Australia’s worst-ever treasurer, Jim “chicken” Chalmers is being humiliated daily:

Mr Macfarlane, who was governor from 1996 to 2006, said that under the government’s proposed restructuring of the nine-person board, monetary policy influence would shift from the full-time governor and RBA staff to outside board members.

“The significant change would be the centre of gravity going from the governor and staff of the Reserve Bank operating with an advisory board, to a decision-making board where the majority of the votes rest with the six part-timers,” he said.

…Mr Fraser said he opposed the reforms, arguing that the interest rate-setting committee would be governed by “super monetary policy nerds” who were overly focused on inflation at the expense of the central bank’s other objectives, including achieving full employment and prosperity for Australians.

…Mr Fraser said the idea that creating a board of monetary policy experts was world’s best practice was “bullshit”, adding that the best board members during his time as governor from 1989 to 1996 were those able to take a broader view of the economic outlook, including former union leader Bill Kelty.

…Dr Lowe’s former peers, speaking on the condition of anonymity, said he had privately told them that the continuity of the existing nine board members was very important and that he opposed ending their five-year terms prematurely during the biggest inflation fight in more than 30 years.

What do you call a group of revolting central bankers? I propose the collective noun should be a “nerd”.

The nerd has put its finger on something very dangerous for the nation beyond the central bank reform process: the ineptitude of Treasurer Jim “chicken” Chalmers.

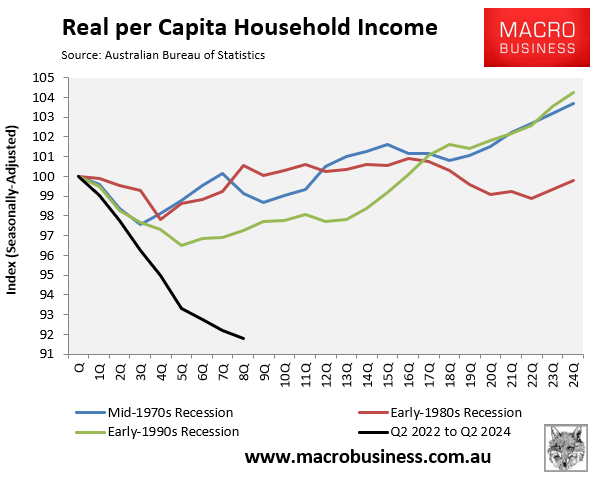

Chalmers has already wrecked fiscal policy via massive overspending to support excessive immigration combined with weak energy regulation to deliver a world-beating stagflation shock:

Now, as the RBA fights to contain the fiscal wreckage, Chalmer’s central bank reform project is a circus with an unknown structure, compromised independence, and burgeoning internecine war.

It takes a special kind of idiot to simultaneously destroy all three arms of Australian macro management—fiscal, monetary and population.