The market must clear!

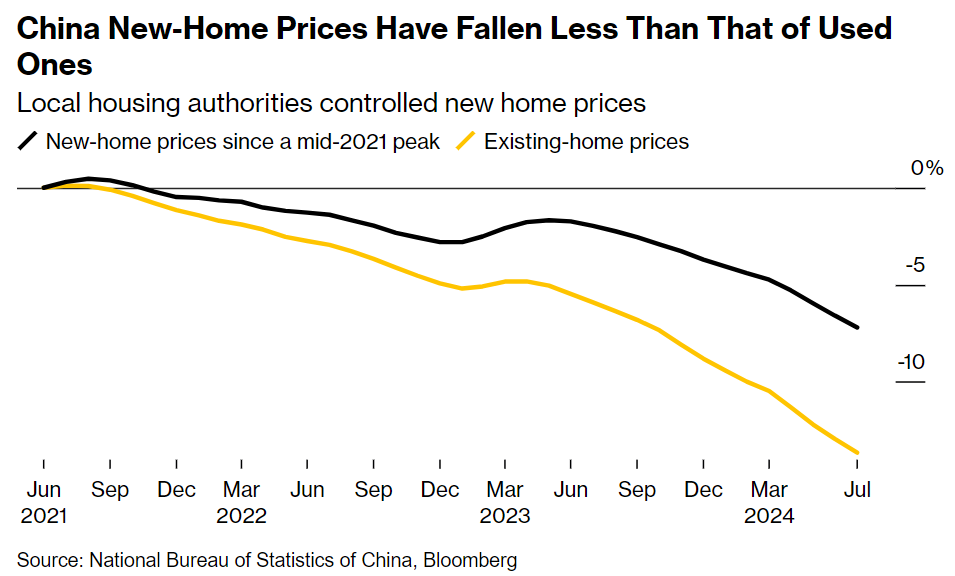

A price war is spreading across China’s new-home market, as local governments dial back on intervention and developers race to recoup cash.

In Beijing, a sudden 18% price cut in May at a mid-sized residential project on the city’s outskirts has forced adjacent new developments to follow suit, according to people familiar, who requested not to be named because the matter is private. Near the southern border, the Shenzhen government approved a 29% cut in unit prices for a complex compared with a year ago, according to other people familiar.

After intervening for years, at least 10 city governments have relaxed or scrapped new-home price guidances to let market demand play a bigger role, according to China Index Holdings Ltd. and public statements.

…“Restrictions on home price declines have hindered developers’ sales since mid-2021,” said Chen Wenjing, a research director at property agency China Index Holdings. “Easing or removing such restrictions will allow them to set prices reasonably.”

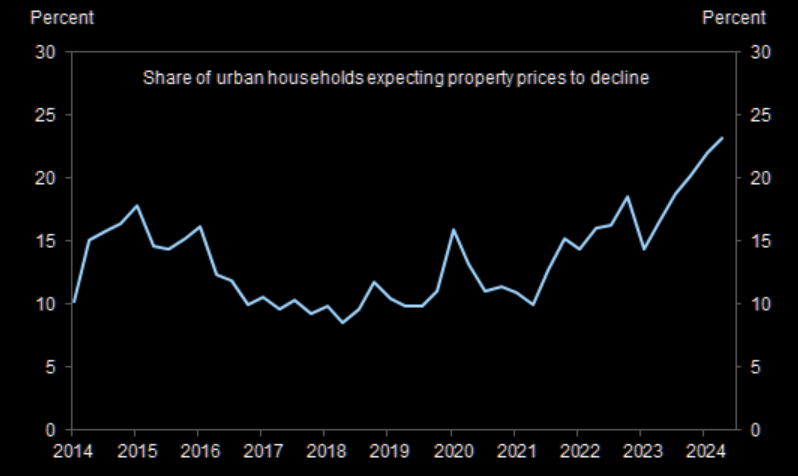

These cities will clear more quickly, but prices will fall faster too so don’t expect any rebound in purchases until they do:

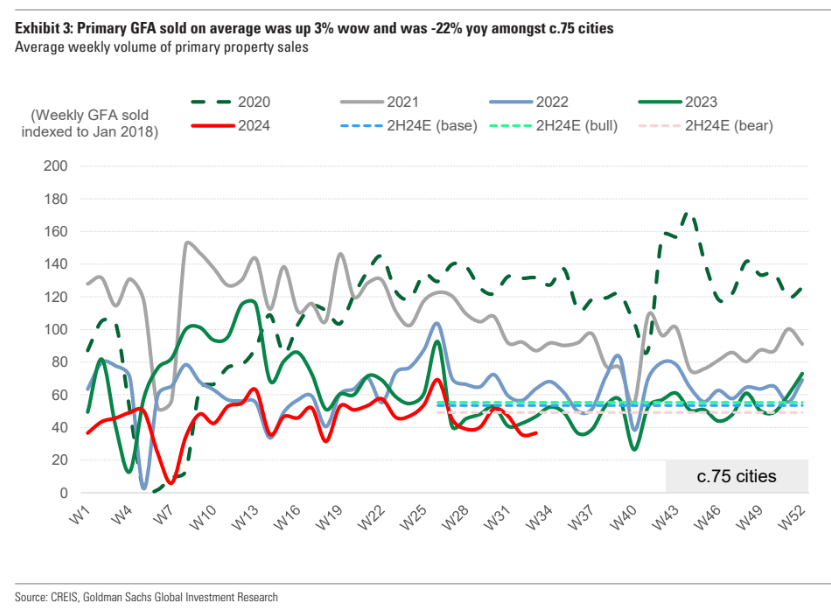

Sales remain cratered:

