This is what is ahead for iron miners. ALL OF THEM. Mineral Resources:

“This was the biggest year of development in our history, culminating with the start-up of the transformational Onslow Iron project.

“Onslow Iron achieved first ore on ship ahead of schedule in May, just 11 months after we broke ground at the Ken’s Bore mine site. This phenomenal achievement is a testament to the in-house project delivery expertise that MinRes has developed over more than three decades.

“Our hands-on, agile and creative culture made Onslow Iron possible and will enable the unlocking of an entire new mining region in the West Pilbara. Thank you to our people for their commitment, professionalism and ingenuity in making this vision a reality.

“Our meaningful partnerships with every level of government, communities and – importantly – the Traditional Owners of the lands that Onslow Iron is located on has helped bring the project to life. We look forward to continuing to spread the project’s benefits widely.

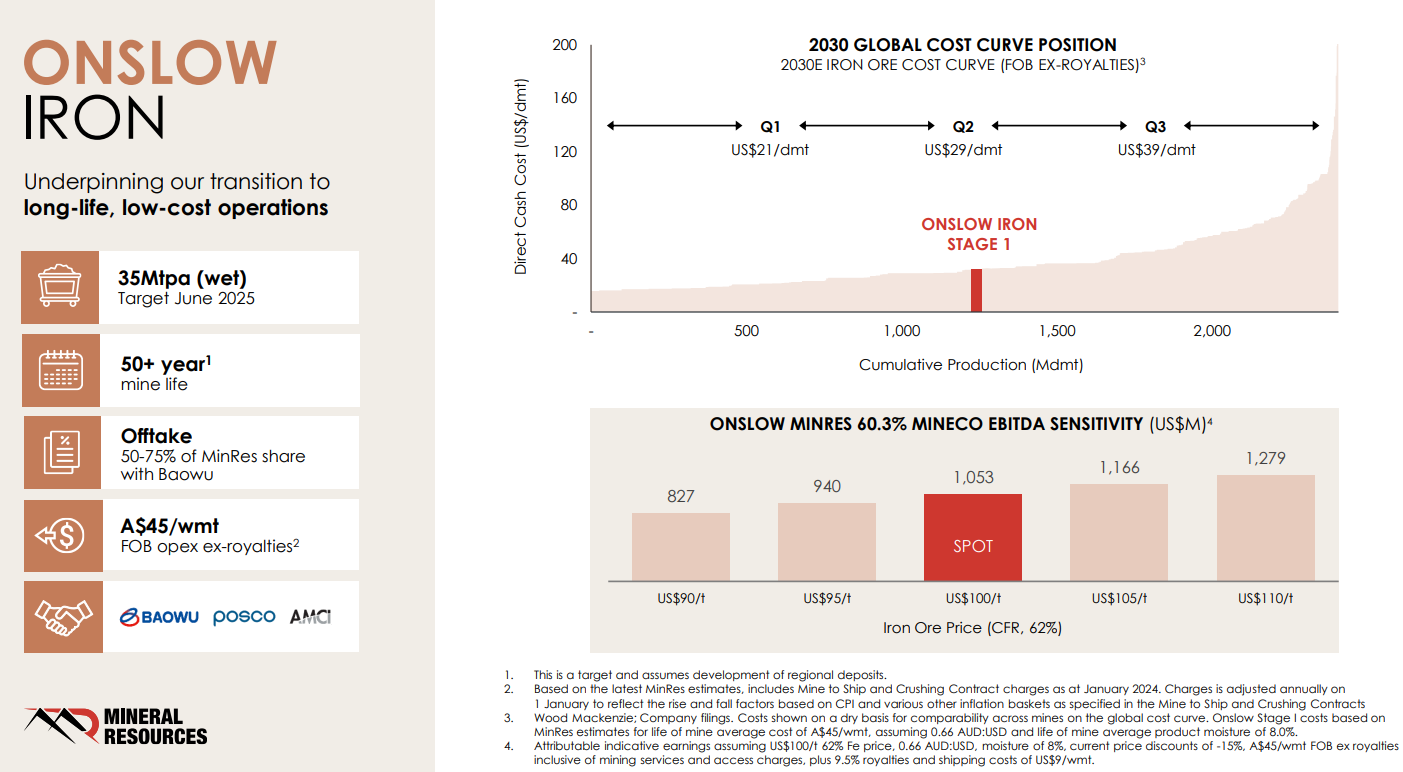

“Onslow Iron will generate strong returns through commodity cycles and underpin significant growth in our services and infrastructure earnings. The value of Onslow Iron has already been demonstrated by the sale of a minority share of the dedicated haul road to Morgan Stanley Infrastructure Partners for $1.3 billion.

“The sale of the haul road stake further strengthens the MinRes balance sheet and demonstrates the Company’s unique ability to recycle capital. We expect to de-leverage rapidly as Onslow Iron hits nameplate capacity and becomes cashflow positive over the next 12 months.

“Overall, the results highlight the strength of MinRes’ business model, with our diverse income streams all contributing to solid group earnings, despite a depressed lithium price. Our core Mining Services division increased Underlying EBITDA by 14%, driven by record production and new external contracts, with its growing infrastructure focus spearheading a new era of future growth.

…“Given the stubborn lithium price and our remaining investment in Onslow Iron, we will continue to take a conservative approach during FY25, deferring expansion projects and focusing on cost reduction and cash preservation. This approach was reflected by the Board’s decision to not declare a final dividend for FY24.

“Our management team has decades of experience through commodity peaks and troughs. I have full confidence in our ability to manage the balance sheet and keep delivering leading returns for our shareholders.”

In short, MinRes is slashing costs and battering down the hatches for the long winter.

However, each time it cuts those costs, the wider cost curve edges down that little bit more and, as everyone does it, the iron ore price just keeps on falling.

I expect Onslow to come under intense pressure before the shakeout is over and MinRes debt is going to be an issue.