Westpac’s credit card tracker is still very soft.

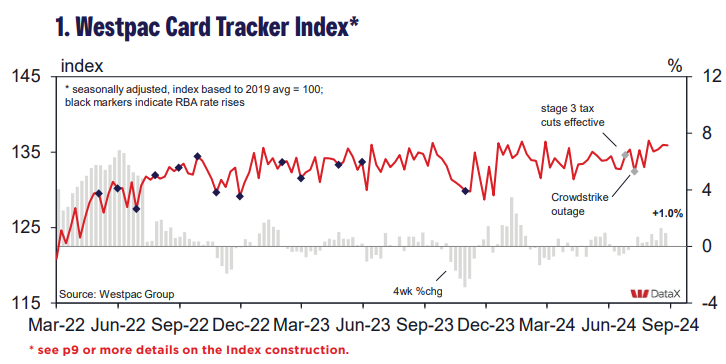

The Westpac Card Tracker Index* lifted slightly over the two weeks to September 7, rising 0.5pts to 135.9. The ‘Stage 3’ tax cuts and other fiscal support measures that came into effect at the start of July look to be generating a little more traction with but the up-trend is still only gradual.

Quarterly growth momentum has firmed slightly, to a 0.6% pace in the latest week. That compares to contractions through June-July but is still off the stronger pace seen at times earlier in the year and during the second half 2023.

Recall that all of these measures are in nominal terms. Westpac expects the headline CPI to show a 0.3%qtr rise for the September quarter, the more subdued result compared to the 1% gains in the last two quarters reflecting the impact of increased government assistance around electricity, rent and public transport.