Of yes:

Commonwealth Bank has sliced variable interest rates for most new home loan customers, in a sign competition in the mortgage market is heating up again.

The country’s largest lender said on Friday it had cut the variable mortgage rate it is offering new owner-occupier borrowers by 0.25 of a percentage point – to 6.89 per cent if they have a 20 per cent deposit.

For those with a bigger deposit, loan pricing will fall by 0.20 of a percentage point. It also made reductions to variable rates on some investment loans by up to 0.35 of a percentage point.

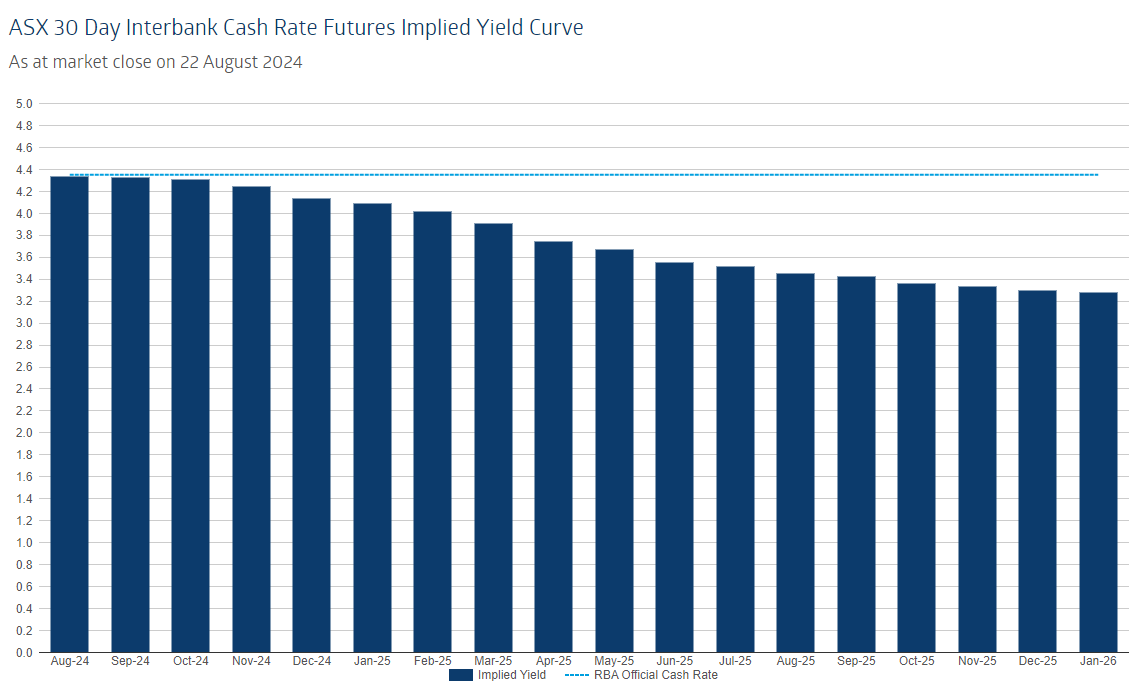

With four rate cuts priced into cash rate futures, it’s time they get the housing ball rolling:

Unleash the bubble!

Advertisement