Oil adds more pressure on RBA to cut

Advertisement

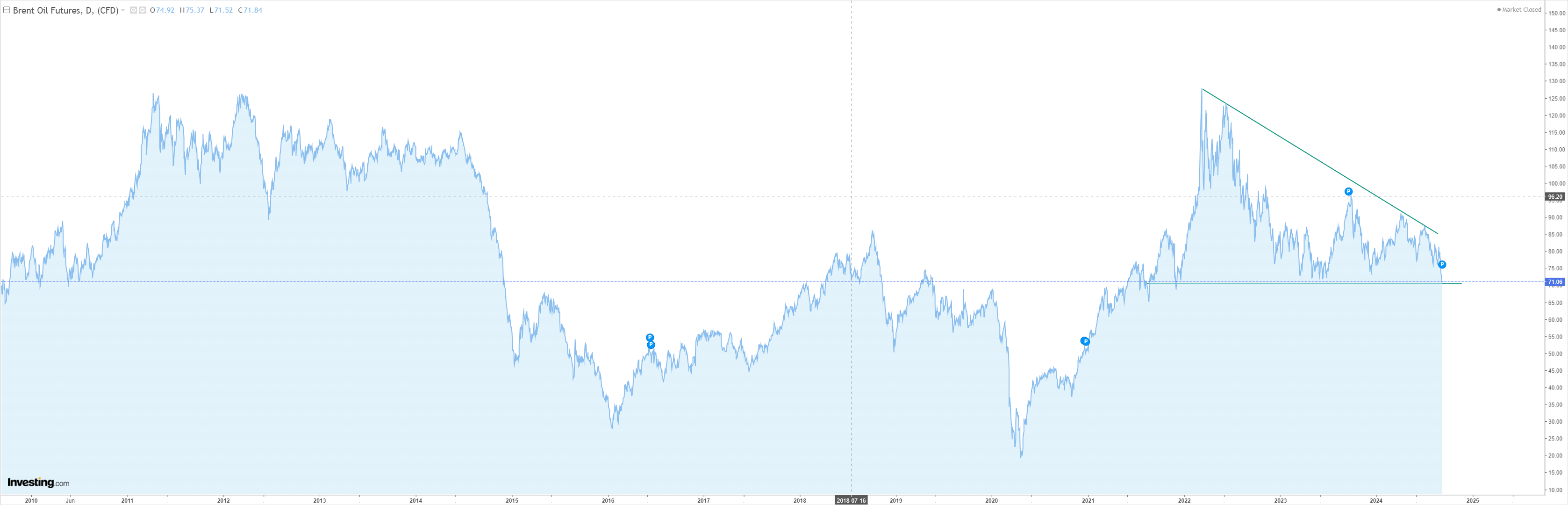

Oil has about the worst bearish descending triangle chart I have ever seen:

It takes a lot to make Wall Street bearish on oil but it has happened. Goldman:

- The 8 OPEC+ countries agreed yesterday to extend their extra voluntary production cuts for two months until the end of November, underscoring the flexibility of the producer group.

- We still expect three months of OPEC+production increases, but have pushed out the start date to December (vs. October previously).

- We stick to our $70-85 Brent range and our December 2025 Brent forecast of $74/bbl.

- We expect the tightening impact of modestly lower OPEC+ supply incoming months to be roughly offset by the easing effect from ongoing softness in our China demand nowcast and from a quicker than previously expected recovery of Libya supply.

- We still see the risks to our $70-85 range as skewed to the downside given high spare capacity, and downside risks to demand from weakness in China and potential trade tensions.

Advertisement

The full text of this article is available to MacroBusiness subscribers

Cancel at any time through our billing provider, Stripe

About the author

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geo-politics and economics portal.

He is also a former gold trader and economic commentator at The Sydney Morning Herald, The Age, the ABC and Business Spectator. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.