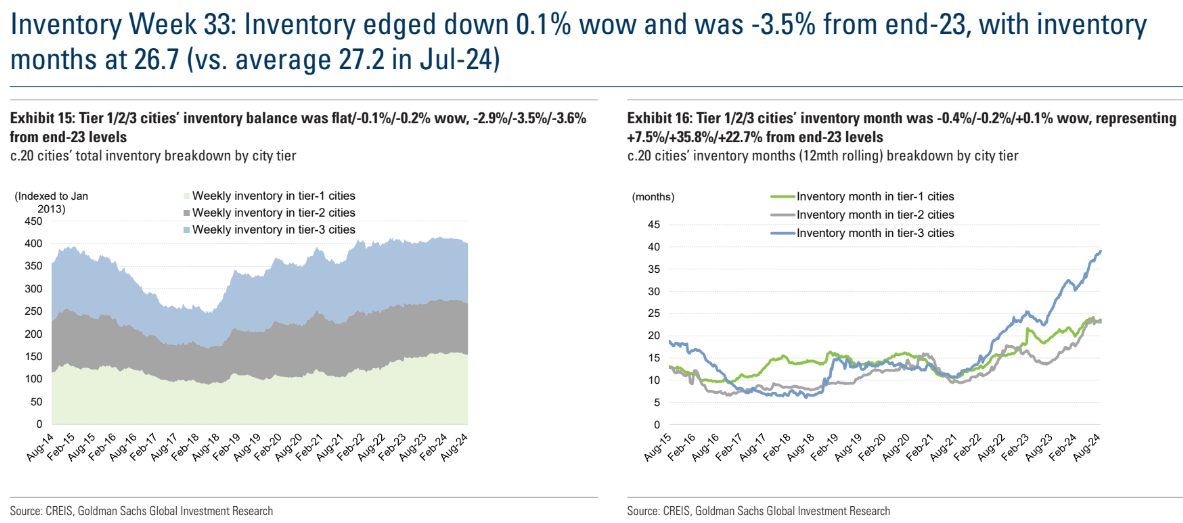

Inventory is huge, most notably in ghost cities:

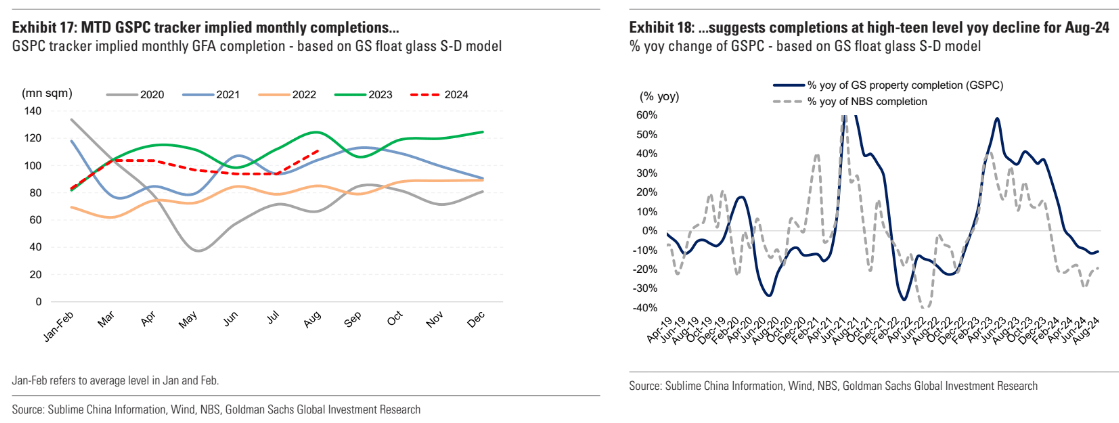

And completions are falling:

Another hair-brained idea is being mooted:

China is considering a new funding option for local governments to buy unsold homes after a series of rescue packages failed to prop up the market, according to people familiar with the matter.

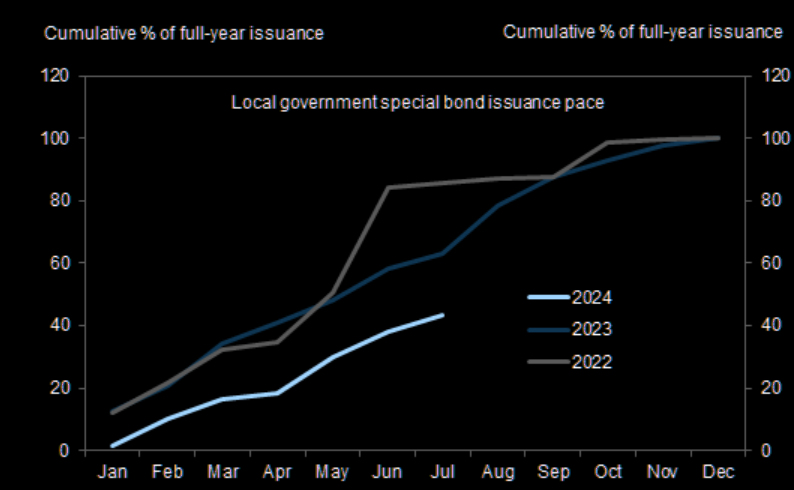

The latest proposal would allow local governments to fund their home purchases by issuing so-called special bonds, the proceeds of which are currently restricted to uses including infrastructure and environmental projects, the people said, asking not to be named discussing private information. Local governments have already used more than half the 3.9 trillion yuan ($546 billion) quota for special bond issuance this year; it’s unclear what portion of the remainder might be directed toward home purchases if the plan is approved.

Existing funds haven’t been drawn because the circle of falling prices does not square with the debt that built them.

As well, diverting funds to property purchases will drain infrastructure spending:

There is no way out but down.