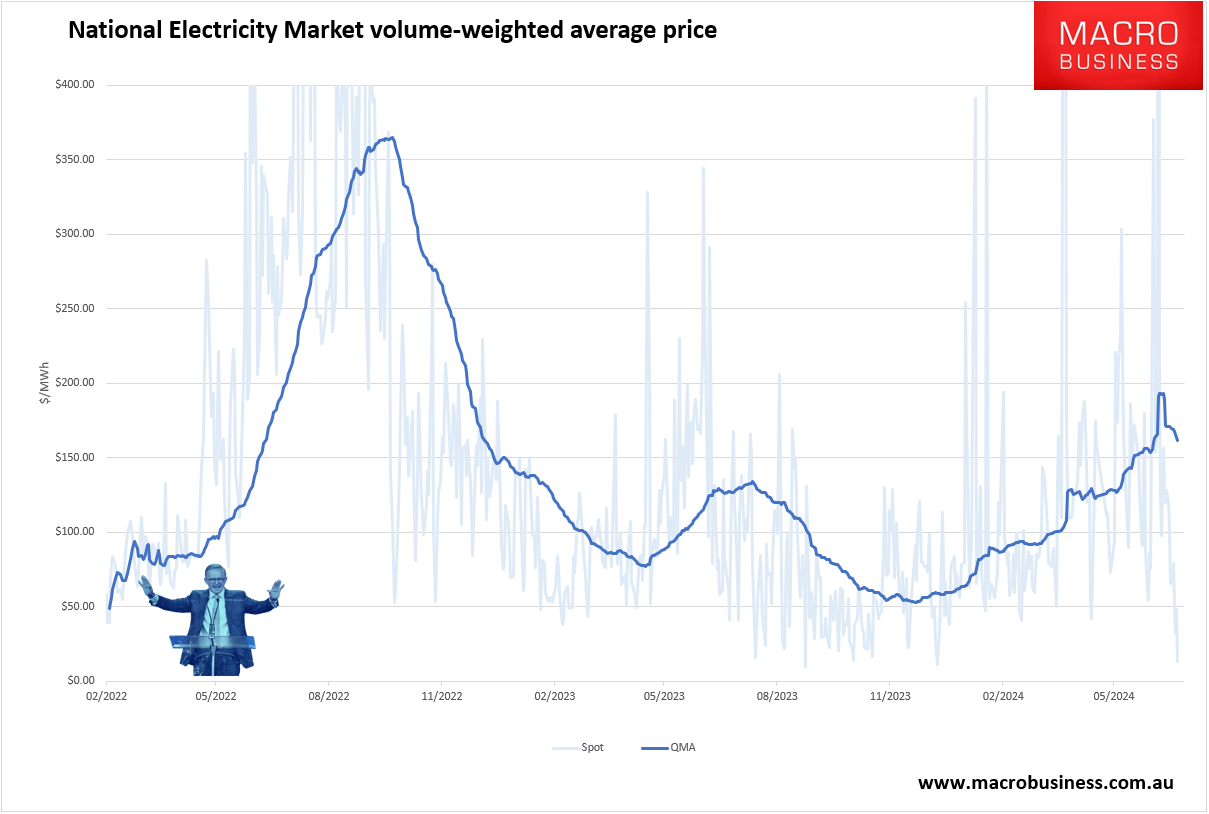

The wind blew and power was cheap for a day:

Solar farm owners in south-eastern states are switching off their plants to protect their profits as extreme winds, abundant rooftop solar generation and low demand from customers enjoying the warm start to spring create an oversupply of power.

However, tomorrow it will not blow and gas will return as the marginal price setter of electricity.

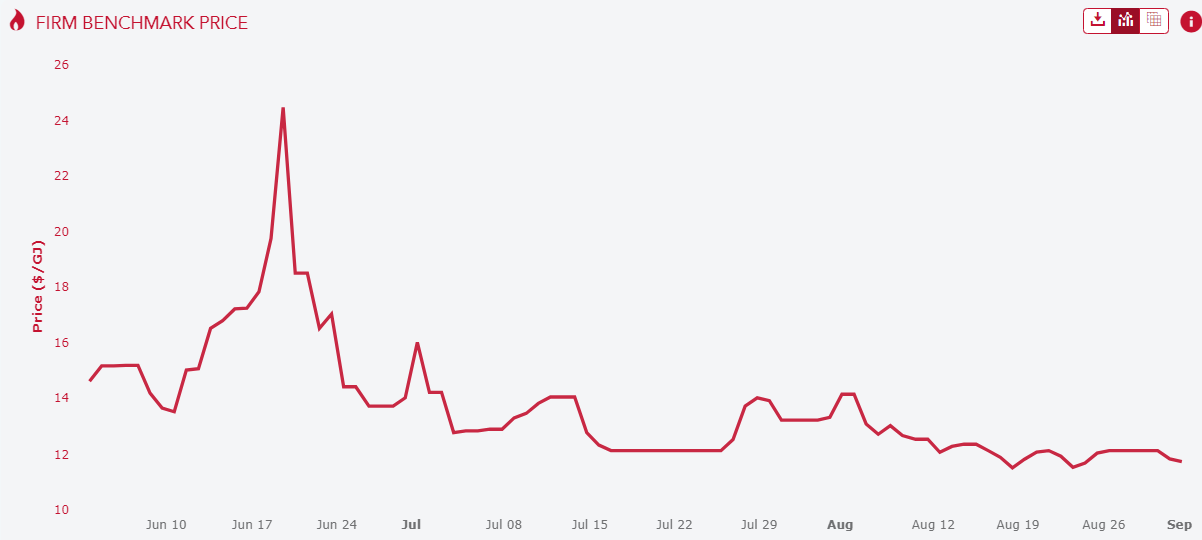

It is still glued to $12Gj:

Off-season is starting to reduce power prices:

But hope is fast being lost for any sensible outcome of using our own cheap gas:

Mr Watson, one of the strongest critics of Australia importing LNG from countries such as Qatar, said: “It looks like LNG imports are the only alternative left.”

Industry sources said importing gas was likely to inflate domestic prices at least in the short term.

Frank Calabria, chief executive of Origin Energy, the country’s largest electricity and gas retailer, said east coast supplies were depleting quickly and imports shaped as the viable solution. But he added such a move would end the disconnection between domestic prices and international benchmarks.

“Our view is that LNG imports will play an increasing role in those southern states,” he said. “It certainly strengthens international linkage pricing.”

If we had international pricing today, the gas price would be double.

Bend over and place your head firmly between your legs.