DXY is back for now:

AUD is struggling to regain momentum:

JPY is on the march:

Oil is dead cat bouncing:

Advertisement

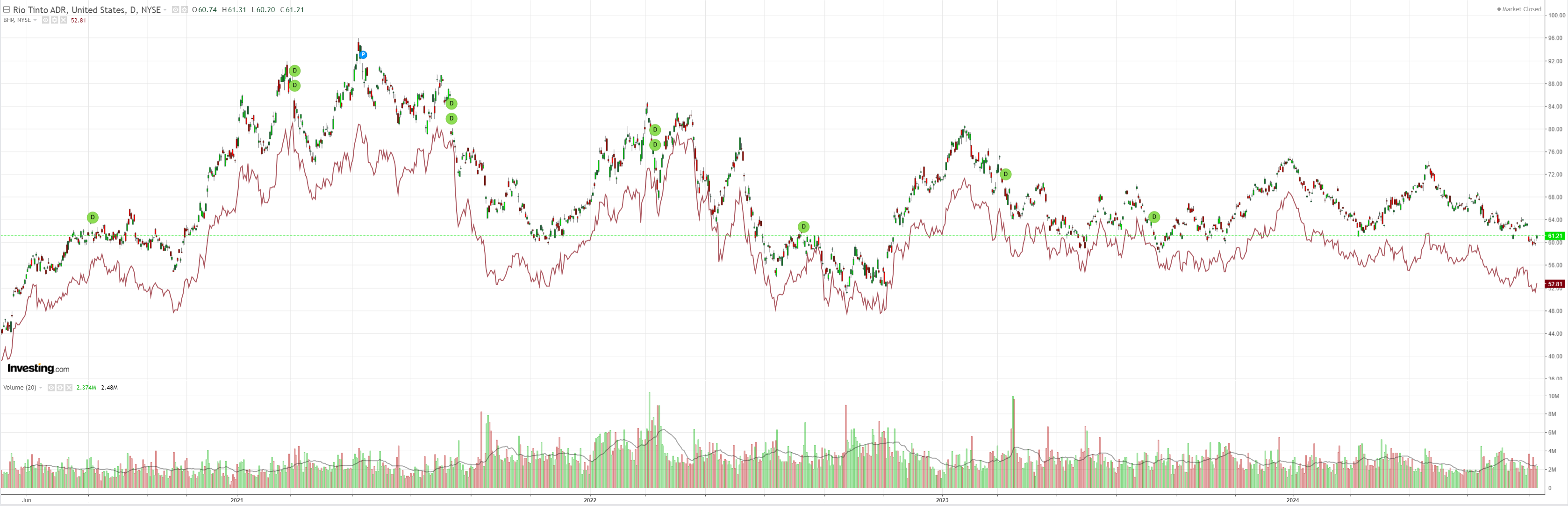

Metals took the hint:

Miners too:

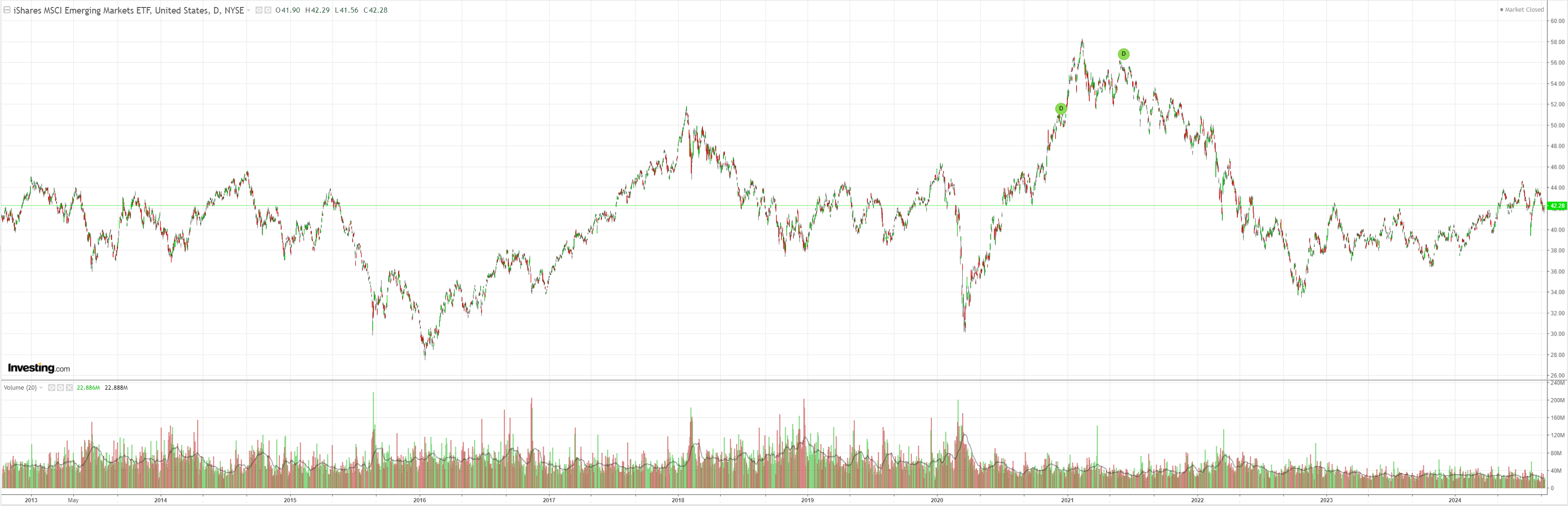

EM is so yesterday:

