Aussie banks sink in bath of blood

A whiff of panic today in Aussie bank selling:

As US regional banks increasingly fall apart thanks to deposit flight, crushed margins, CRE bad loans, tight liquidity, soaring counterparty risk, equity and capital evaporation.

Moreover, NAB has confessed:

National Australia Bank stepped back from the mortgage wars and let its retail banking profit slide, turning to its business bank to propel first-half earnings, but its share price slumped as the sharemarket opened as analysts flagged a tougher outlook for interest margins due to growing competition, including for deposits.

Cash earnings were up 17 per cent to $4.07 billion for the six months to the end of March, propelled by the higher official cash rate, and NAB will pay an 83¢ a share interim dividend, up from 73¢ in the first half of 2022.

Both figures were below expectations for a first-half cash profit of $4.2 billion and interim dividend of around 86¢, as its interest margin undershot expectations as NAB paid more for savings.

Ouch.

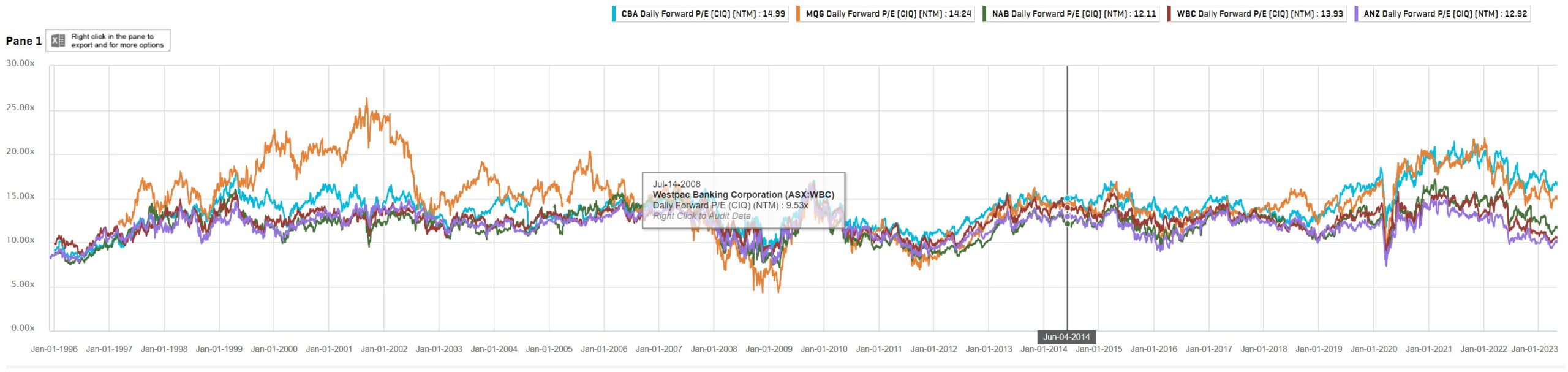

The fundamental overvaluation of Aussie banks remains preposterous. Especially CBA and MQG but noen has properly discounted a downturn:

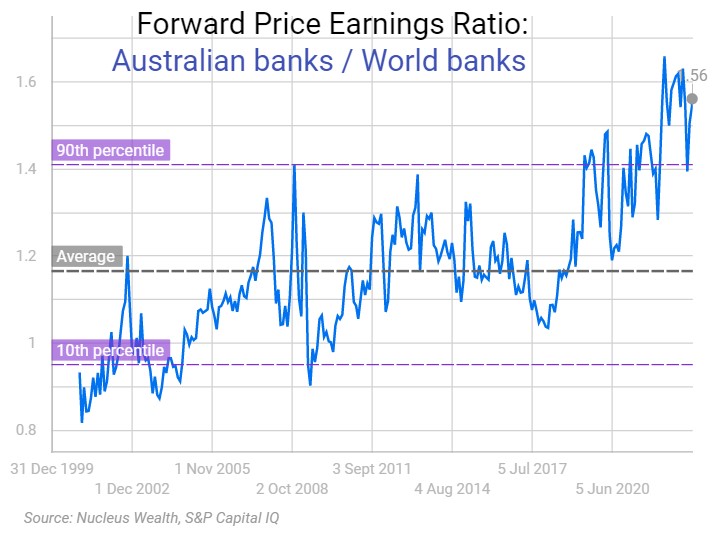

The relative overvaluation remains bonkers:

The banking double-shock is underway:

- US regionals collapse under pressure from margins.

- Credit crunch hammers US economy.

- Economy smashes bank assets.

- Rinse and repeat worldwide as spreads explode.

Plenty more blood and guts to come here…