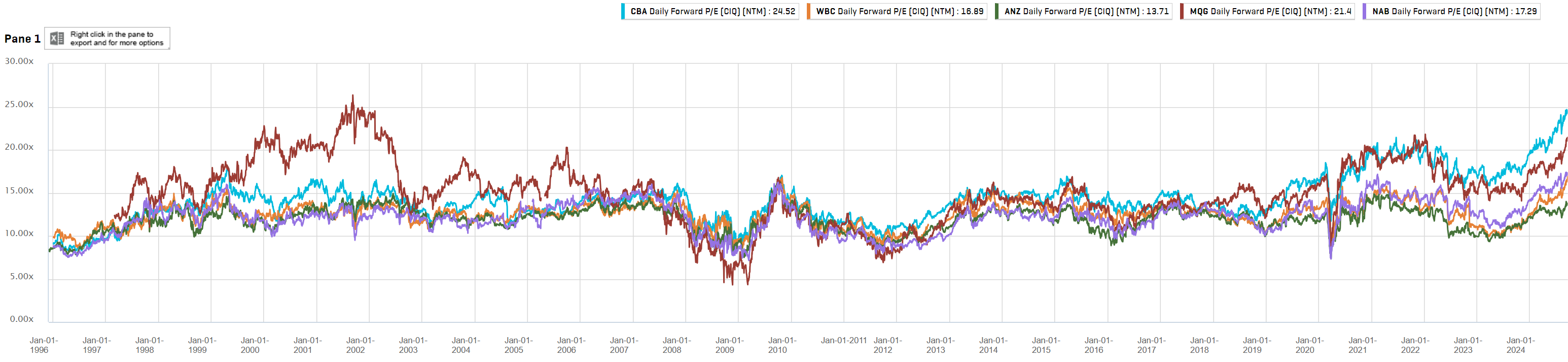

The bank bubble is now so large that it has become a standing joke among brokers:

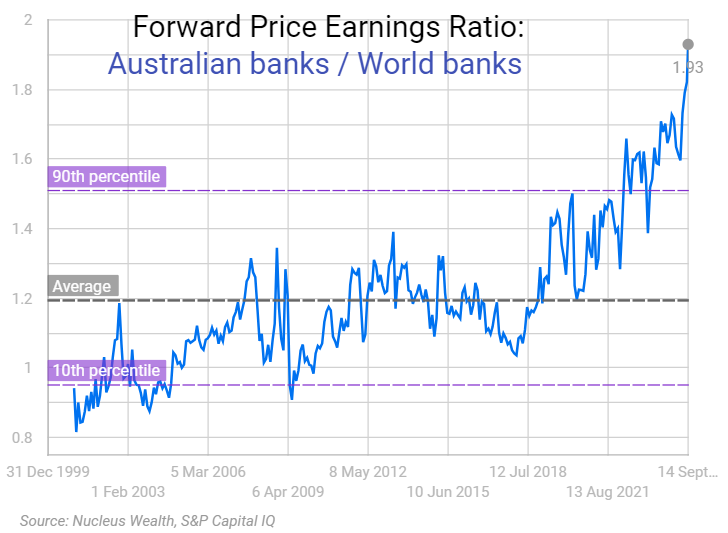

Relative to international peers is hilarious:

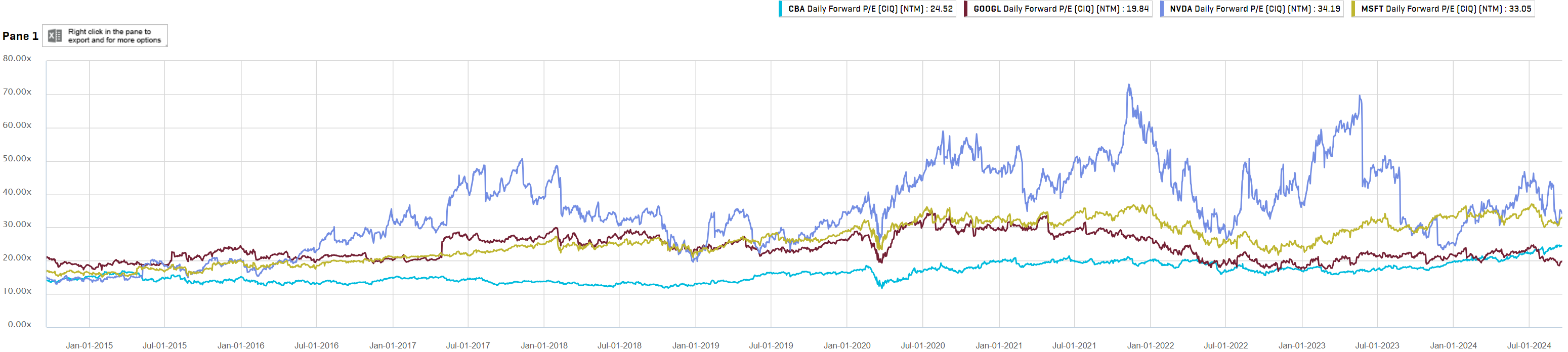

CBA is now part of the Mag 8, valued between Google and Microsoft. The only difference is they have tearaway earnings growth versus the CBA’s donut:

What will bring this comedy festival to a close?

Will it be bad loans? I don’t think so.

Will it be deflation in the Mag 8. Perhaps a little.

But the big one is interest rate cuts. The market thinks bank margins will be protected as the cash rate only falls 1% over the next year.

This fails to discount the immensely deflationary terms of trade shock coming out of China, most notably from iron ore, coals and gas.

This crash will play out for years and, just as it did after 2015, interest rates will be ground much lower than anyone expected at the commencement of the easing cycle, owing to the relentless national income shock.

Bank margins will be crushed and although there will be volume growth in mortgages, profits will begin to shrink.

The bank bubble will burst.