Again risk markets remain anxious leading up to tonight’s official US NFP print with a preview through the private ADP report and weekly initial jobless claims not settling the nerves despite no surprises. Treasury yields lifted again while Wall Street vacillated between losses and gains, with European shares still falling amid growth concerns. Commodity markets remain on a downer while the USD softened against most of the major currency pairs with the Australian dollar able to extend above the 67 cent level.

10 year Treasury yields were down a further 4 points to the 3.7% level while oil prices remain weak as Brent crude stayed below the $73USD per barrel level. Gold is making better headway however to get back above the $2500USD per ounce zone.

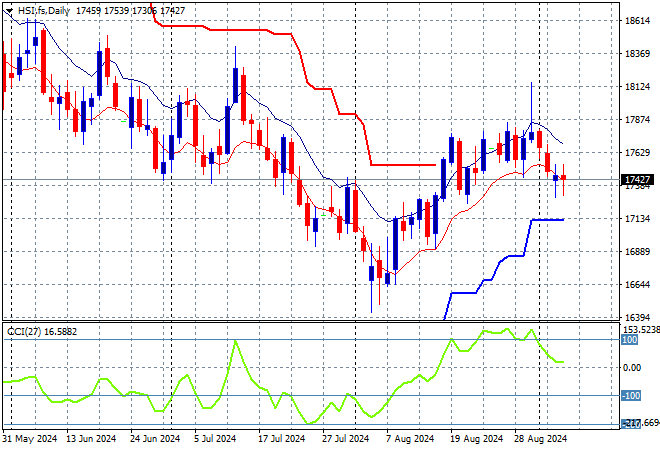

Looking at markets from yesterday’s session in Asia, where mainland Chinese share markets are pulling back slightly with the Shanghai Composite down 0.2% while the Hang Seng Index was off more than 0.5% before settling with a scratch session at 17444 points.

The Hang Seng Index daily chart was starting to look more optimistic a few months back but price action has slid down from the 19000 point level and continues to deflate in a series of steps as the Chinese economy slows. A few false breakouts have all reversed course and another downside move is again looming here as price action won’t clear short term resistance:

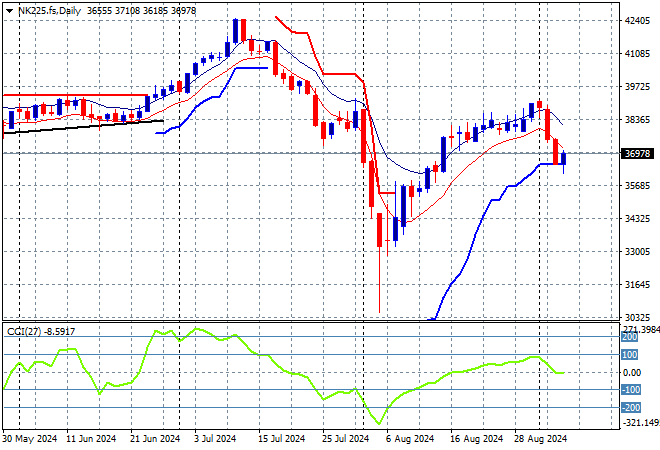

Meanwhile Japanese stock markets are still taking the biggest hits with the Nikkei 225 closing more than 1% lower at 36657 points.

Price action had been indicating a rounding top on the daily chart with daily momentum retracing away from overbought readings with the breakout last month above the 40000 point level almost in full remission. Yen volatility is coming back so a sustained return above the 38000 point level from May/June with futures indicating a flat start today:

