Goldman with the note.

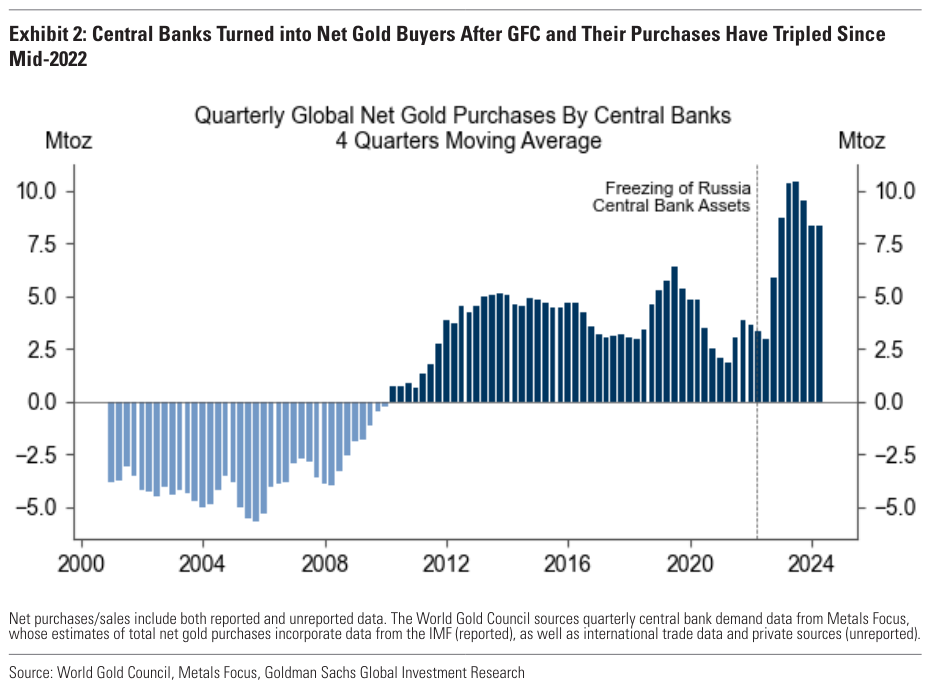

The price of gold reached an all time high in April despite higher US rates. We show that central banks drive the increase in gold demand since mid-2022, and that new geopolitical or financial shocks may push gold prices significantly higher.

EM central banks drive the gold rush. Global central bank gold purchases have tripled since Russia’s invasion of Ukraine. While most central bank gold buying is unreported, six EM central banks—China, Poland, Turkey, Singapore, India, and Qatar—drive all reported net monetary buying since mid-2022.

Advertisement