Australia’s war between monetary and fiscal authorities is intensifying as Michelle Bullock fired back at her lost Treasurer:

The key drivers of elevated inflation at the moment are housing costs and market services inflation, which remain above their average levels and have been easing only gradually.

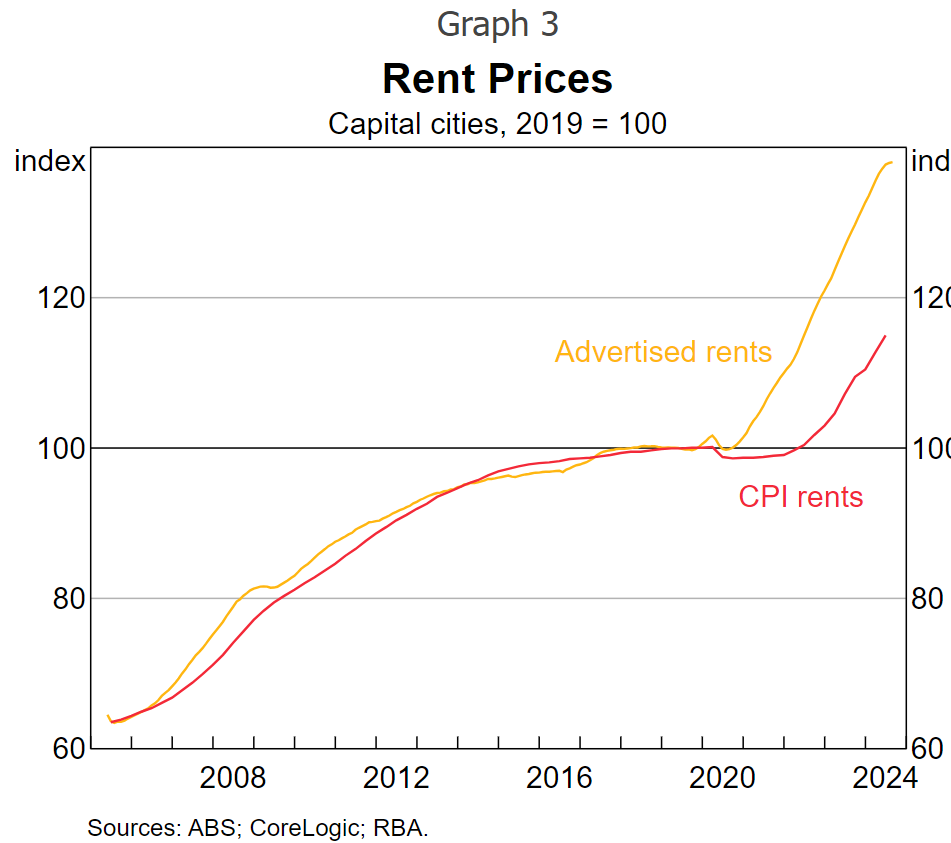

On the housing side, this reflects both construction cost growth and strong increases in rents.

Year-ended growth in advertised rents is still high, reflecting pressure from a rebound in housing demand and limited supply response.

Rents on new leases take time to impact overall CPI rents because only a small share of the stock of rental properties update leases in a given month and so CPI rents inflation is likely to be high for some time (Graph 3).

New dwelling inflation has declined from its earlier peak as materials costs have eased, but it remains elevated.

There is still a large pipeline of work and ongoing labour shortages for certain trades.

Market services is making the largest contribution to above-target inflation.

While year-ended inflation has been moderating across most market services – particularly those that are more discretionary, such as eating out and recreational activities – inflation in this category remains high at 5.3 per cent over the year to the June quarter.