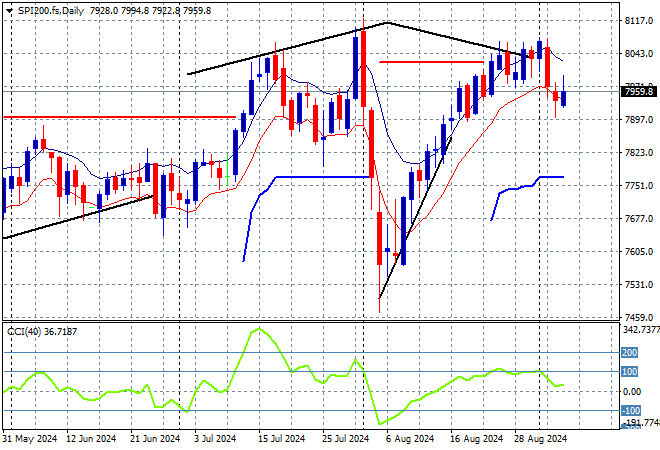

Australian stocks had one of the better sessions in the region, with the ASX200 closing 0.3% higher at 7973 points

SPI futures are up just 0.1% reflecting the continued unease on Wall Street overnight. Short term momentum and the daily chart pattern was potentially signalling a top here and this combination could still eventuate, as support at or just below the 8000 point level is still very much under threat:

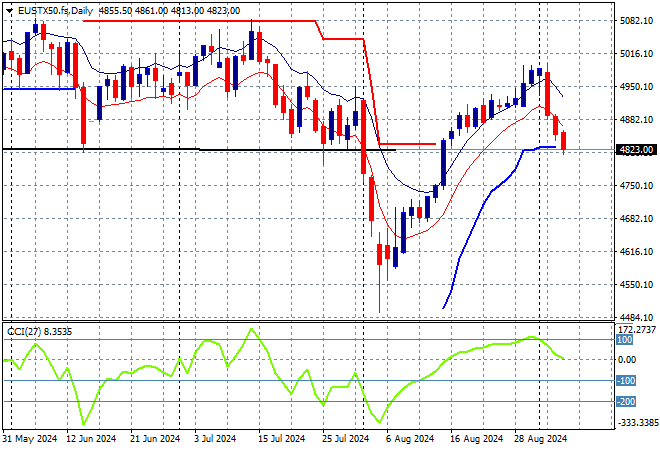

European markets remained in negative mode with losses across the continent as the Eurostoxx 50 Index closed 0.7% lower to 4815 points.

The daily chart shows price action off trend after breaching the early December 4600 point highs with daily momentum retracing well into an oversold phase. This was looking to turn into a larger breakout with support at the 4900 point level quite firm with resistance just unable to breach the 5000 point barrier. Price has cleared the 4700 local resistance level as it seeks to return to the previous highs but momentum was slowing before this pullback:

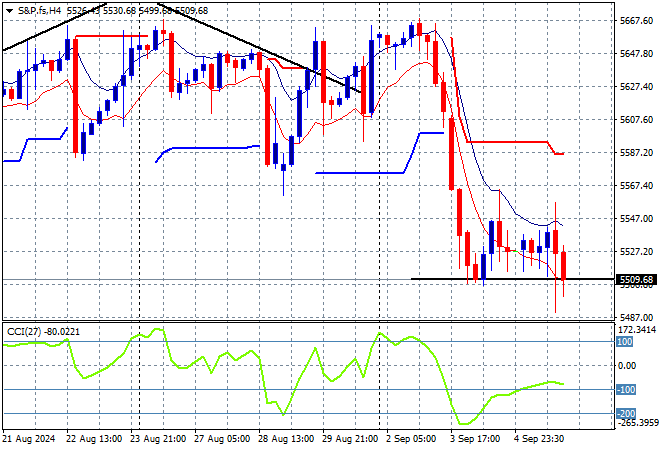

Wall Street was again unable to find any positive momentum although the NASDAQ eventually finished some 0.2% higher but the S&P500 lost more than 0.3% to close at 5503 points.