Advertisement

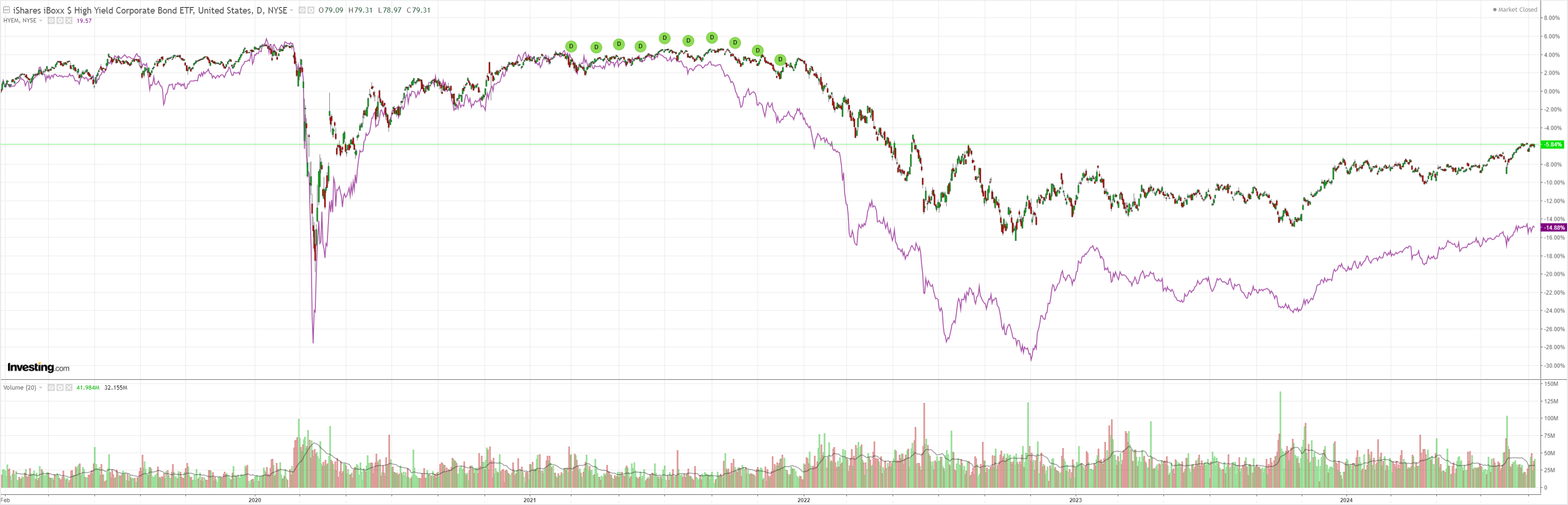

Junk is stalled but fine:

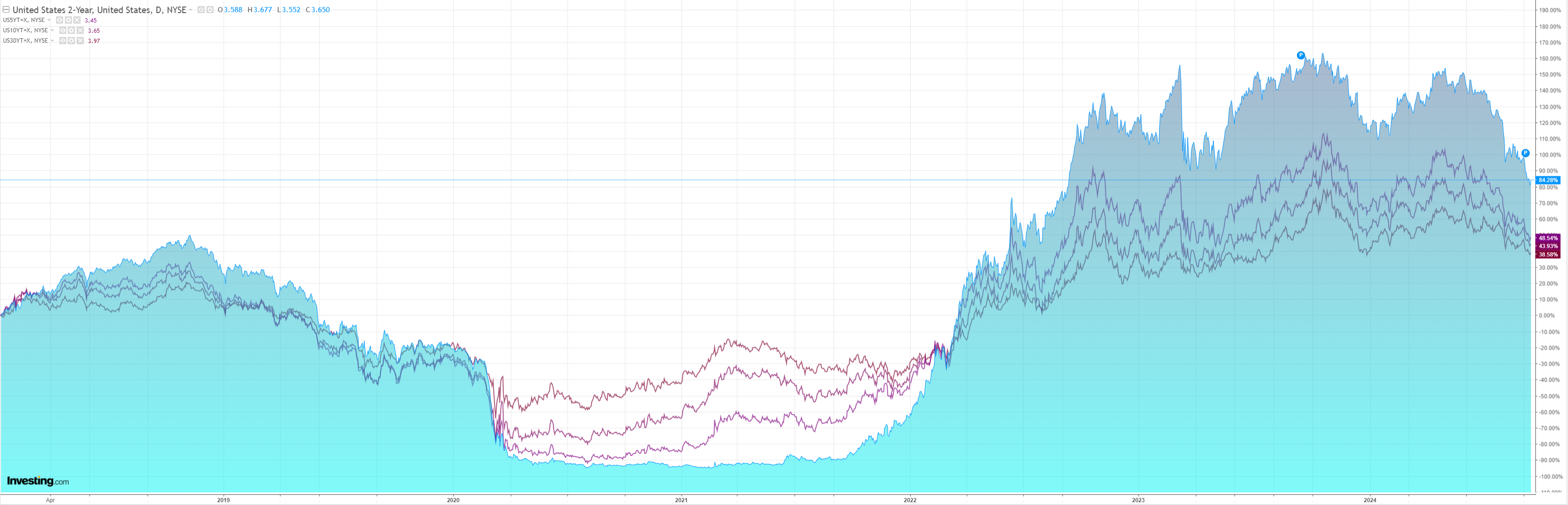

The curve flattened:

Stocks are about as convincing as Jim Chalmers:

Advertisement

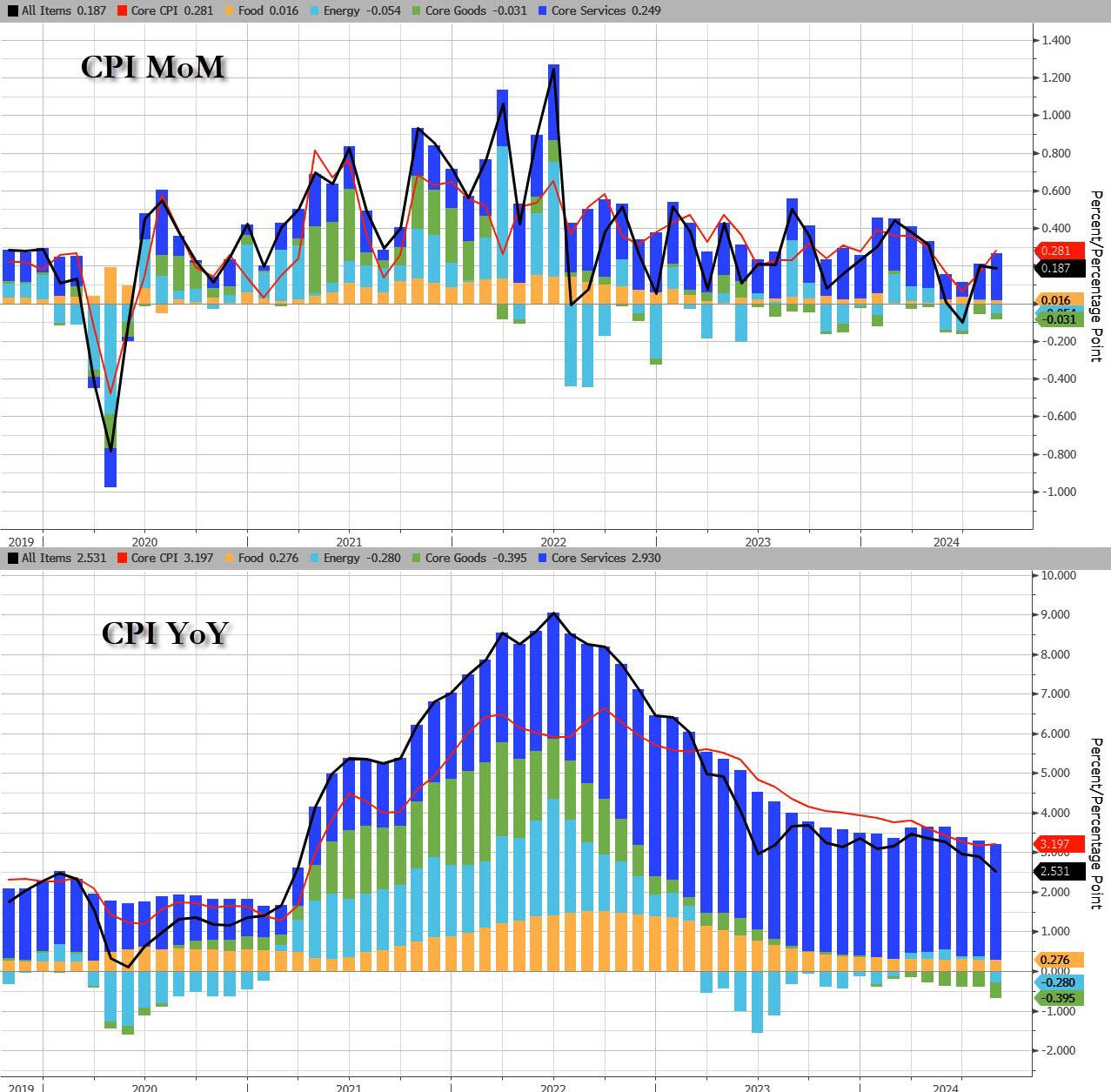

US inflation came in stronger than expected but it is irrelevant. Rents via OER are still all that matter, and a one month jump will more than reverse in due course:

NVDIA gave the market some positive rhetoric as well and triggered the one-day party.

Advertisement

Nothing but noise here. Expect the Fed to cut 25bps and for more pressure on risk as the global slowdown continues.

High-beta currencies like AUD will follow the broader trend until greater clarity emerges entering 2025.