Asian share markets remain in a somewhat flat mood today with the return of Chinese stocks as all eyes are now on the Federal Reserve meeting tonight. This has extended to other risk markets which have remained steady as traders weigh up how big the rate cut could be, as the Australian dollar rises well above the 67 cent level to exceed its previous weekly high.

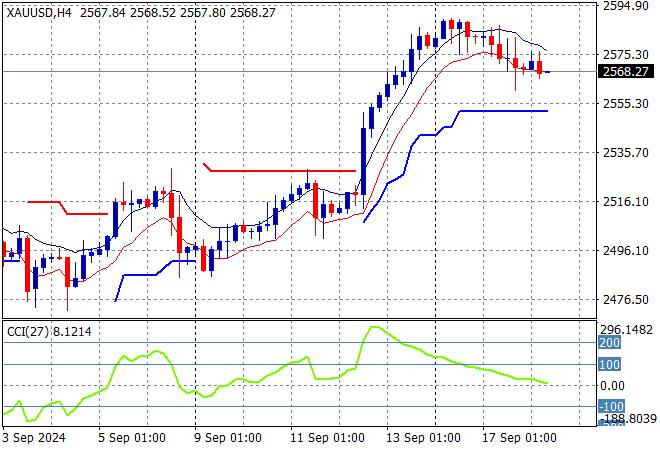

Oil futures have dropped slightly as Brent crude retraces below the $74USD per barrel level while gold is slowly steadying here as it rebuffs the $2600USD per ounce level, waiting for the Fed and where the USD goes to next:

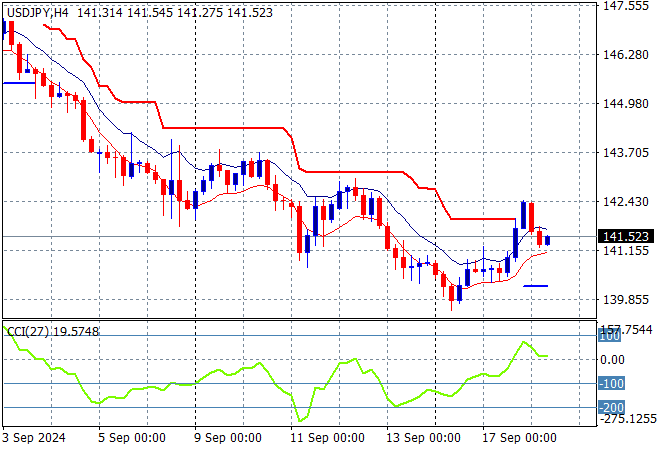

Mainland Chinese share markets have reopened with the Shanghai Composite up slightly while the Hang Seng Index was closed for a holiday. Japanese stock markets have stabilised somewhat with the Nikkei 225 lifting some 0.4% to 36351 points as Yen pushed back against a resurgent USD, sending the USDPY pair back to the mid 141 level:

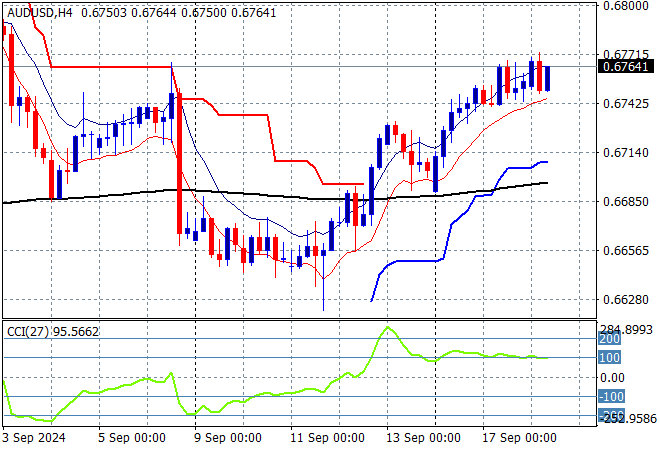

Australian stocks were unable to put in any gains as the ASX200 closed dead flat at 8142 points while the Australian dollar was able to hold on well above the 67 cent level to extend its two week high:

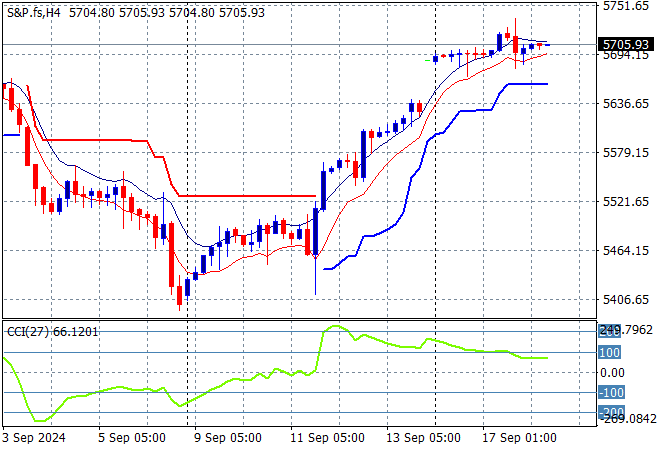

S&P and Eurostoxx futures are steady going into the London session with the S&P500 four hourly chart showing momentum remaining flat but very positive as traders await the FOMC meeting tonight:

The economic calendar ramps up again tonight with the latest Euro inflation print, followed by the long awaited FOMC meeting.