The four hourly chart illustrates how this bounceback had cleared the mid 5300 point level with momentum retracing fully from oversold to very positive these past two weeks. The potential for a positive breakout was building for a swift return to the early August highs as price has respected short term support, but that has now evaporated:

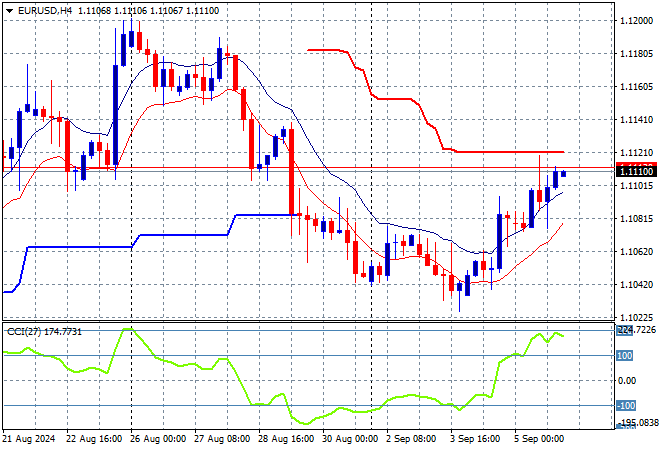

Currency markets saw further short term weakness building in USD again overnight, particularly against Yen while Euro was able to move back above the 1.11 level.

The union currency was looking overbought in the short term as I mentioned before, but had also been structurally supportive so this extended dip was threatening to turn into a wider rout if it couldn’t get back above former support at the 1.11 handle. Not out of the woods yet, and while this looks promising it could all be taken out tonight in the NFP print!

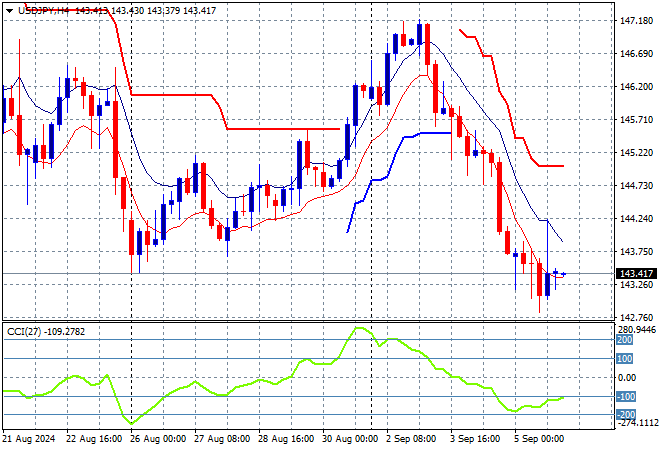

The USDJPY was doing well to get out of its downwards medium term pattern with a follow through after the weekend gap to return well above the 146 handle, but has continued to fail with further downside overnight to extend below the August at the 143 level.

The overall volatility leading up to the recent rout spoke volumes as it pushed aside the 158 level as longer term resistance in the weeks leading up to the BOJ rate hike. Momentum was suggesting a possible bottom was brewing as the BOJ wants to get this under control with this breakout building, but this retracement is coming faster than expected:

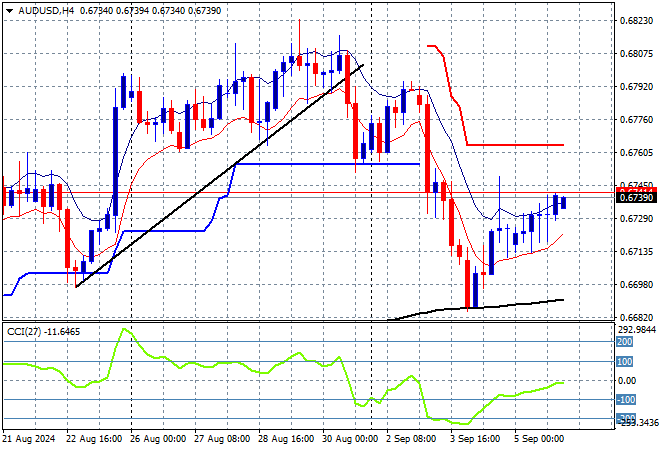

The Australian dollar had been pushing higher on the weaker USD but it finally broke its short term uptrend on Friday night, retreating below the 68 cent level. Last night saw a continuation of the mild stability that has returned since the big dip, returning above the 67 handle but still in a weak position.

