Asian share markets remain uncertain leading up to tonight’s US unemployment print with only local stocks advancing appreciably while currency markets tread water although the USD is starting to soften again. Yen remains on a tear while the Australian dollar remains surprisingly resilient as it extends above the 67 cent level.

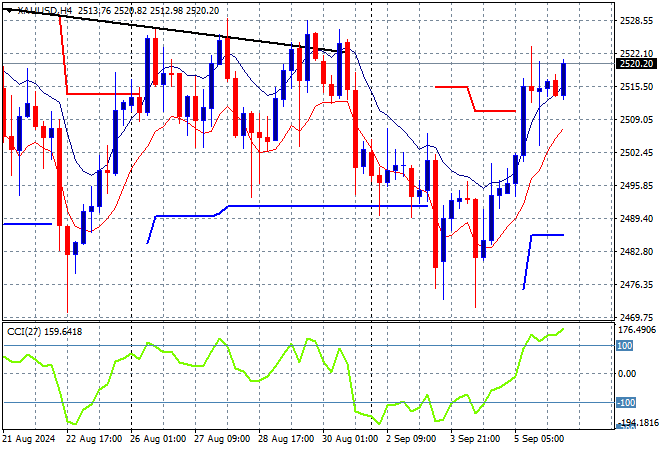

Oil futures are looking very weak as Brent crude hovers around the $73USD per barrel level while gold is extending it return above the $2500USD per ounce level to almost match the previous week’s high:

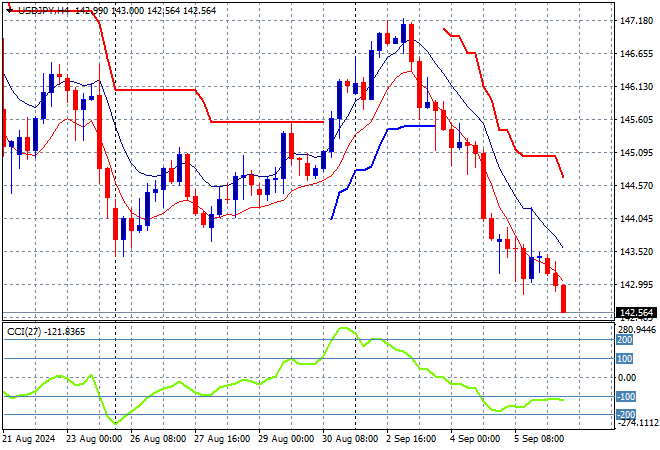

Mainland Chinese share markets are pulling back slightly with the Shanghai Composite down 0.3% while the Hang Seng Index is dead flat. Japanese stock markets meanwhile are still taking the biggest hits with the Nikkei 225 closing 0.7% lower to 36368 points while trading in USDPY has seen further retracement below the 143 level on BOJ rate hike speculation:

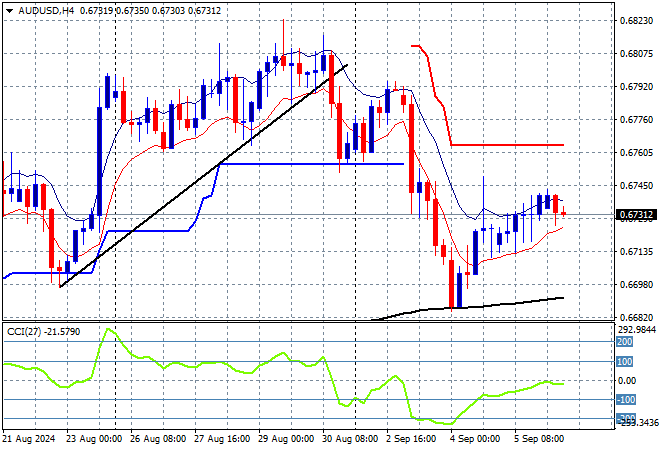

Australian stocks is again the best in the region, with the ASX200 about to close 0.3% higher at 8008 points while the Australian dollar is trying to stabilise just above the 67 cent level in the wake of tonight’s US jobs report:

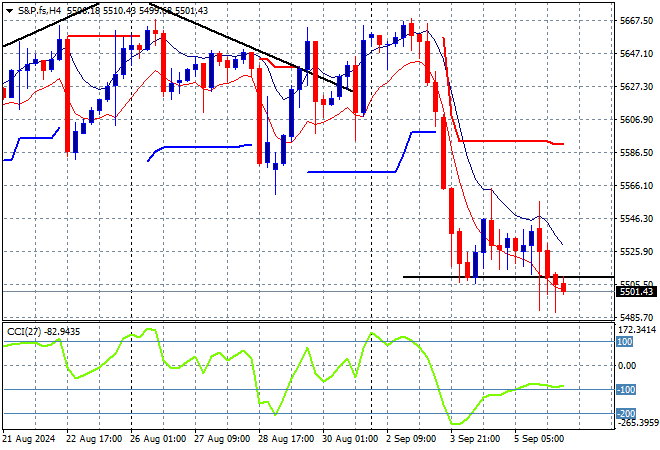

S&P and Eurostoxx futures are pulling back again with the S&P500 four hourly chart showing momentum trying hard to get out of oversold conditions as price action looks to invert again:

The economic calendar will focus on nothing else but tonight’s US jobs print aka non-farm payrolls.