In the short term, gas imports into eastern Australia may lower prices.

There is such a glut of global gas coming that the price ought to crash. Goldman:

Europe’s scars from the 2022 energy crisis have yetto fully heal, as illustrated by its still depressed industrial activity, and its vulnerability to natural gasand electricity price spikes this coming winter.

However, we have long argued that lower energy prices lie in the horizon.

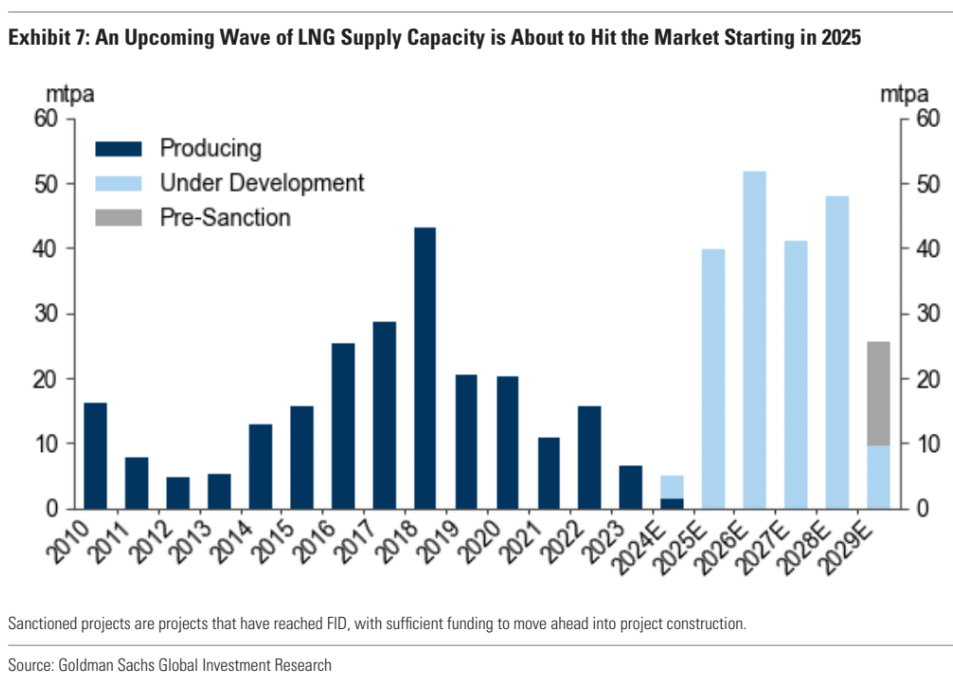

To be clear, an upcoming wave of global liquefied natural gas (LNG) supply capacity additions is about to hit the market starting in 2025, and growing significantly through most of the second half of this decade.

With the scale of these supply additions, which we expect to reach more than 200 mtpa by 2029, significantly above Asia’s average annual LNG demand growth near 20 mtpa, it is clear that the market will need to incentivize incremental demand via lower gas prices, so this growing LNG supply can find a home.

However, Australia should not see this as a chance to get lower local gas prices via imports but as an opportunity to cut itself off from global gas markets during a time when there is abundant replacement supply for Asia export customers.

If we allow gas imports to become our energy answer, we will be exposed to much higher prices than the historical norm in the long run, and be exposed to every international shock.

What we need is east coast gas reservation as well as a new pipeline:

Physical infrastructure such as pipelines do not care about intuition. There are real, physical limits on the ability to transport gas from Queensland to the southern states. Specifically, the Southwest Queensland Pipeline (SWQP) can transport around 500 terajoules a day of gas, which although a lot of gas, is still not equivalent to what has been lost from Longford Gas Plant output as the Gippsland fields decline.

The upshot of the production declines and the inability to move an unlimited gas volume to meet demand in the southern states is the real risk of gas shortages. The shortages are most likely during renewable droughts in the colder months where GPG is necessary for grid stability and residential gas demand for heating will be highest in Victoria. A reservation policy on Queensland exports, on its own, will not help get more gas to Victoria, given the physical system bottleneck in the SWQP.

The problem the East Coast Gas Market faces is not aggregate gas supply or average demand, but rather it’s the inability to get sufficient gas to meet demand where it’s needed, when it’s needed. Gas supply is not infinitely flexible, despite the persistence of this apparent assumption in much government policy.

The SWQP does not run full tilt on the off season which is why I have argued that southern storage tanks are part of the gas solution.

But if it needs expansion into the future, then do it now!

1000km of pipe will cost about $1bn.

It’s peanuts.