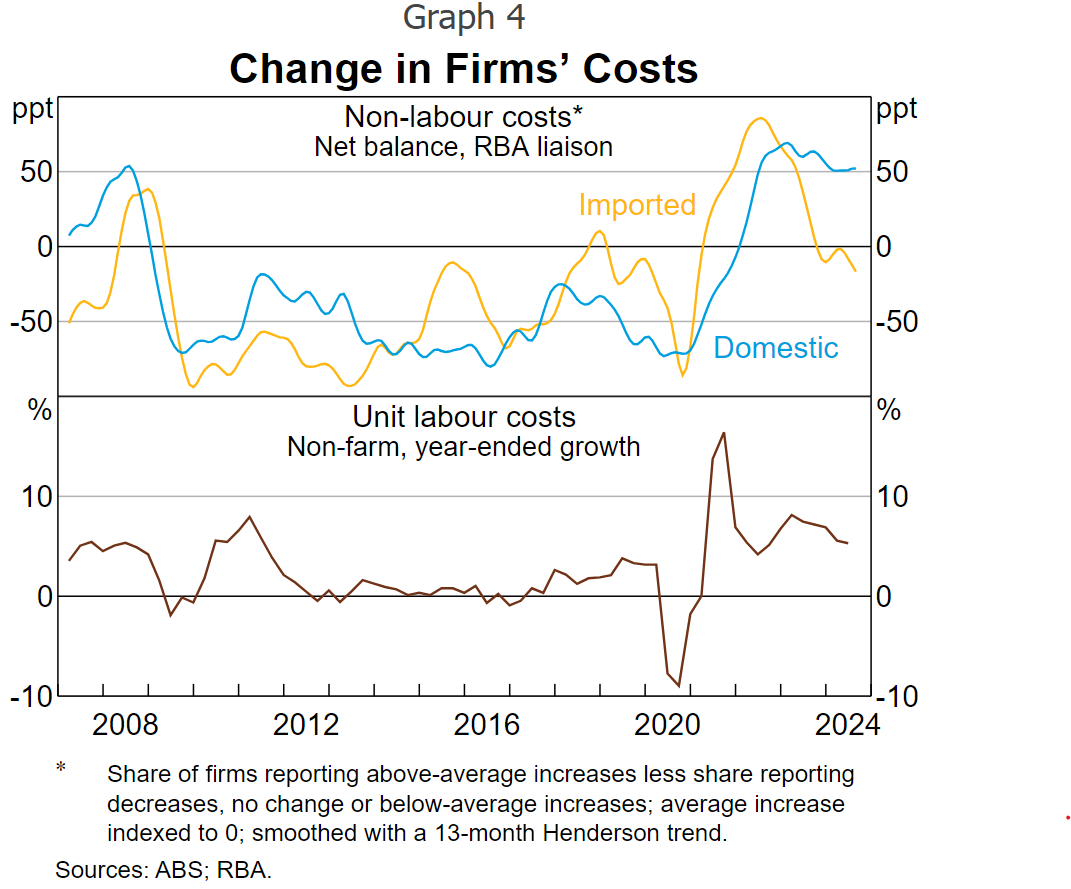

We typically think of market services inflation as reflecting overall domestic inflationary pressures – a combination of costs and margins.

Domestic non-labour costs (including, for example, electricity, insurance and warehousing and logistics rents) continue to increase strongly, and labour cost growth is also strong, reflecting both wage increases and weak productivity growth (Graph 4).

In short, rents, dwelling construction costs, and electricity are the key problems. Logistics and insurance are oil and event risk-related.

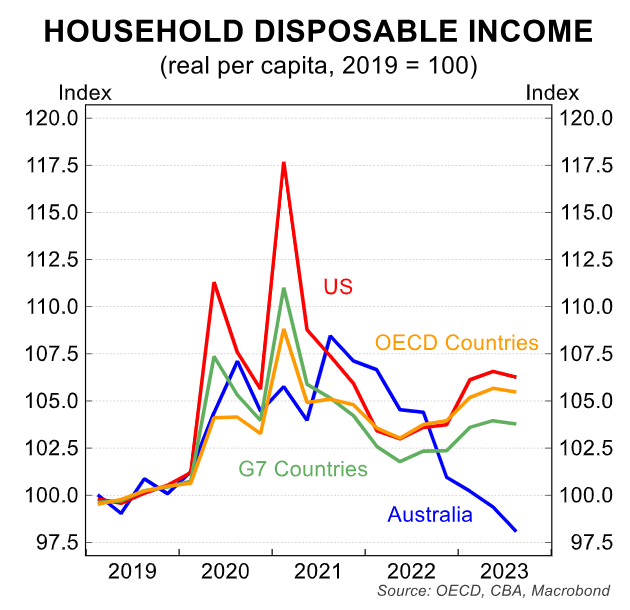

Put another way, Treasurer Jim “Chicken” Chalmers’s over-egging immigration and under-egging energy regulation has delivered the RBA and Australians a stagflationary shock that is cracking living standards: