A nice wrap here from Morningstar. Nothing new but the conclusion is right. In the iron ore Ice Age it is massive stimulus or bust for the miners.

Iron ore prices have dipped below $100 US per tonne and analysts expect the price declines to continue as weakness in the Chinese property market are impacting steel prices.

According to Rio Tinto, China’s huge residential property market accounts for roughly 30% of its steel demand. Central government efforts to limit speculation are reducing activity. After years of inflation, residential house prices are falling. The National Bureau of Statistics reported that prices of new homes in China’s 70 largest cities fell 3.6% year on year in May 2024, the sharpest decline since January 2019. Prices of existing homes fell even further, down 8.2%. Falling prices exacerbate pressure on developers trying to finish properties and house purchasers seeking to pay for them. Advertisement

Property developers are highly leveraged, with many like Evergrande and Country Garden in default. Rising unsold inventory adds to pressure on developers. With house prices falling, unsold inventory continues to rise as homebuyers tighten their pockets in anticipation of further decreases in prices. Advertisement

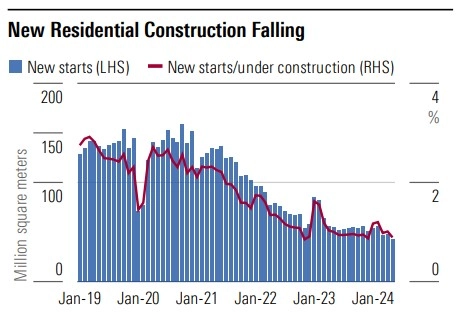

As a result, newly started construction activities continue to slow. In May, the People’s Bank of China unveiled a CNY 300 billion (USD 42 billion) package to help local governments purchase unsold new homes and turn them into affordable social housing. However, the package is likely to have minimal impact, as it accounts for less than 10% of the total value of unsold new apartments. With China’s population shrinking since 2022, for the first time since 1961, structural pressures on housing construction are building, in our view.

While exports and imports modestly improved over the quarter, China’s trade is soft. Soft consumer demand damps imports, while weaker growth overseas, driven by rising interest rates, weakens exports. Global trade frictions, including “friendshoring”— manufacturing in and sourcing from countries that are allies—and onshoring, are also contributing. These are likely to remain longer term headwinds. Advertisement

China’s playbook is to boost commodity-intensive infrastructure spending when economic growth slows. However, a combination of poor returns on new infrastructure investment and a central government commitment to more consumption-led growth means stimulus spending in this downturn is muted. The stimulus can come if the Chinese economy substantially slows or enters a recession. But growing debt is a headwind to both the amount of stimulus and its effectiveness.

Rising fixed asset investment in manufacturing partially offsets muted demand from the property and infrastructure sectors, which drive more than half of China’s steel demand. JPMorgan estimates building and construction accounts for about 30% of the country’s copper use. Investment in China’s real estate sector is soft, a headwind for GDP growth. The central government has increased support for the property sector, but we think much more needs to be done for it to stabilize. Advertisement

China weakness and falling iron ore prices are impacting the share prices of miners. Here is our view on the largest three miners in the ASX 200.

- Morningstar Rating: 3 stars

- Fair Value Estimate: $40.50

- Moat rating: None

- Uncertainty rating: Medium

Advertisement

BHP is the world’s largest miner by market capitalization. Its main operations span iron ore and copper, with smaller contributions from metallurgical coal, thermal coal, and nickel. The company is also developing its Jansen potash project in Canada. BHP merged its oil and gas assets with Woodside Energy in June 2022, vesting the Woodside shares it received to BHP shareholders, and exiting the sector. It purchased copper miner Oz Minerals in fiscal 2023. The share price has declined over 20% year to date. Advertisement

Commodity demand is tied to global economic growth, China’s in particular. BHP benefited greatly from the China boom over the past two decades. China is BHP’s largest customer, accounting for roughly 60% of sales in fiscal 2023. With demand for many commodities likely to soften as the China boom ends, particularly iron ore which has disproportionately benefited from the boom in infrastructure and real estate investment, we think the outlook is for earnings to materially decline. Its generally low-cost, high-quality assets mean BHP is likely to be one of the few miners that remains profitable through the commodity cycle. Much of the company’s operations are located close to key Asian markets, particularly the low-cost iron ore business, providing a modest freight cost advantage relative to some producers such as those in Africa and South America. BHP correctly values a strong balance sheet to provide some stability through the inevitable cycles and derives some modest benefit from commodity and geographic diversification. Much of its revenue comes from assets in the relative safe haven of Australia. The development of Jansen in Canada is BHP’s major expansion project now that the Spence Growth Option copper project is ramping up, with the company also pursuing modest expansion of its Western Australia Iron Ore operations above 290 million metric tons per year. Advertisement

The good times during the height of the China boom saw significant capital expenditure, notably on iron ore and onshore US shale gas and oil. Overinvestment in the boom diluted returns to the point where we struggle to justify a moat. As a commodity producer, BHP lacks pricing power and is a price taker.

- BHP is a beneficiary of continued global economic growth and demand for the commodities it produces.

- BHP’s Jansen potash project gives it additional diversification, with potash being less correlated to the other commodities it produces.

- BHP’s iron ore assets are industry-leading. The company remains well placed to continue low-cost production and increase output with minimal expenditure and an efficiency focus.

Advertisement