Stability leads to instability is China’s problem. Central planning has for so long hit growth targets via stimulus that its economy is now a debt-saturated laggard that spends so much repaying interest on unproductive assets that it can’t grow.

Nowhere is this more obvious than local governments, so long the engine of outsized growth, and now a caboose full of bad debt.

Pantheon has a great note on it.

China’s policy response so far has been limited.

RMB300B out of the total RMB1T central-government long-term special-bond quota for this year has been reassigned to the consumer goods and industrial equipment trade-in scheme.

In addition, benchmark interest rates have been lowered.

The PBoC expects local-government special-bond issuance to accelerate, providing additional funding for infrastructure and manufacturing investment, while supporting long-term yields.

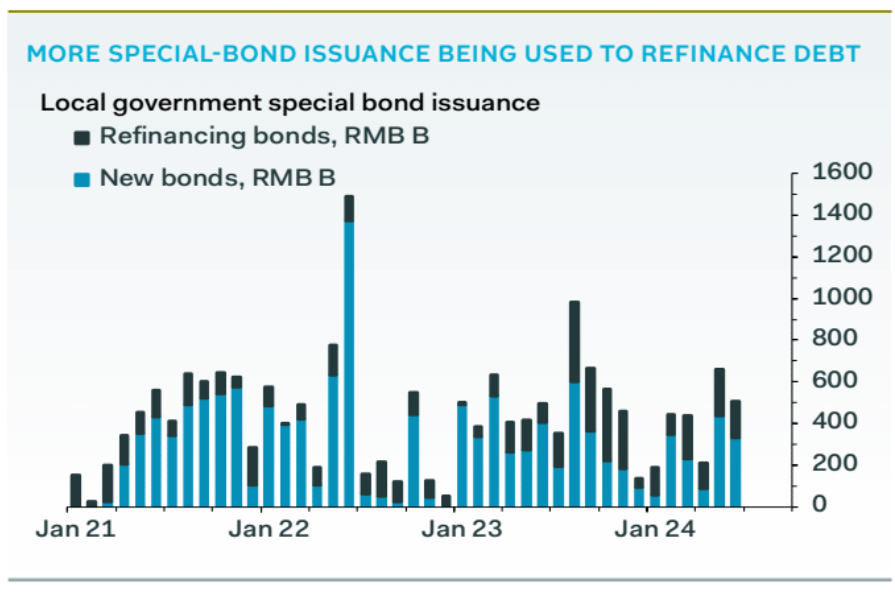

This should happen to some extent, though local governments are using a larger share of funds raised from bond issuance for debt refinancing, rather than new project investment, diluting the economic impact.

China is likely to fall short of the full-year GDP growth target of “about 5%”, given softening external demand and the restrained policy response so far, despite broad agreement that domestic demand is insufficient Infrastructure investment excluding utilities rose just 2.0% year-over-year in July, after 4.6% in June.

This was despite calls from top policymakers for local governments to step up special-bond issuance, a key source of financing for infrastructure investment.

The problem is the increased usage of special-bond funds for debt refinancing, rather than investment in new projects.

The Ministry of Finance has required 12 provinces to focus on controlling their hidden debts, including swapping lower-interest-rate special bonds for local-government financing platform and other hidden debts, in order to reduce financial risk.

Meanwhile, the government has directed the financially healthier provinces, such as the leading coastal regions, to take on a greater share of the burden of supporting growth by issuing more debt.

So far this hasn’t worked.

Total local-government special-bond issuance fell 13.7% year-over-year to RMB2.4T in H1, but RMB955B went towards debt refinancing, a 78% jump.

This left only RMB1.5T for new project investment, a 35% dive.

Land sales revenue also dropped 22.3% in the first seven months.

No wonder infrastructure investment is languishing.

We expect China to announce more fiscal or quasi-fiscal policies, especially if infrastructure investment remains sluggish.

Still, this is likely to be tinkering rather than a change of direction.

Don’t expect any mega-stimulus.

China’s local governments are what Hyman Minsky would describe as “ponzi-borrowers”. Those marginal borrowers increase debt to pay off older debt.

The jig is up and the only reason the Chinese economy is not in depression is that its banks are centrally controlled.

But there is a price for that too: Japanification.