Westpac with the report.

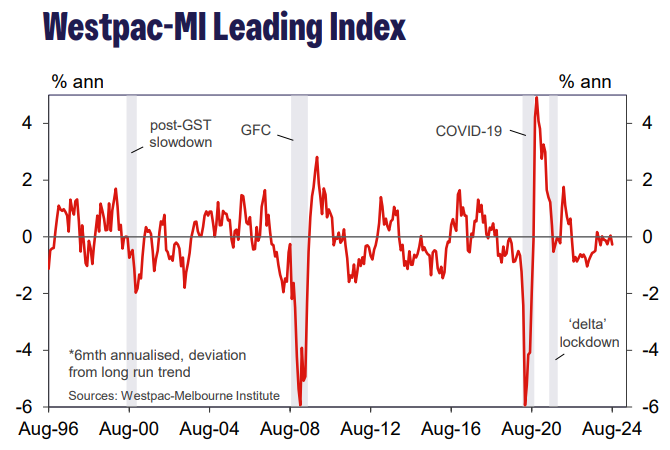

- Leading Index growth rate drops back to –0.27%.

- Commodity price fall a significant drag on momentum.

- Other components stable rather than weak.

- Signal points to activity remaining subdued through first half of 2025.

The fall takes the Index growth rate to an eight-month low, albeit still in the –0.3 to +0.2% range that has prevailed since November last year. Momentum has improved relative to 2022 and 2023 but is still soft. The latest read implies that below-trend growth will continue in the first half of 2025.

Westpac expects this extended period of sluggish performance to last even longer. GDP growth is forecast to lift from 1%yr currently to 2.4%yr in 2025, an improvement but consistent with the sub-trend signal from the Leading Index. Our recently revised forecasts now see a slower recovery for private demand as income pressures persist. With public demand moderating, this is expected to see growth stay at 2.4% in 2026. Australia’s trend growth rate is considered at or slightly above 2.5%yr.

The Leading Index growth rate has fallen from +0.02% in February to –0.27% in August. The main source of the deterioration has been a sharp reversal in commodity prices (measured in AUD terms) which swung from a 5.8% gain over the six months to February to a 12% decline over the six months since. This move alone has taken 0.37ppts off the Leading Index growth rate. A softening in consumer sentiment and unemployment expectations has taken a further 0.18ppts off the rate.

These increased drags have been partially offset by lifts in dwelling approvals, total hours worked and US industrial production. These components added 0.28ppts to the Index growth rate over the same period.

The weakening in commodity prices has carried into the first half of September, suggesting this will continue to exert a significant drag on the Leading Index growth pulse in the months ahead. However, outside of this, other components of the Index are broadly steady on a combined basis. As such, momentum should stabilise if and when commodity prices settle, provided the sharp falls do not start to have significant negative spill-over effects on other components.

The Reserve Bank Board next meets on September 23–24. We expect it to again leave the official cash rate unchanged and maintain its ‘vigilant’ stance on inflation.

The latest Leading Index read shows near-term growth momentum remains weak. However, the Reserve Bank’s primary concern is still whether the associated rebalancing of demand and supply will see inflation return to target over an acceptable time frame. The picture here is likely to evolve slowly with the September quarter CPI (due October 30) and the September quarter national accounts (due December 4) set to be the next important updates locally.