Asian share markets remain in a sea of caution leading up to tomorrow night’s US unemployment print with only local stocks advancing appreciably while currency markets tread water. Yen however remains on a tear due to some words of warning from the BOJ today. Commodities are still weak but this hasn’t hindered the Australian dollar which remains surprisingly resilient even amid the speech by the RBA Governor cautioning about inflation as it remains just above the 67 cent level.

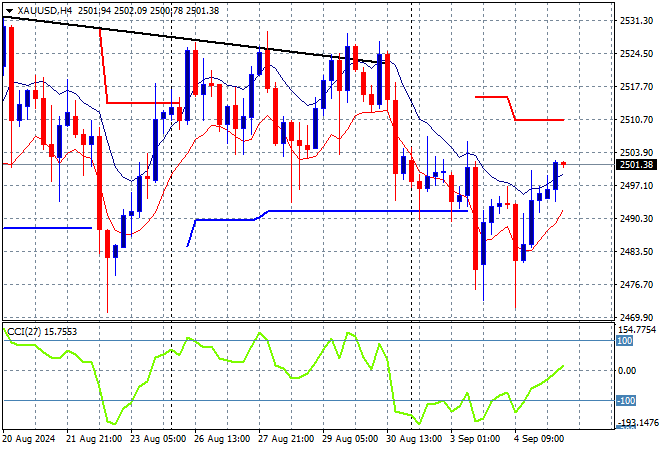

Oil futures are looking very weak as Brent crude hovers around the $73USD per barrel level while gold is also trying hard to return above the $2500USD per ounce level after the last few retreating sessions:

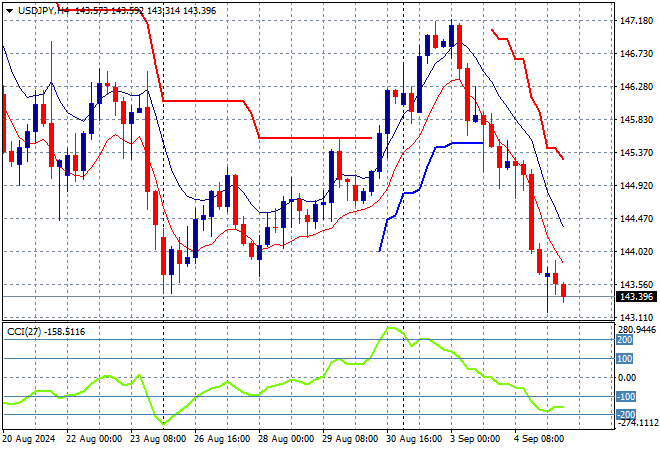

Mainland Chinese share markets are pulling back slightly with the Shanghai Composite down 0.2% while the Hang Seng Index is currently off more than 0.5% at 17373 points. Meanwhile Japanese stock markets are still taking the biggest hits with the Nikkei 225 closing 0.7% lower to 36788 points while trading in USDPY has seen further retracement below the 144 level on BOJ rate hike speculation:

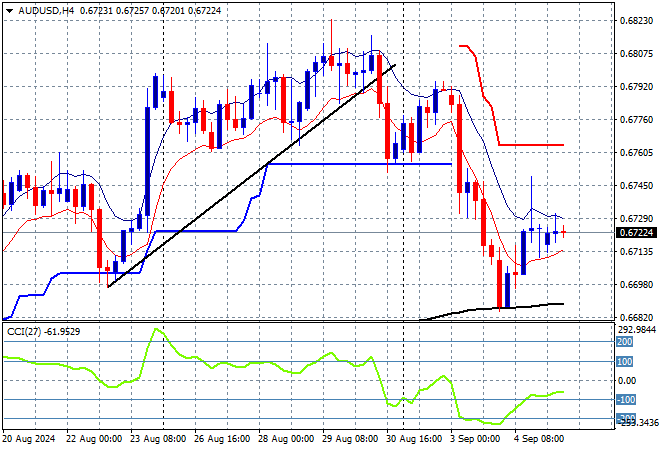

Australian stocks had one of the better sessions in the region, with the ASX200 closing 0.3% higher at 7973 points while the Australian dollar is trying to stabilise just above the 67 cent level in the wake of the risk off mood:

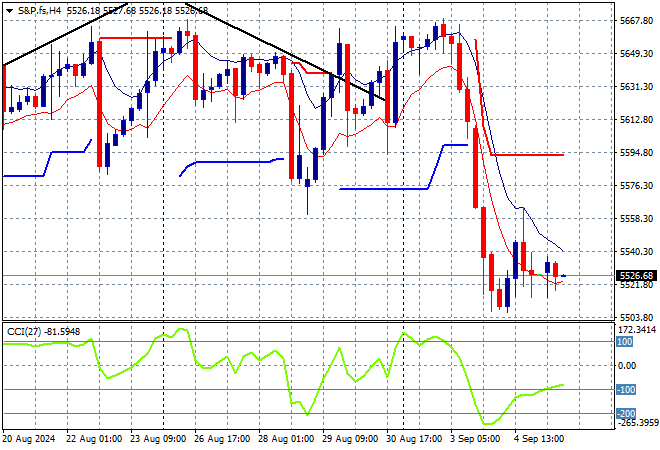

S&P and Eurostoxx futures are pulling back with the S&P500 four hourly chart showing momentum trying to get out of oversold conditions as price action looks overextended:

The economic calendar includes Euro wide retails sales and then US initial jobless claims as a preview to tomorrow night’s job print.