During June the Pacific Peso hadn’t been able to take advantage of any USD weakness with momentum barely in the positive zone but that has changed in recent weeks with price action finally getting out of the mid 66 cent level that acted as a point of control. This positivity has disappeared with a full retracement of the last two weeks of weak price action, sending it back to the 67 cent level:

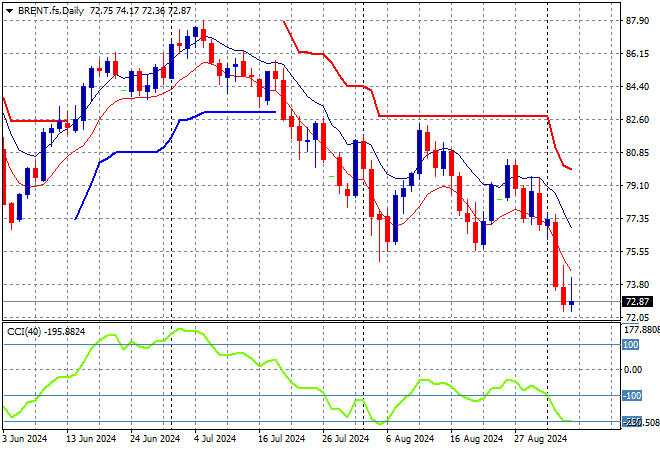

Oil markets remain in sell mode as they couldn’t get out of their previously weak position with Brent crude again moving lower overnight, remaining below the $73USD per barrel level making another new monthly low in the process.

After breaking out above the $83 level last month, price action had stalled above the $90 level awaiting new breakouts as daily momentum waned and then retraced back to neutral settings. Daily ATR support had been broken with short term momentum still in negative territory, setting up for this sharp retracement – watch out below:

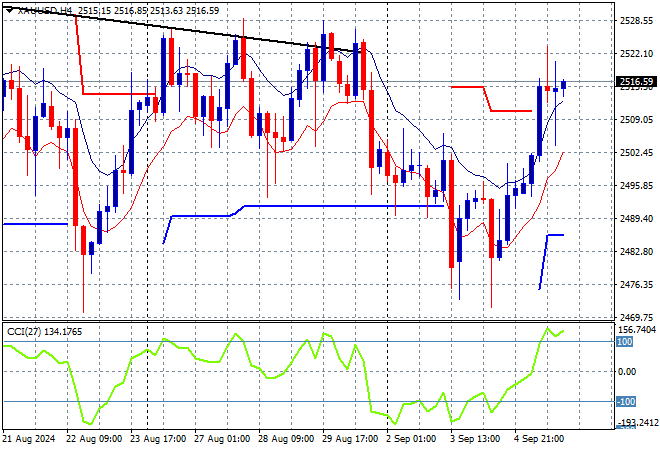

Gold has been unable to get back above the $2500USD per ounce level since the start of the week slump, but finally got a wriggle on overnight on USD weakness with a move up to the $2520 level but still below last week’s highs.

The longer term support at the $2300 level remains firm while short term resistance at the $2470 level was the target to get through last week as I indicated. This is still too dependent on USD weakness and I expect a retracement later tonight:

Glossary of Acronyms and Technical Analysis Terms:

ATR: Average True Range – measures the degree of price volatility averaged over a time period

ATR Support/Resistance: a ratcheting mechanism that follows price below/above a trend, that if breached shows above average volatility

CCI: Commodity Channel Index: a momentum reading that calculates current price away from the statistical mean or “typical” price to indicate overbought (far above the mean) or oversold (far below the mean)

Low/High Moving Average: rolling mean of prices in this case, the low and high for the day/hour which creates a band around the actual price movement

FOMC: Federal Open Market Committee, monthly meeting of Federal Reserve regarding monetary policy (setting interest rates)

DOE: US Department of Energy

Uncle Point: or stop loss point, a level at which you’ve clearly been wrong on your position, so cry uncle and get out/wrong on your position, so cry uncle and get out!