Goldman Sachs is still bullish, DXY.

USD: Cuts, now what.

The time for cuts has come, but we do not think that is a reason to be overly bearish on the Dollar.

First, while the broad Dollar has fallen only about 1% since the summer peak, DXY is down around 5% and back to unchanged on the year.

So cuts and recession risk are already well reflected in FX.

Second, if anything, this may have gone too far.

While there is a case for a more aggressive Fed response than our baseline expectation, on our metrics growth pricing has undershot our more upbeat expectations.

If the Fed underdelivers versus market expectations and the US economy over delivers at the same time, that should allow the Dollar to regain some of its losses against the majors.

Third, more structurally, we think the “cutting playbook” is hardly straight forward.

Our empirical analysis suggests that cutting cycles have not been a reliable signal for Dollar weakness.

In fact, the Dollar tends to strengthen after the first cut in coordinated cycles like this one.

Slicing the data in different ways does not offer a clear bearish signal either.

While no past cycle offers a perfect parallel, the data clearly demonstrate that the macro backdrop still matters considerably.

These findings are consistent with our recent work on the so-called “Dollar smile,” where we find that the Dollar’s high valuation reflects better relative asset returns, and not just rate differentials—equities matter.

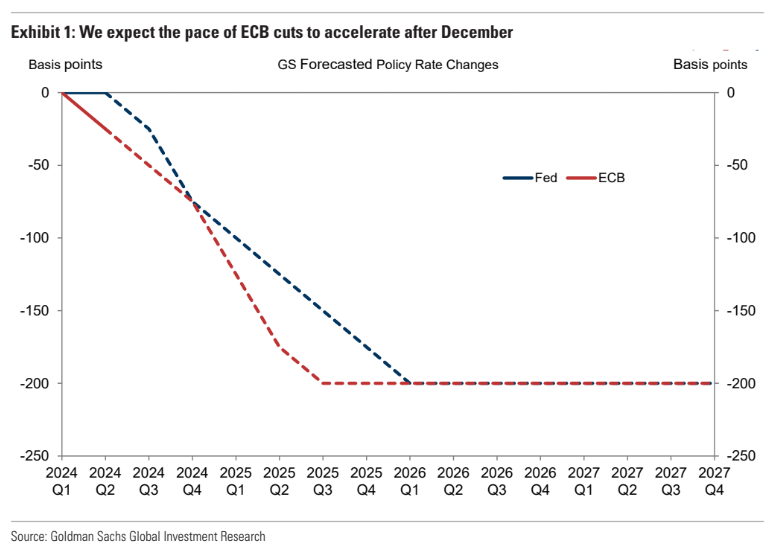

On net, we expect the Fed to deliver sequential 25bp cuts (slightly less than the market is pricing) before slowing down after December.

And we are projecting the opposite pattern in Europe, with the pace of cuts accelerating after December (Exhibit 1).

And, in the meantime, US election uncertainty should deter more structural shifts in portfolio flows or Dollar hedging ratios.

This outlook helps reinforce our view that the imminent cutting cycle should not be the start of a much deeper depreciation trend.

Instead, we think the recent correction against the majors is close to the end, not the beginning.

As we know, AUD follows EUR so GS is calling the top for the local currency as well.

I see a more bumpy landing for the US, though still of the soft variety, so still think AUD can rally another leg yet.