As usual, the pet shop is squawking while saying nothing.

The two national business dailies could not be more distracted:

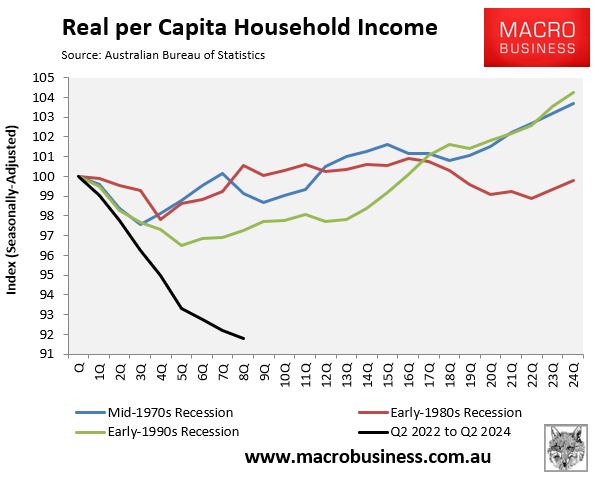

This week’s national accounts for the June quarter confirm an economy that has split apart: consumers are being battered by inflation while governments are on a spending spree. The headline figure was a 0.2 per cent increase in gross domestic product in the quarter, meaning annual output growth was a mere 1 per cent – the weakest result, outside of a crisis, since the recovery from the early ’90s recession engineered by the Reserve Bank to pop the bubble economy of the era’s credit-crazy boom.

More:

While the anaemic growth numbers for the June quarter were of no surprise, “one of the really interesting things that jumped out from those national accounts was that if it weren’t for our approach to the budget, Australia would be in recession”, he said.

…The fundamental difference between today and 2009 is that, back then, the government and the RBA were both clearly pulling in the same direction and there was none of the talking points we hear now about each having the same objective but different responsibilities.

Wrong.

Today’s economy is not the same as it was fifteen years ago.

The key difference is there are seven million more Australians without anything like the capex needed to ensure sustained living standards.

In 2009, the Aussie economy had an immigration program designed to complement strong business investment.

Ever since we have had weak business investment and a very strong immigration program that demands high public investment.

Thus, characterising inflation today as public versus private investment is to mistake effect for cause.

The problem is an economic model that privileges immigration and corporate rent-seeking over productivity reform, including regulating functional market structure.

Thus, today we have massive infrastructure and housing shortages combined with tearaway profiteering, most notably in energy.

As a result, our economy now depends entirely on government spending to expand while failing markets prevent the competition to hold prices down.

If you want to fix it, immigration must be cut to allow infrastructure and housing catch-up while the key failed markets, like gas, must be reformed.

Otherwise, the doom loop of falling living standards, desperate governments pumping in people to cover it up, and rent-seeking maximising associated profits will prevent any meaningful growth or equitable distribution of national income.