DXY has bounced off big support:

AUD bashed back into place:

North Asia too:

Oil is fighting for its life:

Metals meh:

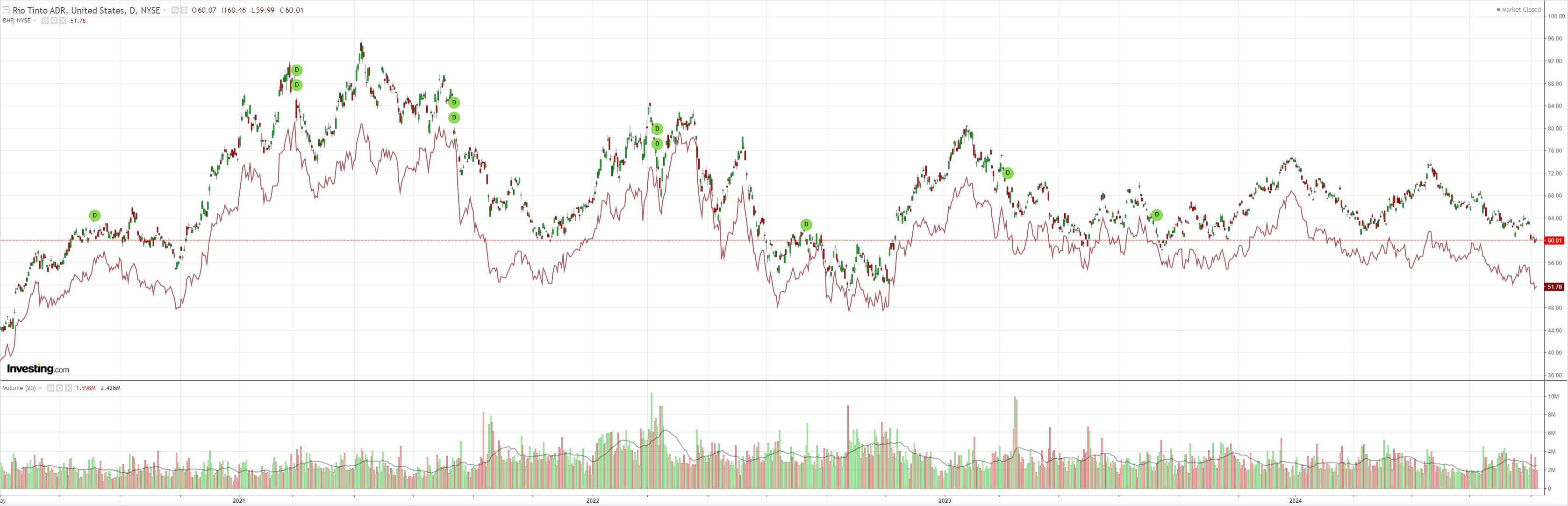

Mining meh:

