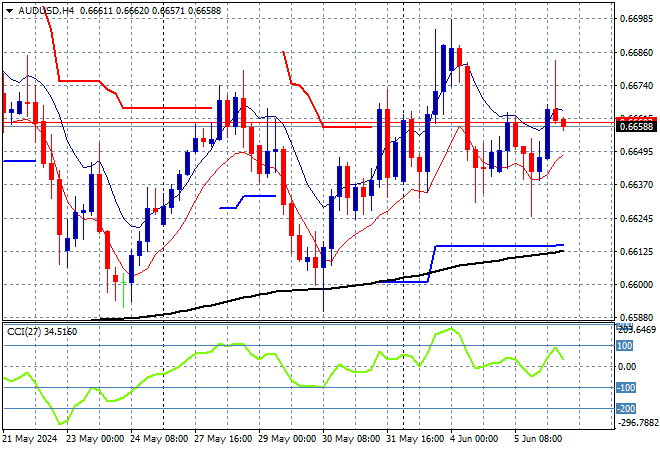

Asian stocks are still having a mixed session today partly due to Chinese risk markets hesitating while others look towards tonight’s anticipated ECB meeting with a rate cut potentially on the cards. This is keeping currency-land steady with the USD broadly unchanged while the Australian dollar continues its non-reaction to the recent GDP print as it holds at the mid 66 cent level.

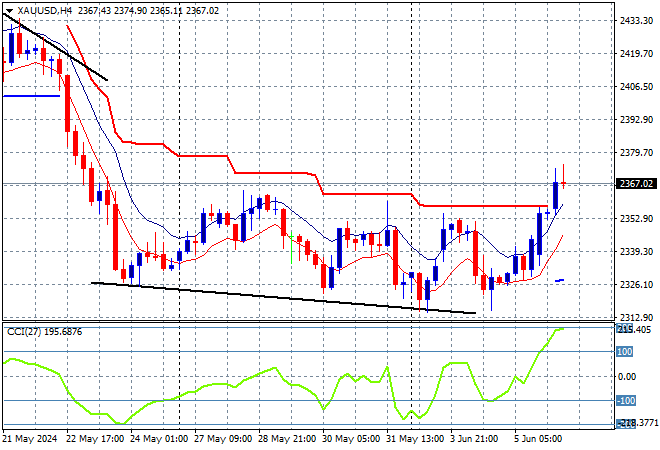

Oil prices are still quite depressed as Brent crude tries to steady below the $78USD per barrel level while gold is holding on to its overnight breakout above the $2350USD per ounce level this afternoon:

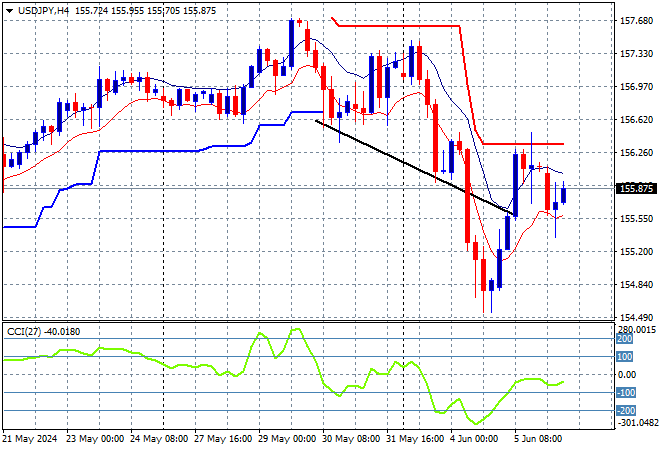

Mainland Chinese share markets are moving further down following yesterday’s poor PMI survey with the Shanghai Composite off more than 0.4% while the Hang Seng Index is flat, currently at 18493 points. Meanwhile Japanese stock markets are liking the slightly lower Yen with the Nikkei 225 up over 0.7% to 38777 points as the USDJPY pair holds steady following its recent rebound above the 155 level:

Australian stocks were almost the best performers in the region with the ASX200 moving 0.7% higher to 7823 points while the Australian dollar has held on to the mid 66 cent level despite the GDP print, with some optimism creeping through:

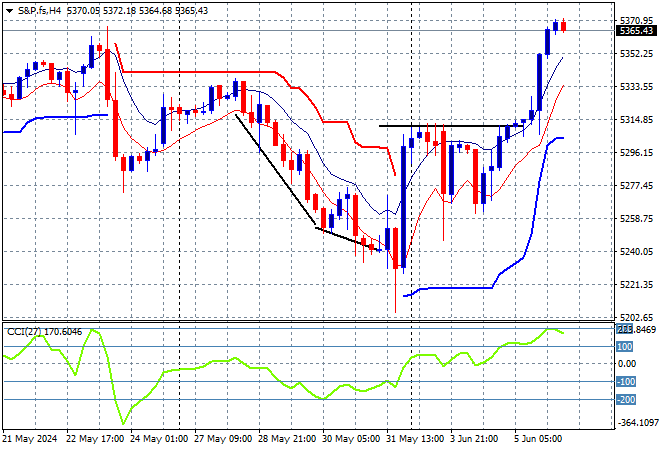

S&P and Eurostoxx futures are both up marginally as we head into the London session with the S&P500 four hourly chart showing price action holding well above the 5300 point level after its overnight breakout as short term momentum remains well into overbought mode:

The economic calendar tonight will focus squarely on the latest ECB meeting with US initial jobless claims thereafter.