Asian share markets have all opened and stayed in the red following the soft but not soft enough US unemployment print from Friday night that saw Wall Street slump nearly 2% across the board. The risk off mood has not been helped by the latest Chinese CPI and PPI prints with the latter remaining well into retraction mode. Currency markets remain under the sway of a resurgent USD with some minor weekend bounce/gap action particularly with Yen, but the Australian dollar is now faltering well below the 67 cent level.

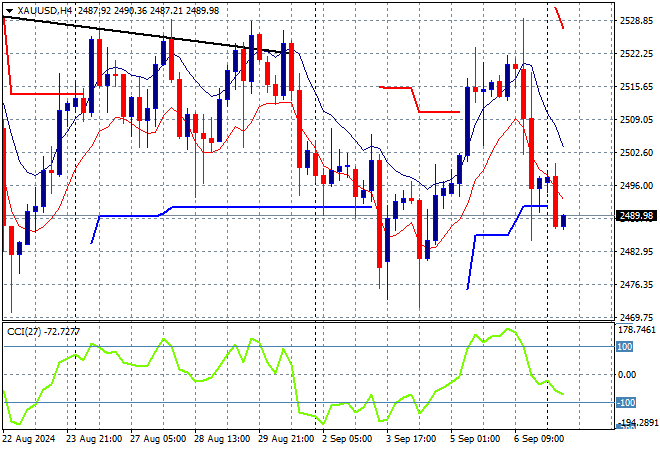

Oil futures remain very weak as Brent crude hovers around the $71USD per barrel level while gold is failing to return above the $2500USD per ounce level after getting slammed on Friday night:

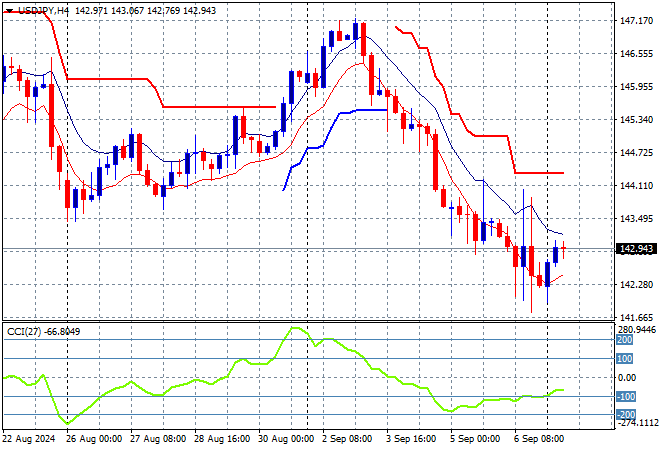

Mainland Chinese share markets are again pulling back sharply with the Shanghai Composite down 1.3% while the Hang Seng Index is off nearly 2% to 17122 points. Japanese stock markets meanwhile are still falling as Yen appreciates with the Nikkei 225 closing 0.6% lower to 36171 points while trading in USDPY has seen a slight bounce from the weekend gap but still holding below the 143 level at a new monthly low:

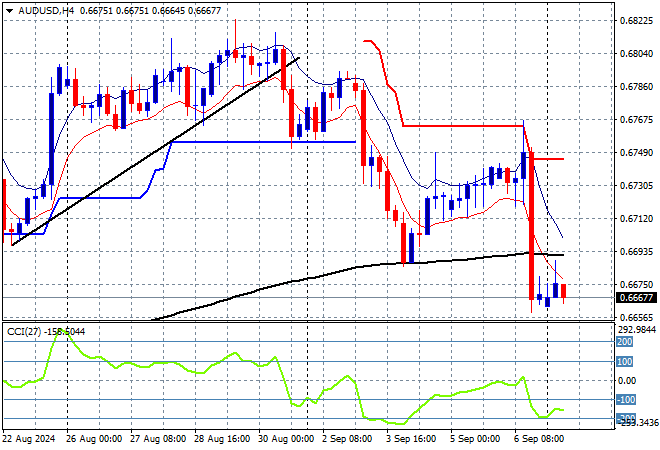

Australian stocks were down sharply at the open but the ASX200 only closed 0.4% lower to retreat slightly below the 8000 point level at 7981 points while the Australian dollar is trying to stabilise just above the mid 66 cent level after slumping in the wake of Friday night’s US jobs report:

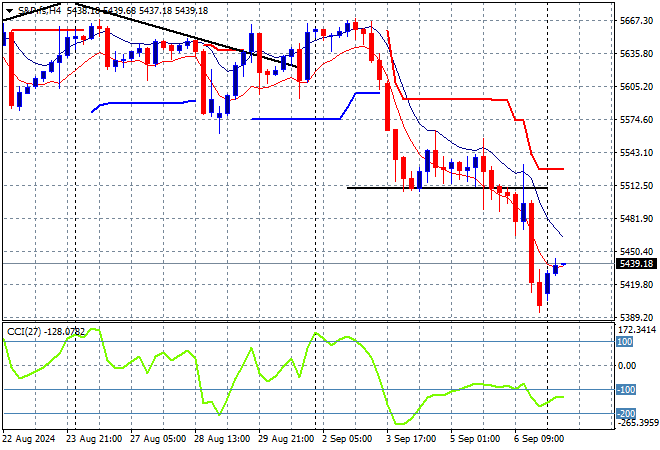

S&P and Eurostoxx futures have rebounded ever so slightly going into the London session with the S&P500 four hourly chart showing momentum trying hard to get out of oversold conditions as price action in the medium term doesn’t look impressive:

The economic calendar is notoriously quiet following Friday night’s non-farm payrolls with nothing much going on.