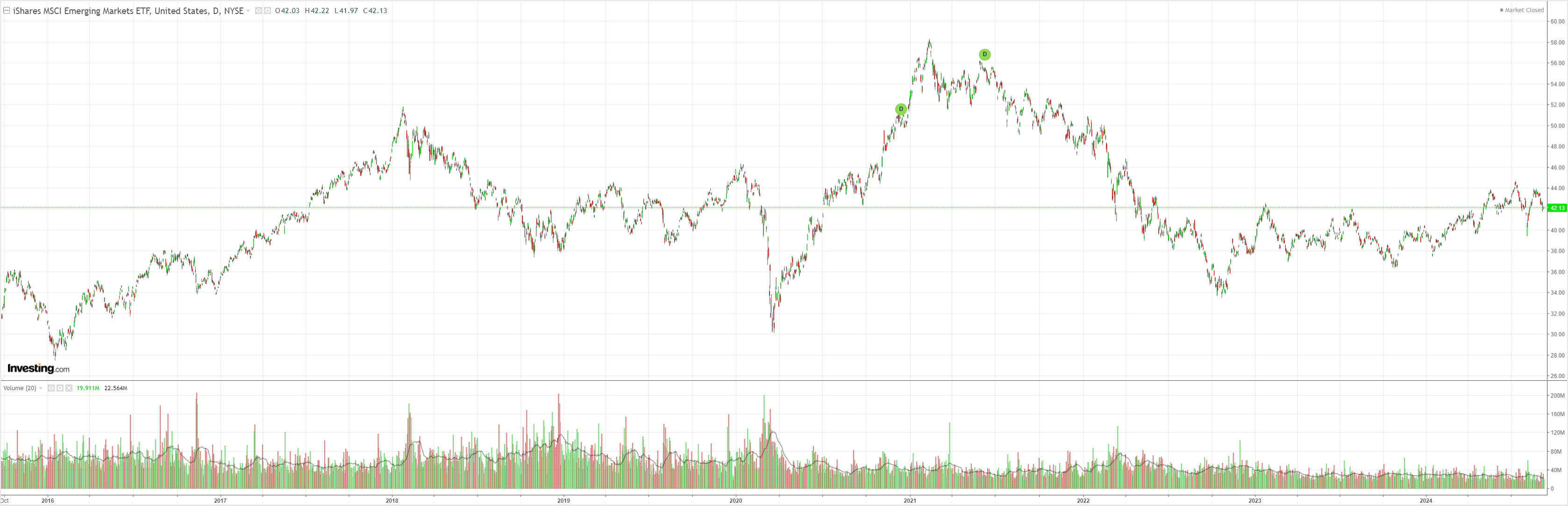

EM nasty:

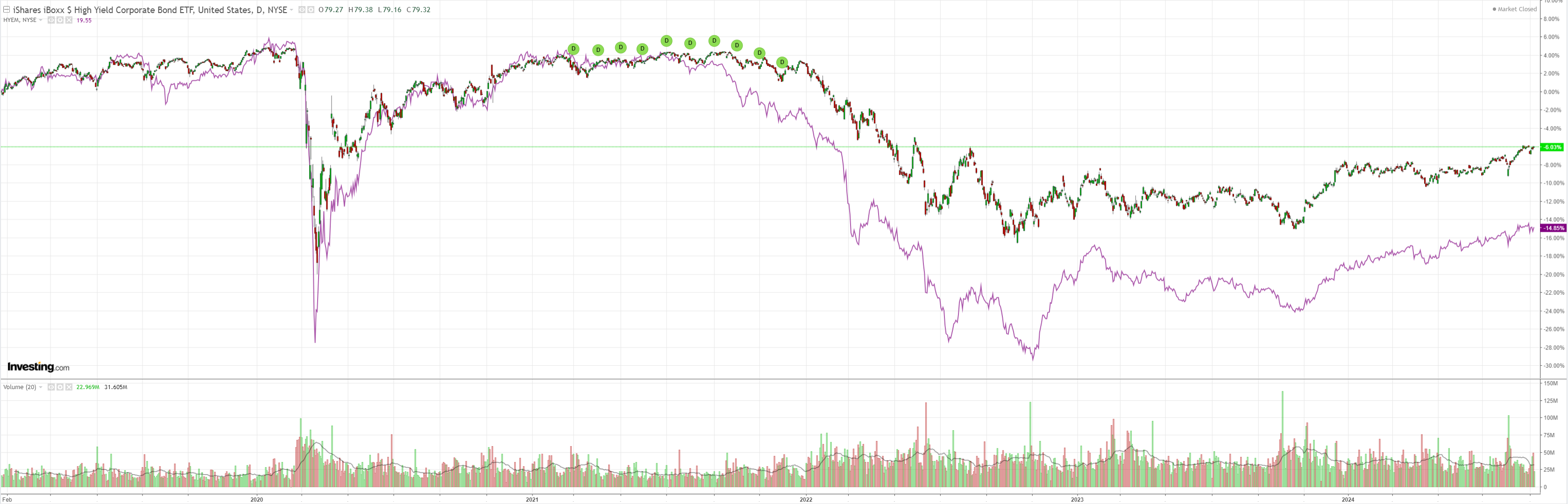

Junk still bullish:

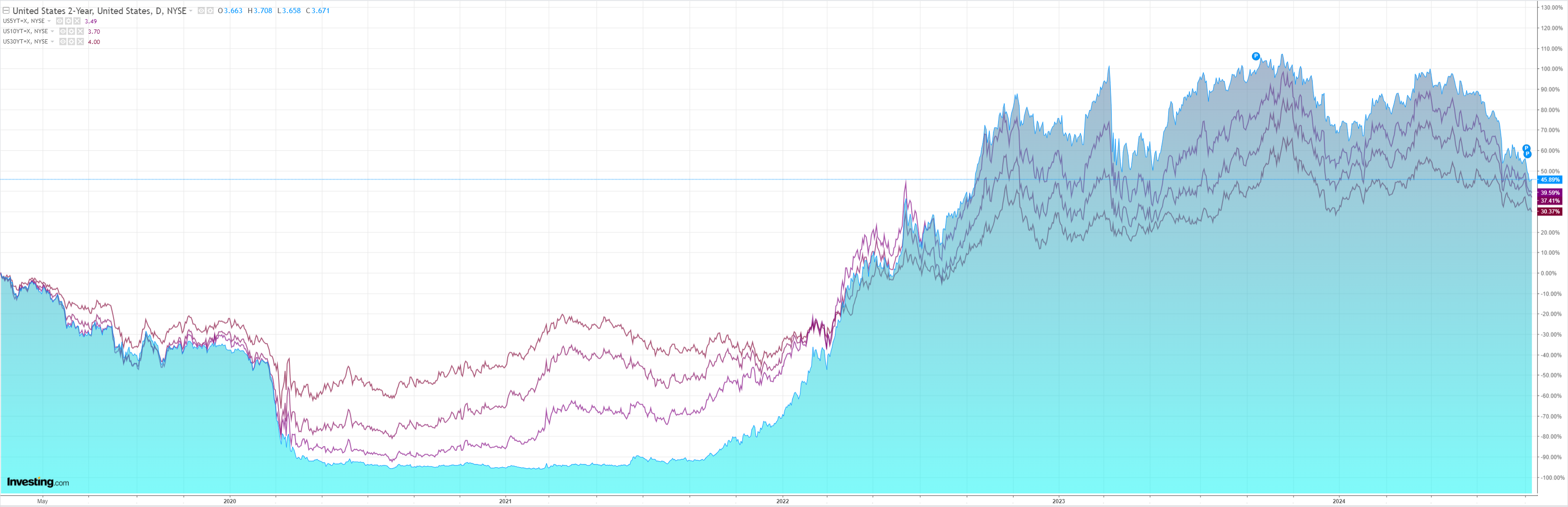

Yields falling, falling, falling, but into what?

Stocks worried:

It was a typical Monday rally on not much more. Goldman is rightly skeptical of more DXY falls:

USD: Toeing a fine line.

The incoming data over the past month, including the August employment report, clearly points to a slowing US economy with restrictive monetary policy.

The Fed has already signaled imminent sequential cuts, first in Powell’s speech at Jackson Hole and then echoed in remarks by Williams and Waller post-NFP; the question is at what speed.

The still-low level of layoffs and positive (but fading) labor supply shock appear to be a source of comfort for the Fed, leaving them seemingly less eager to cut by more than 25bp at the upcoming meeting.

But the fact that markets had been placing roughly 50-50 odds on a bigger cut means that, for now, a 25bp cut tightens financial conditions, especially if equities continue to sell off (as seen in the cross-asset price action following payrolls), arguably challenging the Fed’s decision on the size of the cut.

If risk can ultimately digest a gradual pace of non-recessionary Fed cuts—assuming the openness to a faster pace as needed offers enough relief—the aggregate impact should be more marginal and trades like long GBP/CHF can do well.

That said, with rates currently in the driver’s seat for the Dollar, it can fall further if the Fed decides to speed up easing (relative to our baseline of three consecutive 25bp cuts) in response to softer data.

CPI on September 11 and, most importantly, retail sales on September 17 will be the key releases to watch ahead of the FOMC meeting, alongside the weekly claims data.

But we continue to see limited room for sustained Dollar weakness without better return prospects abroad—and disappointing activity data out of Europe and China make that hard to see.

Moreover, the upcoming election should come back into greater focus as the candidates are set to debate on September 10, likely adding further support to the Dollar if higher odds of tariffs get priced in.

Overall, we continue to believe that Dollar strength will not erode quickly or easily, especially if the Fed continues to move gradually as it currently looks set to do.

I still expect further AUD upside as the global easing gets underway in earnest but I agree it may take a while.

And there is the tail risk that Trump wins a debate and charges back into contention.

That would put the wind up risk markets as they need to price a China crash.