DXY faded last night:

AUD held on:

JPY is unwinding more carry:

Oil is screwed:

Advertisement

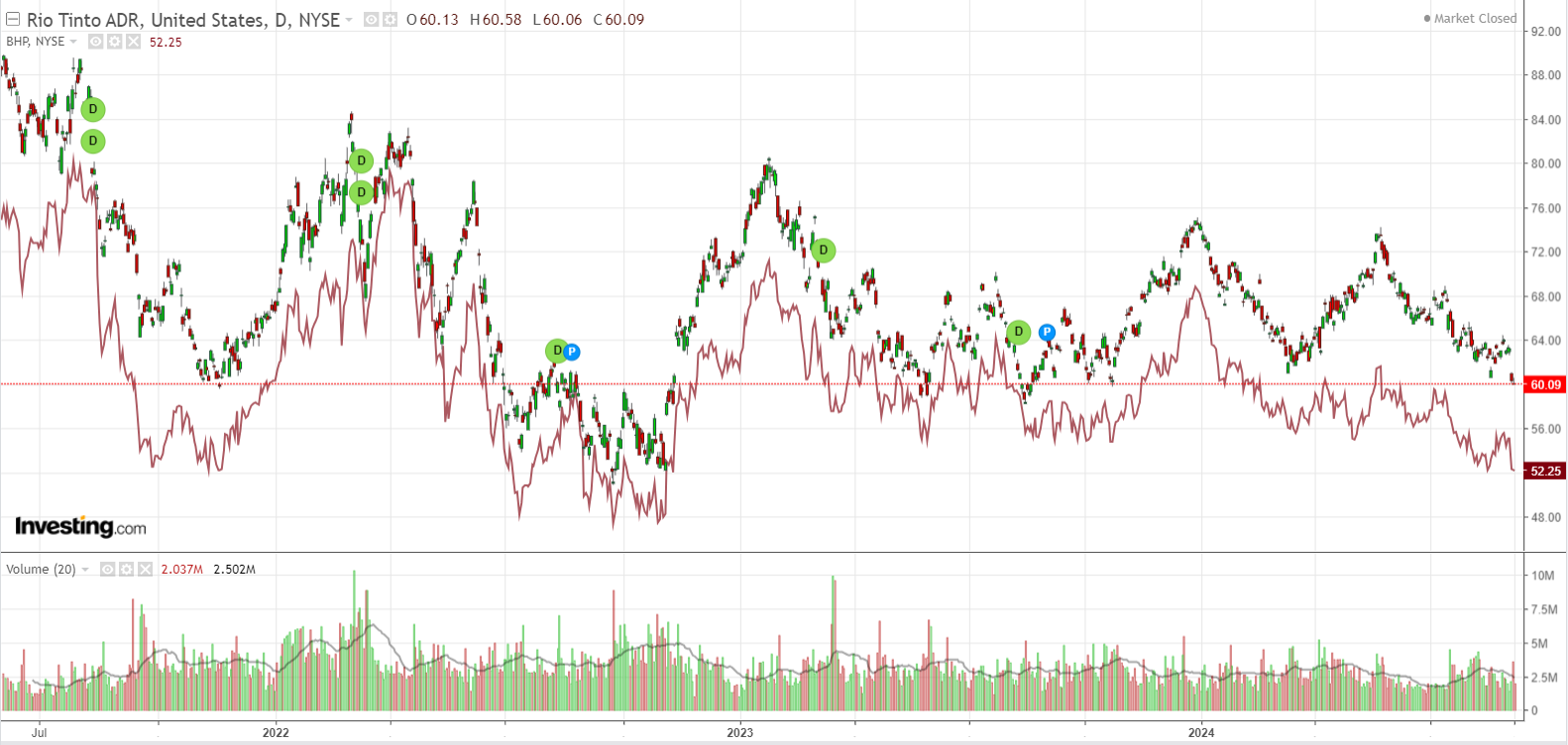

Another metals pimple bursts:

Big miners are going to retest 2022 lows:

EM has a nice head and shoulders top:

Advertisement

But junk is still pretty happy:

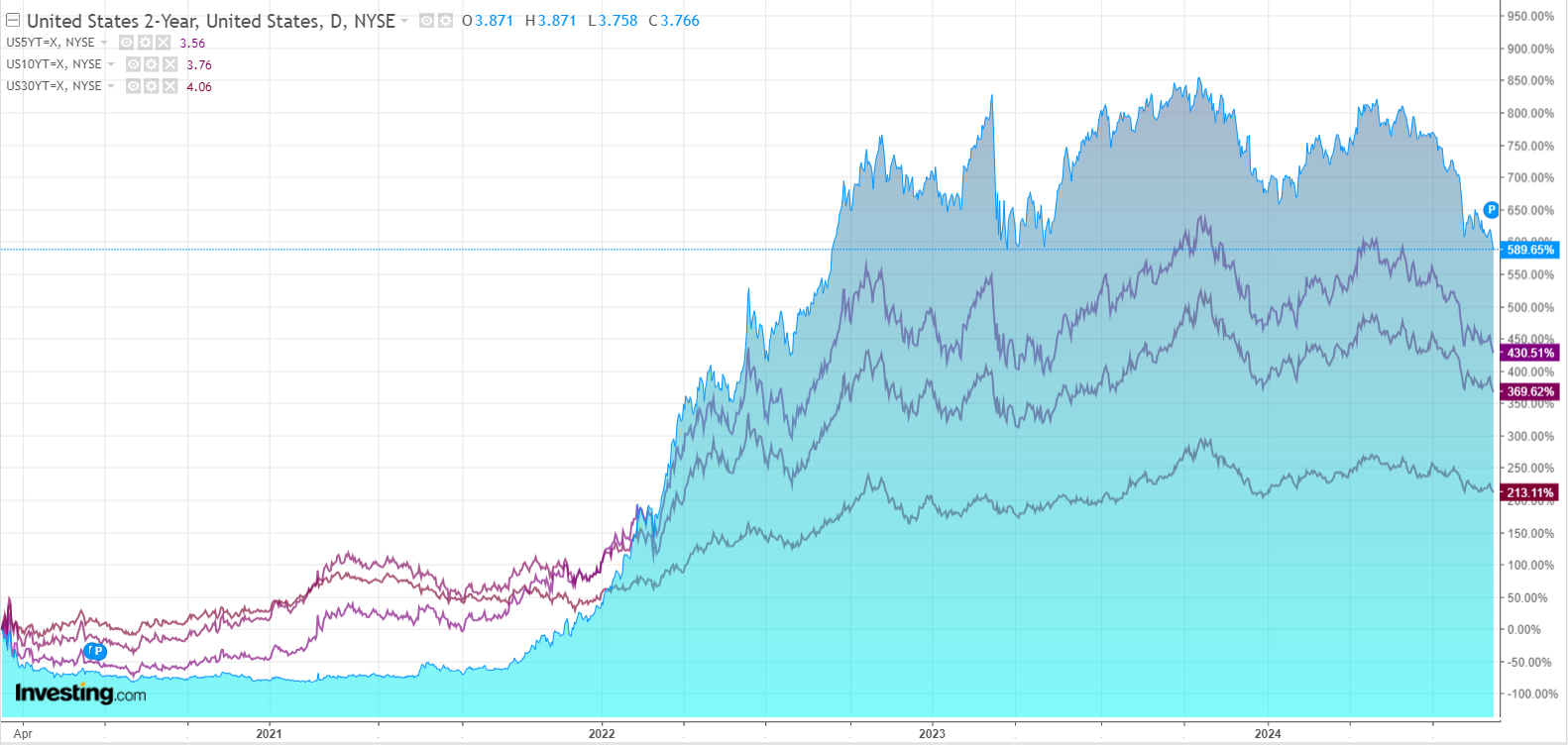

US yields are breaking down:

Stocks look precariously double-topped:

Advertisement

Last night’s key data was JOLTS and it was weak:

If we get another weak BLS on Friday, all bets are off for this market.

Advertisement

Yields will crash towards 50bps cuts but stocks will also fall on the mushrooming growth scare.

This is not an environment in which AUD can prosper.

Of course, a good BLS report could reverse all of that.

Advertisement

As said many times, employment reports a craps shoot, but the trend in US jobs is not good so be careful.